CMBS Delinquency Rate Climbs Again in October as Office Hits New High

The U.S. CMBS market saw another uptick in distress last month, with the office sector continuing to rewrite the record books—for all the wrong reasons.

Good morning. The U.S. CMBS market saw another uptick in distress last month, with the office sector continuing to rewrite the record books—for all the wrong reasons.

Today’s issue is brought to you by InvestNext—download the 2025 Multifamily Investment Report for key capital trends, market opportunities, and strategies top firms use to stay ahead.

🎙️This Week on No Cap: With New York’s mayoral election looming, former Deputy Mayor and founder of M Squared Alicia Glen breaks down how the next administration could reshape affordability, zoning, and the politics of getting housing built.

Market Snapshot

|

|

||||

|

|

*Data as of 10/31/2025 market close.

Data Demand

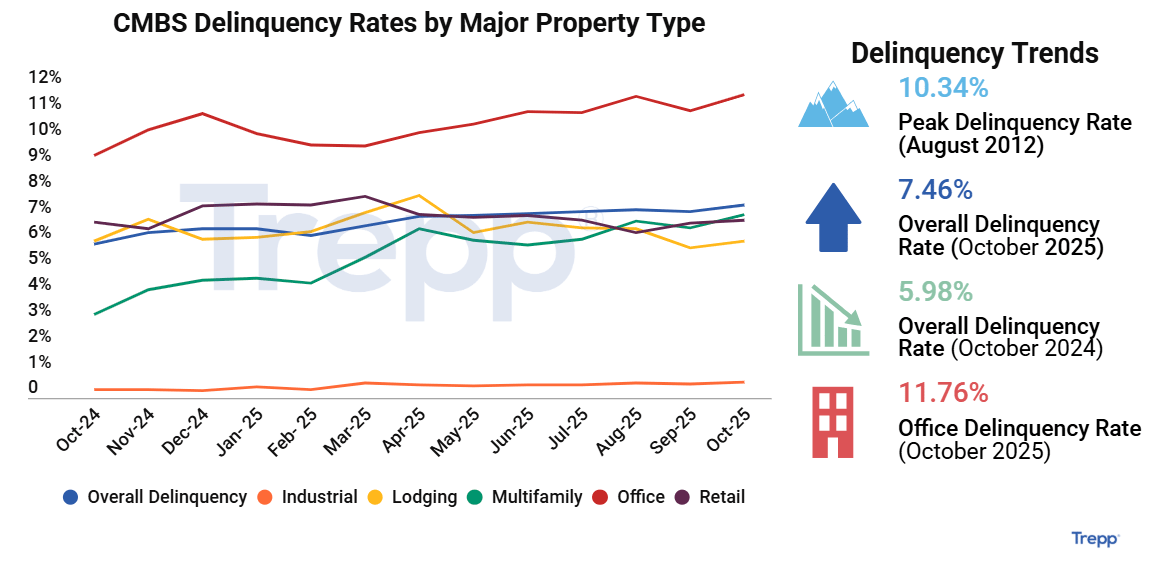

CMBS Delinquencies Deepen as Distress Spreads Beyond Office

October’s surge in delinquencies confirms a growing shift—from sector trouble to a broader market reckoning.

On the rise: Trepp reports that the overall commercial mortgage-backed securities (CMBS) delinquency rate rose 23 basis points in October 2025, reaching 7.46%. This jump was fueled by a $1.1B increase in delinquent loan balances, totaling $44.6B, combined with a $3.2B drop in the overall outstanding balance, which now stands at $598.1B. It’s the latest signal that distress remains elevated across the commercial real estate landscape.

Office sets another record: The office sector was again the hardest hit, with its delinquency rate jumping 63 basis points to 11.76%—a new all-time high. This comes after a brief reprieve in September, when the sector posted a 50+ basis point improvement. October’s new peak surpasses previous highs recorded earlier in 2025, including June (11.08%) and August (11.66%).

Multifamily not too far behind: The sector’s delinquency rate rose 53 basis points to 7.12%. This marks the first time the industry has breached the 7% threshold in nearly a decade, last seen in December 2015. While still not approaching the severity of the office sector, rising multifamily delinquencies are raising eyebrows, especially given the sector’s historic resilience.

Across property types: All five major property types tracked by Trepp posted higher delinquency rates in October, reflecting broad-based pressure across the CMBS universe. Though the 30-day delinquency bucket dipped slightly to 0.47%, the overall momentum points toward growing stress—particularly in sectors sensitive to structural and capital market shifts.

