Beige Book Shows Economy in Pause, CRE Still Searching for Momentum

The U.S. economy cooled this summer, as businesses and consumers across most regions pulled back amid rising prices, labor shifts, and growing uncertainty.

Good morning. The Fed’s Beige Book signals a cooling economy, as inflation, labor shifts, and growing uncertainty weighed on both business activity and consumer spending.

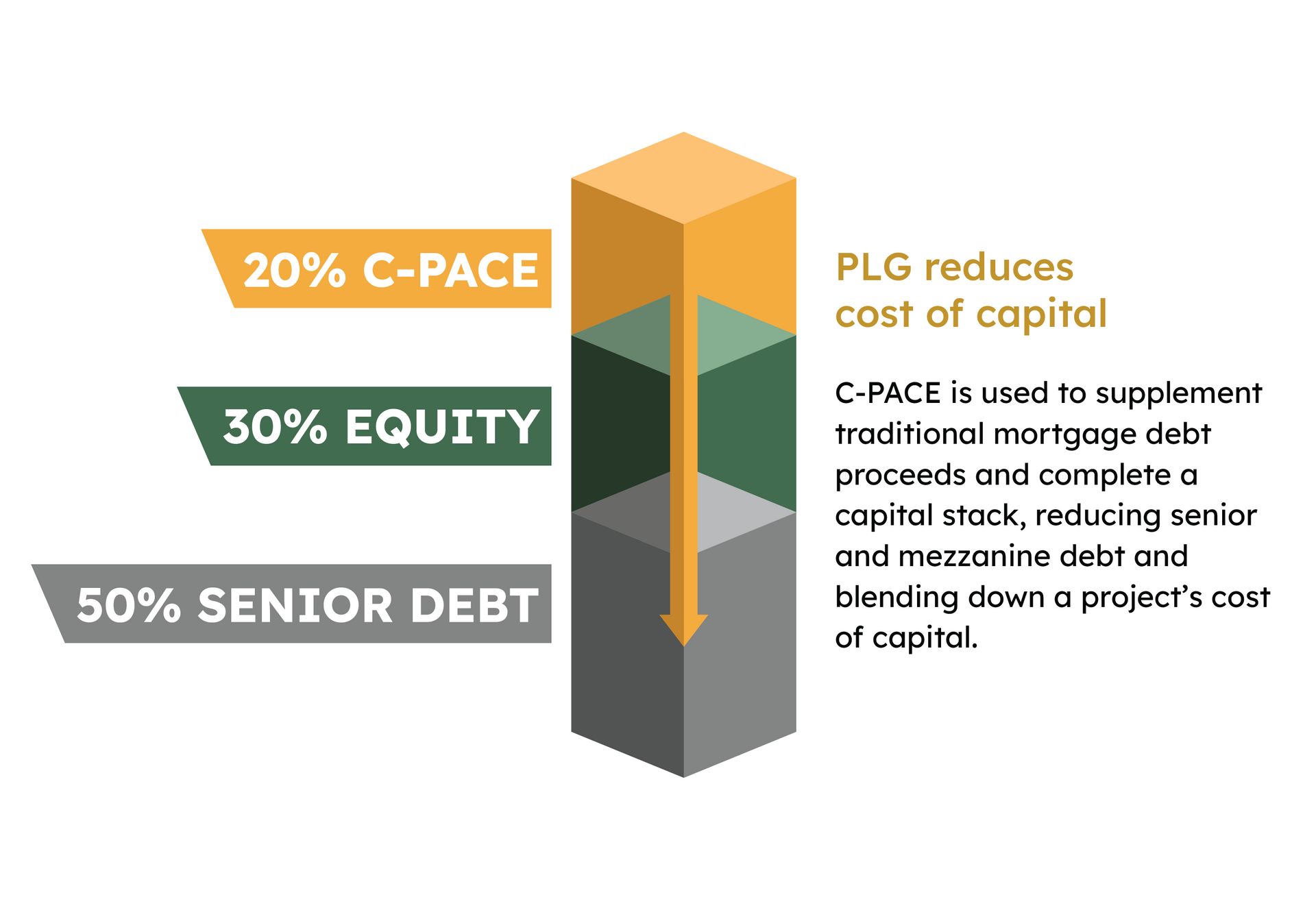

Today’s issue is brought to you by PACE Loan Group—fill the gaps in your cap stack with C-PACE.

Market Snapshot

|

|

||||

|

|

*Data as of 09/04/2025 market close.

Economic Activity

Beige Book Shows Economy in Pause, CRE Still Searching for Momentum

While the broader US economy remains stalled, the Federal Reserve’s Beige Book highlights surprising bright spots in CRE—thanks in part to AI.

Stuck in neutral: The Fed’s August Beige Book showed little or no economic growth in 11 of 12 districts, with flat or falling consumer spending and rising costs outpacing wages. Labor market weakness and tariff-driven inflation added pressure, fueling speculation of a potential rate cut at the next FOMC meeting.

Bright spots emerge: While overall economic momentum remains muted, CRE showed resilience, especially in data center construction. Districts like Philadelphia, Cleveland, and Chicago reported a surge in development, driven by the AI boom and select infrastructure projects, offering a rare bright spot in a cautious market.

Developers remain cautious: Several districts, including St. Louis, Minneapolis, and Kansas City, noted that developers are hitting pause on new projects. High financing costs, economic uncertainty, and rising material and labor prices were common refrains.

Region-by-region breakdown:

-

New York: CRE improving modestly, with leasing up, vacancies down, and stable rents.

-

Philadelphia: Slight growth in leasing and lending, though construction activity slowed.

-

Boston: CRE “slightly improved” overall, but office and multifamily markets stayed weak.

-

Cleveland: Industrial held steady, but retail softened. Construction contracts were flat.

-

Richmond: Leasing momentum was limited; outdated office buildings are being repurposed.

-

Atlanta: Vacancy rising in most sectors; Class A office stabilized due to amenity demand.

-

Chicago: Rents up, vacancies flat. Strong demand for high-quality office and warehouse space.

-

St. Louis: Activity steady but new starts are rare due to high borrowing and construction costs.

-

Minneapolis: Development pipeline shrinking, helping existing assets by limiting competition.

-

Kansas City: CRE activity unchanged; material costs and labor shortages constrained builders.

-

Dallas: Leasing slightly improved, but construction was subdued; multifamily occupancy rose.

-

San Francisco: CRE demand remained weak, with leasing decisions delayed and costs high.

➥ THE TAKEAWAY

The bigger picture: Despite isolated bright spots—in AI-driven manufacturing, data centers, and select real estate pockets—the U.S. economy is losing steam heading into fall 2025. Tariffs are inflating costs, hiring is cautious, and consumers are feeling the pinch.

TOGETHER WITH PACE LOAN GROUP

Fill the gaps in your cap stack with C-PACE

C-PACE is non-recourse, long-term (up to 30 years), fixed-rate financing that can fill gaps in the capital stack in any market. Whether for new construction, redevelopment, or recapitalizations, C-PACE offers a creative solution:

Retroactive C-PACE (refinancing)

-

Pay off/down mortgage debt

-

Fund reserves

-

Repatriate equity

New Construction / Gut Rehab projects

-

Interest rate/term hedge

-

Bank participant alternative

-

Non-recourse alternative

-

Leverage builder

Existing Building

-

Large CapEx projects

-

Renewable additions (Solar roof arrays, carports, EV charging stations, energy storage)

This is a paid advertisement. CRE Daily is not a registered broker-dealer or investment adviser.

✍️ Editor’s Picks

-

Extra Space Storage: The largest REIT doesn’t manage sub-par assets. 20+ units already leased at Hearthfire Holdings’ newest investment opportunity. Class A returns 2.7X EM, 23% IRR until 9/15/25. (sponsored)

-

Trump territory: Donald Trump Jr.’s 1789 Capital is partnering with Frisbie Group on a $1B fund to target CRE deals in South Florida, its first move into the sector.

-

Distress divide: Minneapolis, Austin, and Denver top CRED iQ’s list of most distressed CRE markets, while Stockton and Columbus show near-zero trouble.

-

Smart payments: Trimont is using JPMorgan’s Kinexys blockchain to speed up $730B in loan payments, cutting processing time from days to minutes.

-

September slide: After a strong August, public REITs stumbled out of the gate in September, dragged by office and data center sectors, despite optimism around rate cuts.

-

Park Ave pitch: Owners of adjacent lots on Park Avenue are seeking over $500M for a prime Midtown Manhattan development site with up to 700K SF of potential office space.

-

AI edge: BGO used AI to spot undervalued markets like Las Vegas, where a data-led investment far outperformed rent expectations.

🏘️ MULTIFAMILY

-

Market softening: US apartment rents fell 0.2% YoY in August, marking the first annual decline since 2021.

-

Dorm deal: Global student housing firm Yugo has acquired Campus Advantage, adding 40K beds across 88 properties.

-

Housing shift: Multifamily demand is soaring as the single-family market softens, with Q2 absorption hitting a 30-year high and vacancies dropping to 4.3%.

-

Legal tension: DFW suburbs are pushing back on Texas’ new pro-housing law with local rules that critics say block apartment growth.

-

City sprawl: Multifamily development is moving toward East Austin and Inner Ring areas, driven by lifestyle-focused renter demand.

🏭 Industrial

-

Storage slowdown: Self storage construction starts fell 12.8% in 1H25, continuing a multi-year slowdown as future pipeline activity remains weak.

-

Power pairing: NextEra aims to restart Iowa’s Duane Arnold plant by 2028, targeting a Big Tech power deal to meet soaring AI data center demand.

-

Texas trade: Blacktop’s JV acquired Houston’s 11-building Rosslyn Business Park, tapping into strong demand for heavy industrial space.

🏬 RETAIL

-

Budget crunch: Holiday spending is expected to dip 5%, with Gen Z pulling back the most, as shoppers favor value, gift cards, and shared meals over pricey gifts.

-

Bankruptcy loop: More retailers are filing “Chapter 22” bankruptcies, but most end up liquidating instead of recovering.

-

Leasing lifeline: Despite rising store closures, faster backfilling and surging investor demand are helping retail landlords keep vacancies in check.

🏢 OFFICE

-

Lifestyle lift: Lifestyle office districts are outpacing traditional markets with lower vacancies, higher rents, and surging investor demand.

-

Relocation risk: Dallas officials are scrambling to keep AT&T’s HQ downtown as the telecom giant eyes suburban alternatives that could cost the city $62M in annual tax revenue.

-

Downtown demo: Stonebridge and Bernstein are razing a half-empty K Street office tower to build 435 apartments with retail.

-

Office offering: NCR has put nearly 700K SF of its Midtown Atlanta HQ towers on the market, creating one of the nation’s largest office sublet opportunities.

-

Incoming incentive: Amazon will receive its first HQ2-related payment from Arlington County, an $81K cut of hotel tax growth tied to the tech giant’s office occupancy.

🏨 HOSPITALITY

-

Billion bid: Barings is exploring a sale of Florida’s JW Marriott Marco Island Resort, which could fetch nearly $1B.

-

Olympic rentals: High-end tourists are already booking LA mansions for the 2028 Olympics, with some rentals topping $300K per month years in advance.

📈 CHART OF THE DAY

While Census data report multifamily starts rising sharply, CoStar data show them falling steeply, highlighting major discrepancies between the two sources’ methodologies and results.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |