- More than 3B SF of bulk warehouses built before 2000 are becoming functionally outdated as modern occupiers demand higher clear heights, energy efficiency, and upgraded fire and electrical systems.

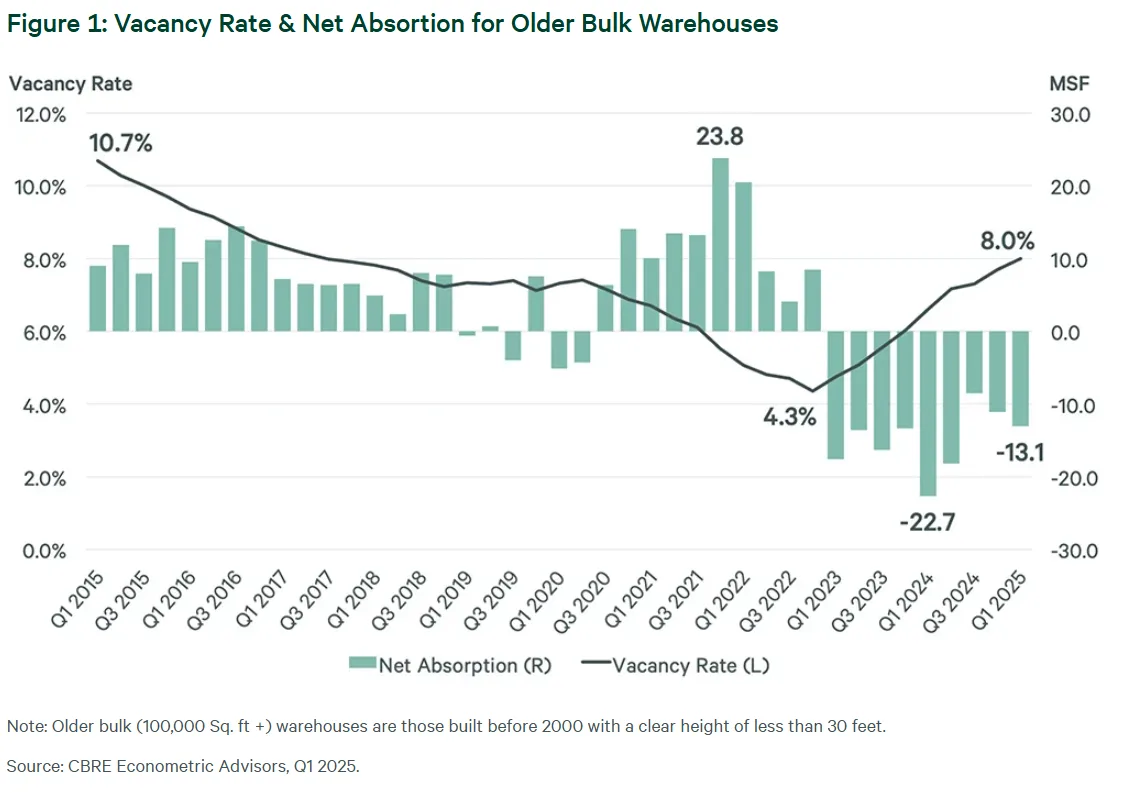

- Vacancy rates for these older facilities have nearly doubled to 8% in the past two years, with 133M SF of negative net absorption.

- Owners now face a choice: sell at a discount to users with lower operational requirements or invest in renovations to bring these properties up to Class A standards.

- Upgrades such as increasing clear heights, installing ESFR sprinklers, enhancing electric capacity, and implementing energy-efficient systems can reposition aging assets for today’s industrial needs.

Obsolete But Not Out

The flight to quality post-COVID has created a divide in the industrial real estate sector, reports CBRE. While over 2B SF of new bulk warehouse space (100K+ SF) has been built since 2020, many older facilities—those over 25 years old with sub-30-foot clear heights—are falling out of favor. These legacy assets now total more than 3B SF nationally, and vacancy among them has spiked, even as newer product continues to see robust demand.

Strategic Renovation Can Reposition Assets

Instead of discounting or selling the warehouses, owners willing to retrofit can capture new demand. Here are key areas to consider:

Structural Enhancements

- Facade refreshes can boost curb appeal and attract prospective tenants.

- Raising clear heights to at least 30 feet is capital intensive but increasingly necessary to compete.

- Upgrading fire suppression systems to ESFR standards can ease tenant concerns and meet modern insurance criteria.

- Electrical capacity upgrades, including new panels and wiring, accommodate modern tenant power needs.

Energy Efficiency Investments

- Insulated windows and shading reduce HVAC loads and utility costs.

- LED lighting retrofits can cut lighting-related energy use by 44%.

- Solar panels, still rare in the US industrial market, offer major upside for sustainable operations.

- Smart HVAC systems using AI-driven sensors can dynamically reduce cooling and ventilation energy usage, which accounts for over 30% of building energy consumption.

Why It Matters

Renovating older bulk warehouse stock is not only a sustainability play—it’s a value-add opportunity. With 325M SF of these assets facing lease expirations within three years, landlords are at a crossroads. Renovation allows them to attract modern tenants and extend the economic life of these properties, albeit with the headwind of higher construction costs and labor constraints.

What’s Next

As vacancy in older industrial properties grows and new development becomes costlier, expect more owners to pursue strategic retrofits. These updates, while capital intensive, could be the key to unlocking underutilized space and meeting rising demand for well-located, modern logistics facilities in a tight market.