Burns + CRE Daily Fear and Greed Index Reveals Investor Pause in 4Q23

Plus: CRE deals are down across the board.

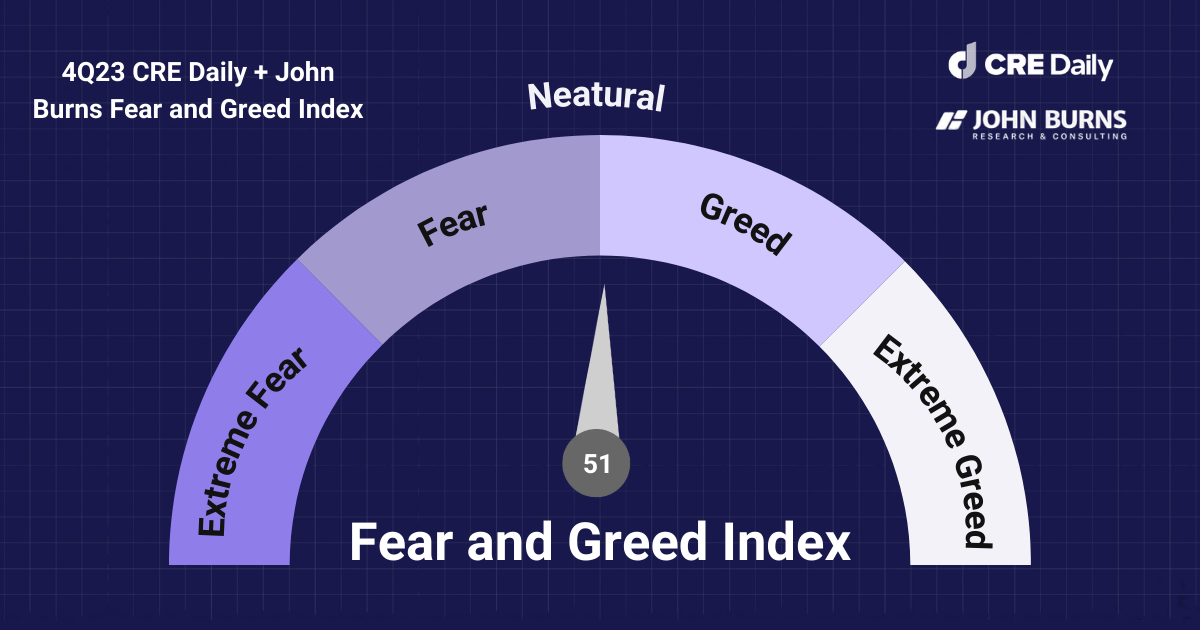

Good morning. The latest Burns + CRE Daily Fear and Greed Index reveals that most CRE investors are still in wait-and-see mode but expect to increase CRE allocations over the next 6 months.

Today’s issue is brought to you by FNRP. Grow your wealth with grocery-anchored, multifamily, and industrial commercial real estate.

Market Snapshot

|

|

||||

|

|

*Data as of 2/26/2024 market close.

MARKET OUTLOOK

Burns + CRE Daily Fear and Greed Index Reveals Investor Pause in 4Q23, But Hope on the Horizon

We are excited to share the new and improved Burns and CRE Daily Fear and Greed Index, offering an exclusive look at CRE investor sentiment, future expectations, capital access, and asset value changes over the next 6 months.

By the numbers: The 4Q23 analysis draws on insights from 972 readers and investors of CRE Daily, covering the multifamily, industrial, retail, and office sectors. With the index at 51 out of 100, it indicates a market hovering between expansion and shrinkage, displaying a mix of cautious and optimistic attitudes across different sectors.

Investment trends: The majority (66%) of CRE investors told us they’re holding their current investments, well above the share who said they’re increasing (21%) or decreasing (13%) their CRE exposure. This is also a considerable jump from the 49% holding strong last quarter.

Sector-specific insights:

-

Industrial and Retail sectors are anticipated to see value growth by the end of 2024, driven by investor optimism and a conducive economic environment.

-

Multifamily sector faces challenges, with expectations of value declines due to factors like excess supply and rising insurance costs.

-

Office real estate remains the least favored, with continued struggles expected for large, centrally located properties.

Access to capital: Credit conditions are tight across all CRE sectors and are getting tighter. Investors across CRE asset classes note that access to capital for CRE became more difficult between 3Q23 and 4Q23, which helped drive down asset values YOY.

“Valuations will be contingent on interest rate movements [in 2024]. Multifamily fundamentals will deteriorate because of excess supply, slower job growth, and insurance cost increases as policies renew. Industrial fundamentals will improve as supply is absorbed and will hold up much better.”

“While 2023 was a slower year, I think the primary reason for the decline in value and transaction volume was due to the increase in interest rates. Assuming there are no black swan events in 2024, we are confident that things will start to pick back up, especially if the Fed decreases rates slowly.”

➥ THE TAKEAWAY

It’s all about the rates: If the Fed does end up cutting rates this year (as is our base case), expect some upside for CRE values in sectors that have been depressed by a lack of capital. However, be aware of headwinds to fundamentals for certain property types in 2024, such as office buildings in central business districts and multifamily buildings in markets with significant construction.

SPONSORED BY FNRP

Partner with Excellence

As a savvy investor, you know the importance of carefully selecting the right sponsor for investing. Here are the top 3 reasons other investors choose First National Realty Partners:

-

EXPERIENCE: FNRP has a strong track record, overseeing $2 billion in assets across 60+ properties and ranking among the top acquirers of necessity-based properties for the last two years.

-

VERTICAL INTEGRATION: FNRP oversees every facet of the investment property lifecycle, from acquisition to sale, ensuring comprehensive management.

-

TRUST: FNRP co-invests their own capital in the same opportunities, aligning their interests with yours.

Please support our sponsors. It helps keep CRE Daily free.

✍️ Editor’s Picks

-

Contrarian play: StanChart is weighing increased real estate investment despite market trends, and the CEO hints at a property debt focus.

-

Elevated: Brandon Sedloff has been promoted to Chief Real Estate Officer at Juniper Square, tasked with overseeing the expansion of the company's real estate vertical. (sponsored)

-

Bets gone awry: Blackstone's (BX) liability to the University of California doubles to $560M as BREIT fails to deliver its promised 11.25% annual return.

-

Domino effect: After numerous interest rate hikes, remote work, and online shopping, the CRE market is looking at up to $1.2T in troubled debt.

-

Funding shift: Amid the pandemic, U.S. startup mega-round funding plummeted in 2023, with $100M rounds dropping to 200 from 600 in 2021.

-

Soaring hospitality: NYC enforcing Local Law 18 leads to 2.2M extra hotel room nights, $380.4M in increased revenue, but 89% fewer short-term rentals.

-

Data-driven innovation: As U.S. CRE continues to adapt to the pandemic with technology, Berkadia focuses on data, AI, and fostering innovation for growth.

🏘️ MULTIFAMILY

-

Rent caps rising: Washington State proposes a 7% annual rent cap amid the state’s housing crisis, as similar measures have been passed in Oregon and California.

-

Building success: Austin's housing market leads with thousands of new units, including multifamily, shifting toward a buyer's market.

-

Pessimism persists: U.S. apartment construction peaks at a 50-year high, while rent growth rises 1.4–8.6% in 2024, according to the NAHB.

-

Sunny side up: Solar energy boosts multifamily property income with free systems, lower electric costs, and potential grid sales.

-

Affordable dreams: The Irvine Company plans to build 1,782 apartments in Santa Clara, with 15% designated as affordable housing.

-

Viva Las Vegas: Nevada led U.S. job growth in 2023, with a 3.8% increase and 57.7K new jobs, per RealPage and BLS data.

🏭 Industrial

-

Easy deal: West Denver's Graham Street Realty sells Commerce Square in Aurora, CO, to Midtown National Group for $21.5M.

-

Urban oasis unveiled: Haltom City's upcoming 50-acre mixed-use development includes four industrial buildings and a $42.6M project cost.

-

Storage goldmine: Heitman purchased a Brooklyn building for $47M, doubling its 2017 price, expanding its self-storage portfolio.

-

From office to warehouse: Kearny Real Estate demolishes an office campus in Santa Ana to build a 163KSF warehouse, aiding Orange County's tight industrial market.

🏬 RETAIL

-

Reviving retail: IKEA purchases struggling malls to revitalize suburbs with co-working spaces and Nordic cuisine, aiming to diversify its retail empire.

-

Ferrari dreams: Ferrari leases 3.7KSF in SoHo on undisclosed terms. The average rent in the area is $1,060PSF.

-

Success story: New Warren retail center 10 Independence Blvd. is fully leased with Playa Bowls and more, boosting office park occupancy.

🏢 OFFICE

-

Wisdom beyond walls: Three U.S. apartment markets show above-average rent growth, while commercial foreclosures and CRE CLO distress rates are rising rapidly.

-

Office overload: The Austin office market looks oversaturated with a 27% vacancy rate, 5.5MSF sublease space available, and tech companies adapting to remote work.

MARKET TRENDS

When it Comes to CRE, Apparently Smaller May Be Better

Property transactions have fallen significantly across the board, with multiple sources, including the Fed, confirming the trend.

Performance variance: Green Street’s Real Estate Alert highlighted a divergence in property sales based on value categories in 2023. Properties valued between $5M–$25M outperformed those valued at $25M+ in terms of percentage change. While both categories saw deal declines, the percentage drop in higher-value properties was higher.

Trend analysis: Despite overall transaction losses in 2023, smaller, less expensive properties faced a drop in sales. Conversely, properties in the $5M–$25M range displayed more resilience, indicating a potential shift in market dynamics towards properties of moderate value.

Benchmark considerations: When making YOY comparisons in property transactions, it's crucial to assess the benchmark used for analysis. Popular assumptions may not always align with the nuanced reality of the market, urging stakeholders to delve deeper into the data for a more nuanced and comprehensive understanding.

➥ THE TAKEAWAY

Strategic decision-making: While CRE transactions continue to face challenges, three specific apartment markets showcased above-average rent growth, signaling pockets of resilience within CRE. This highlights the importance of identifying market segments with favorable performance metrics to guide informed investments.

📈 CHART OF THE DAY

KKR thinks that 2024 will be The Year of Transactions for CRE, projecting that the upcoming wall of CRE loan maturities will lead to countless re-negotiations and new opportunities for patient investors. The firm is projecting $544B in CRE loan maturities in 2024, $533B in 2025, and $561B in 2026.

SHARE CRE DAILY & EARN REWARDS

You currently have 0 referrals, only 1 away from receiving B.O.T.N Multifamily Deal Screener .

What did you think of today's newsletter? |