➥ THE TAKEAWAY

Pressure’s on: The record-breaking office delinquencies may grab headlines, but the real story is broader: distress is no longer isolated. With multifamily now breaching decade-old thresholds, the CMBS market is shifting from sector-specific turbulence to systemic strain—hinting that the reset many hoped was behind us may still be unfolding.

TOGETHER WITH INVESTNEXT

Multifamily Market: Inside 2025’s Performance

The multifamily market is stabilizing after a volatile 2024. With homeownership costs up 25% over renting, the widest gap in 15 years, demand, occupancy, and investor confidence are climbing.

The 2025 Multifamily Investment Report explores where capital is flowing, which regions are poised for growth, and how top operators are adapting to shifting fundamentals.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Workflow upgrade: Crexi Vault brings AI to CRE, automating document review to cut deal time, reduce errors, and accelerate transactions. (sponsored)

-

Selective revival: LPs and GPs are slowly regaining risk appetite, with selective capital returning and deal activity beginning to pick up.

-

Market refocus: Gaw Capital Partners is retreating from U.S. and European markets after 15 years, shifting its strategy and resources back to Asia.

-

Richmond growth: Conserve Holdings and Calibogue Capital acquired The Sphere, a 224-unit Class A multifamily community in Richmond, Virginia, strengthening Conserve’s presence and confidence in the market’s long-term growth.

-

Warning: Big Tech is betting big on AI infrastructure, but investors are wary as Google, Meta, and Microsoft pour billions into data centers.

-

Shaky stability: CRE delinquencies showed early signs of stabilization in Q3, though stress remained elevated in segments like CMBS and multifamily heading into Q4.

-

Extension era: CRE’s looming debt maturity wall has been pushed from 2024 to 2026 due to widespread loan extensions.

-

Antitrust battle: Optimal Blue is pushing back against a class action lawsuit accusing it and major lenders of mortgage price-fixing.

-

Broker boom: Newmark and Cushman posted strong Q3 results as leasing and capital markets activity rebounded, with more growth expected in Q4.

-

Cold feet: Home purchase cancellations rose to 15% in September as economic uncertainty, rising costs, and buyer-seller standoffs stall deals.

🏘️ MULTIFAMILY

-

Price dip: U.S. rents fell for the third straight month in October, with vacancies hitting a record 7.2% and new supply outpacing demand.

-

Bearish turn: Major apartment REITs are cutting forecasts and reporting declining new-lease rents as economic uncertainty, weak job growth, and oversupply weigh on multifamily.

-

Landlord crackdown: The Chetrit brothers have been indicted for tenant harassment in a Manhattan rent-regulated building, with New York lawmakers using the case to push for tougher penalties.

-

Debt bet: Bridge Investment Group has raised $2.15B for its fifth debt fund, targeting residential CRE loans with a focus on multifamily assets and floating-rate debt.

-

Sunbelt softness: MAA continues to face pressure from oversupply in key Sun Belt markets, with Q3 new lease rents down 5.2%.

🏭 Industrial

-

Rural reach: Amazon is boosting capital spending to $125B this year, allocating over $4B to expand fulfillment centers in rural U.S. markets.

-

SoCal expansion: Bridge Logistics Properties has acquired two warehouses in L.A.’s City of Industry for $109M, expanding its Southern California footprint.

-

Policy push: Florida developers are seizing new opportunities to build on protected land after a state law expanded access to mitigation credits, fueling industrial and housing projects.

-

Textile footprint: Northwest Group has signed a $7.9M lease for 158K SF at First Harley Knox Logistics Center in Perris, CA.

-

Facility fund: SROA Capital has closed its $1.1B Fund IX—its largest ever—to acquire and finance self-storage properties nationwide.

🏬 RETAIL

-

Spurred growth: Boot Barn and other retailers are doubling down on Western wear as rising sales and cultural trends fuel aggressive store expansion and new product lines.

-

Fitness footprint: Fitness brand Cadet Athletic Performance signed a 7-year lease for its first NYC facility in Downtown Brooklyn.

-

Density debate: Plans to redevelop Fort Lauderdale’s Galleria Mall into a mixed-use site face resident pushback despite promises of affordable housing under Florida’s Live Local Act.

🏢 OFFICE

-

Trophy discount: Irvine Co. sold San Diego’s tallest tower, One America Plaza, for $120M — a steep loss from its 2006 purchase — as it exits downtown.

-

Office default: Philadelphia’s One South Broad office building is facing foreclosure after owner Aion Partners failed to sell the property or improve occupancy.

-

Market miss: Empire State Realty Trust had its weakest Manhattan leasing quarter in three years, falling behind the market’s broader rebound.

-

Neighborhood catalyst: Fort Lauderdale’s first new office building in five years aims to revitalize the city’s office market and attract top-tier tenants.

🏨 HOSPITALITY

-

Rollercoaster ride: Six Flags faces financial strain, park closures, and leadership changes as it eyes real estate sales and a turnaround, with new investor Travis Kelce in the spotlight.

-

Staying power: Extended-stay hotels outperformed the broader market in September, but RevPAR declines are expected to continue after a strong Q4 in 2024.

-

Luxury reels: Metro Cinema, a new luxury theater in Manhattan’s Chelsea, offers private screenings with gourmet meals for up to $200 per person.

A MESSAGE FROM EQUITY INSTITUIONAL

Tap into More Capital with IRA Investing

Many capital raisers don’t realize they’re missing out on a significant source of funding.

IRAs hold trillions in investable assets,* and a growing number of investors are ready to put them to work.

We’re built to get investors set up, funded, and invested in your fund—quickly and without distractions.

We’re transparent and supportive throughout the process, so you’re never left guessing. You’ll have a direct line to our team, quick response times, and clear communication every step of the way.

Raise more capital faster and get more time back to focus on your next opportunity.

*ici.org; This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

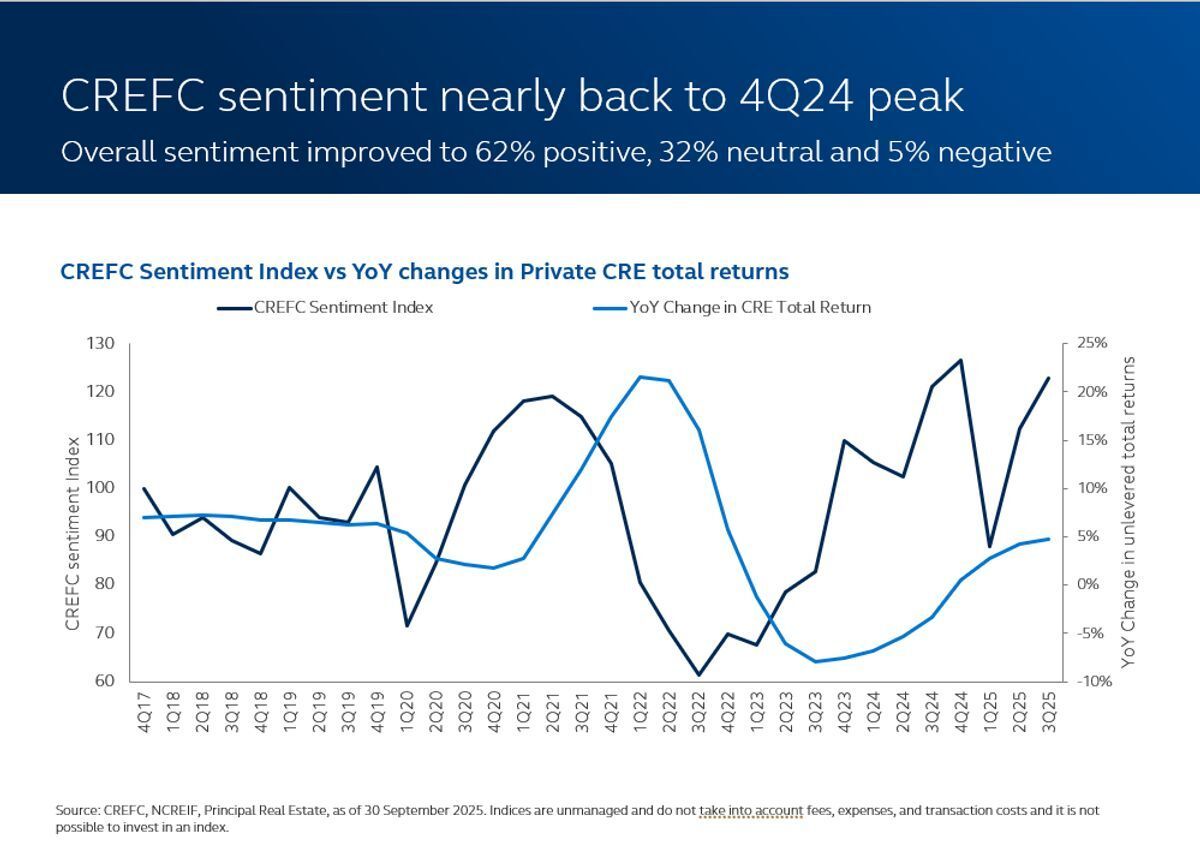

📈 CHART OF THE DAY

CRE sentiment rose 9.3% in Q3 to 122.8, driven by surging optimism around interest rates, financing demand, and transaction activity.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |