- After a capital-markets-driven correction, US private CRE returns have shifted from contraction to recovery—often an attractive entry point, historically.

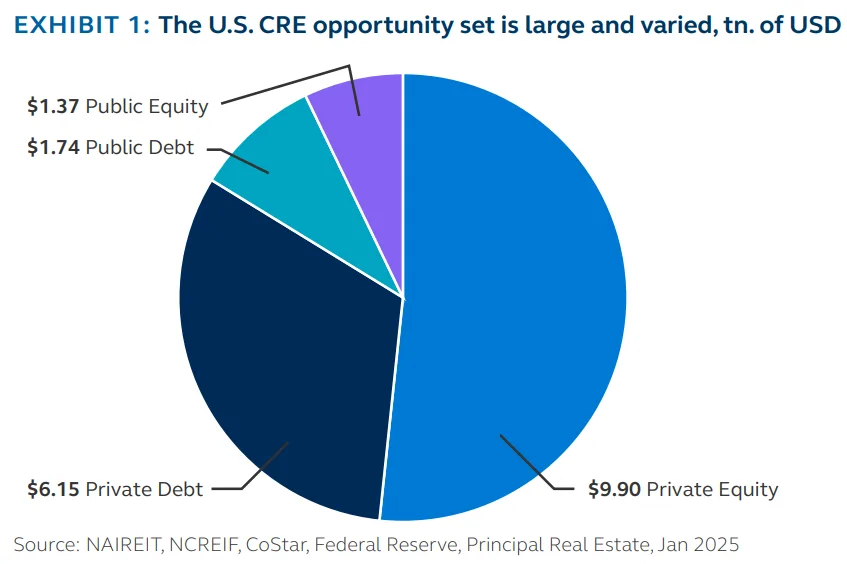

- The US CRE universe is vast—about $19T, or 16.2% of all US risk assets—spanning private equity, REITs, private debt, and CMBS.

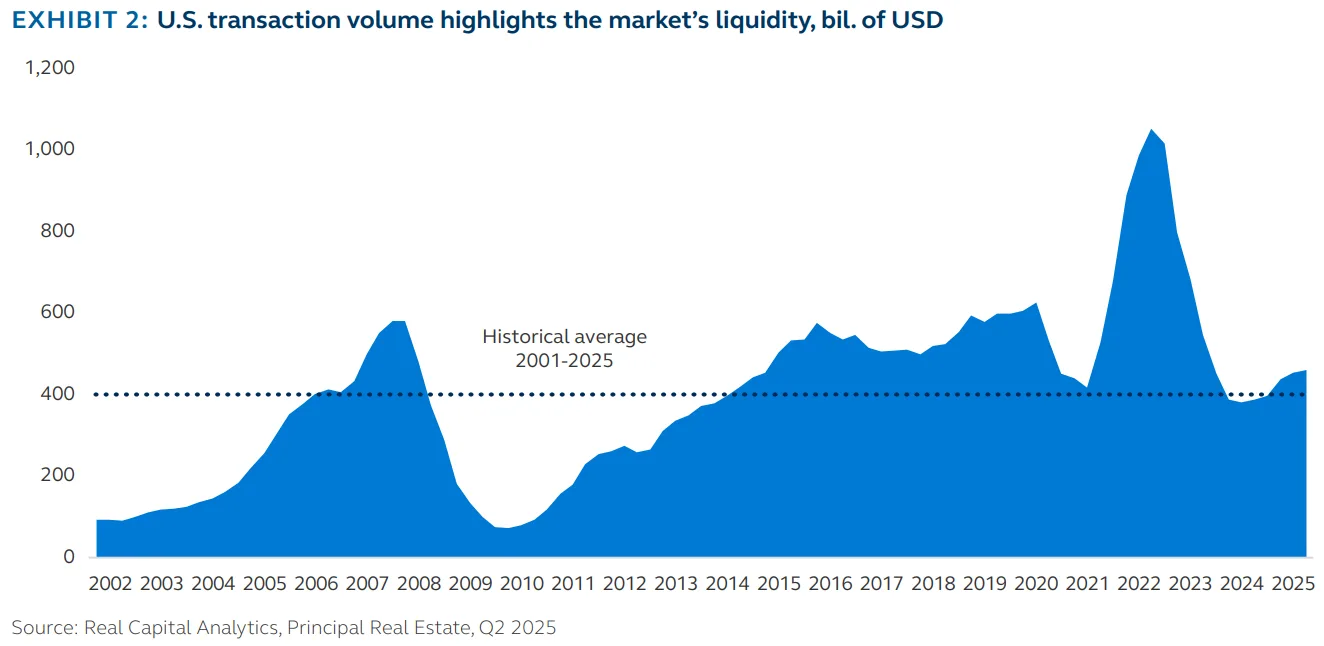

- Liquidity remains a hallmark: roughly $400B in annual deal volume on average over the past 20 years, with sales activity picking up over the last 12 months.

