- Starwood’s SREIT is still contending with $850M in pending withdrawal requests more than a year after it imposed industry-leading limits on redemptions.

- SREIT sold $1.6B in real estate between December and May to improve liquidity and slightly ease withdrawal restrictions.

- Despite asset sales and tighter redemption caps, investor trust in nontraded REITs remains shaken, impacting fundraising across the sector.

Liquidity Crunch Continues at SREIT

According to The WSJ, Barry Sternlicht’s $22.6B Starwood Real Estate Income Trust (SREIT) is gradually lifting the strict redemption limits it imposed last year amid a wave of investor withdrawal requests. However, the fund is far from back to normal.

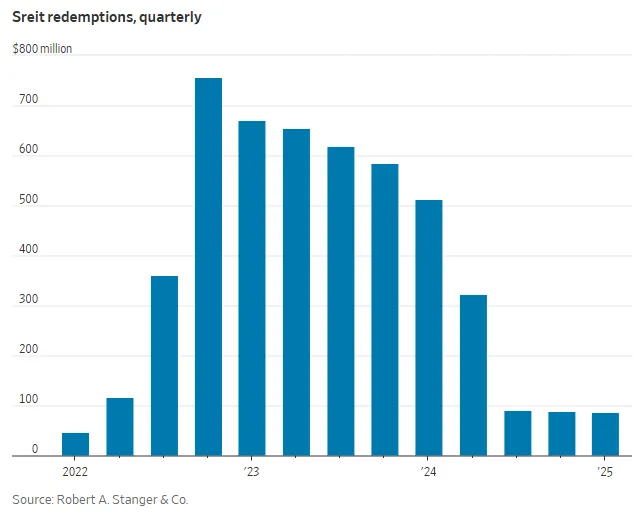

As of June, investors are still seeking to withdraw roughly $850M, according to data from Robert A. Stanger & Co. The backlog dates to early 2023, when SREIT, struggling with falling commercial real estate values, introduced some of the tightest redemption controls in the nontraded REIT sector.

Redemption Caps Loosened—Slightly

SREIT previously limited withdrawals to 1% of NAV per quarter. Now, starting in July, the cap will rise modestly to 1.5%, following a similar monthly increase from 0.33% to 0.5%.

These changes follow the sale of $1.6B in assets from December to May, a strategy aimed at meeting investor withdrawal requests, including a $133M shopping center in West Palm Beach. Those sales helped push SREIT’s liquidity above $900M, up from less than $800M a year ago.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Fund Performance and Market Headwinds

SREIT’s net asset value is down 40% from its 2022 peak, now at $8.8B, reflecting both asset markdowns and significant investor redemptions. The fund’s share price dropped 24% from its high, standing at $20.97 in April, excluding dividends.

Market-rate apartments comprise nearly half of SREIT’s holdings, with most properties located in the US South—a region still benefiting from demographic and rental growth trends, according to Sternlicht.

Broader Implications for Nontraded REITs

The fallout at SREIT is rippling across the nontraded REIT landscape. Once a fast-growing investment vehicle for retail investors, nontraded REITs collectively hold $81B in assets. But fundraising has faltered: in Q1 2025, the sector brought in $1.2B, while facing $2.8B in redemptions.

The liquidity freeze at Starwood has become a cautionary tale for investors evaluating similar funds. “It’s a question that everybody gets: Are you going to gate like Starwood?” said Kevin Gannon, CEO of Stanger.

Leadership Shift Amid Recovery Efforts

In a bid to reset investor confidence, Goldman Sachs veteran Nora Creedon will step in as SREIT’s CEO this July, replacing Sternlicht’s current leadership. The fund hopes that rate cuts and improving property fundamentals will reignite investor interest and reduce the backlog of withdrawal requests.

“We look forward to growing once again,” Sternlicht said, pointing to a likely rebound in apartment rent growth as new supply dwindles.

What’s Next

As commercial real estate adjusts to high interest rates and tighter capital markets, SREIT’s gradual reopening could serve as a benchmark for other nontraded REITs. But rebuilding investor confidence may take time—and a more stable macro environment.