- Long-run performance is resilient: the NPI’s average annual total return is 8.4% with 4.3% standard deviation; only six negative calendar years since 1978.

Principal Real Estate’s latest US Commercial Real Estate Overview contends the market has moved past a capital-markets shock into a recovery phase as pricing reset and clarity improves—conditions that have historically preceded multi-year growth periods.

Where Things Stand

By Principal’s estimate, the investable US CRE stack totals roughly $19T, making it the world’s largest single-country market and cutting across all four quadrants (private equity, REITs, private debt, CMBS).

Depth is matched by tradability: average annual sales have hovered around $400B for two decades, and deal flow over the past year is running ahead of trend.

The Details

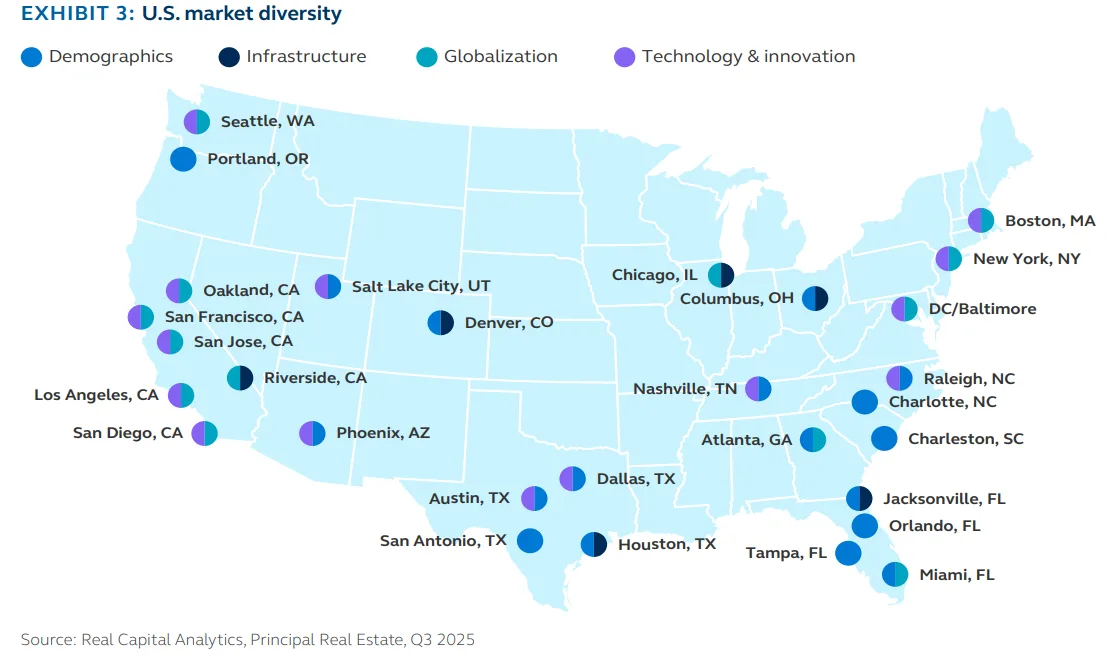

The US economy, worth $27.7T, drives steady demand. Around 50 major metros support diverse property types. The NPI index shows resilience. Since 1978, it has had only six negative calendar years. Average annual returns are 8.4%, with volatility at just 4.3%. Recoveries typically last about 10 years and average 11% returns.

Income is the foundation of performance. About 80% of total returns come from leases. Many contracts adjust for inflation, which adds resilience.

Why It Matters

“Alternative” property types—life science, medical office, data centers, student and senior housing, self-storage, SFR, and more—are rapidly blending into core allocations. They’re 12.9% of today’s US NPI, while public REIT portfolios are already 64% alternatives (up from 21% in 2000), suggesting continued private-market catch-up.

What’s Next

Principal expects liquidity and sector breadth to continue expanding as capital chases growth areas and the recovery matures. Still, investors should underwrite with discipline: CRE carries familiar hazards—from valuation and liquidity swings to leverage, credit/occupancy stress, refinancing and rate risk, and evolving legal/regulatory demands.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes