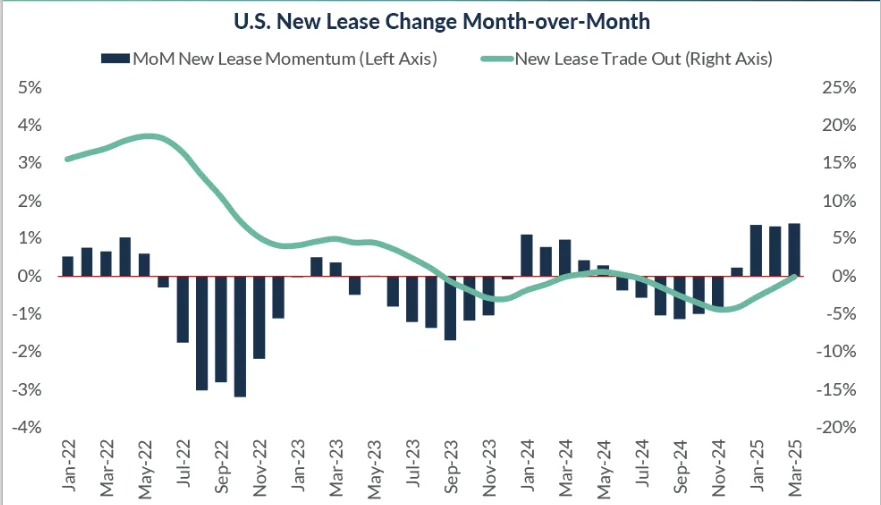

- The month-over-month change in new lease trade-out held steady around 1.4% in January, February, and March 2025, the strongest first-quarter momentum in three years.

- Despite recent gains, March’s trade-out rate remained at 0%, meaning new leases were priced roughly the same as previous leases.

- The turnaround from late 2024, when new leases were trading at a 4% discount, signals significant market recovery.

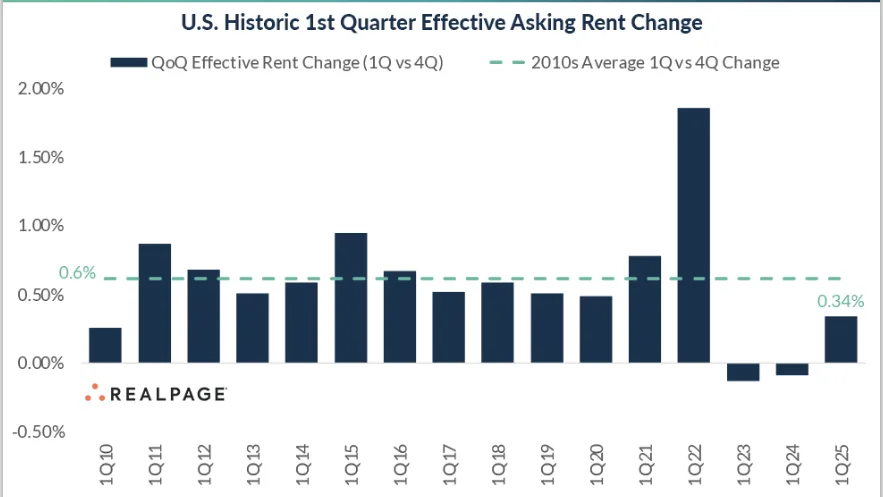

- Effective asking rents in Q1 2025 rose by 34 basis points compared to Q4 2024, the first quarterly improvement in two years.

Early Strength in 2025

The US apartment market started 2025 with notable leasing strength, as reported by RealPage. Month-over-month growth in new lease trade-outs consistently hovered around 1.4% through January, February, and March — a period that is typically strong but was even more impressive this year compared to the last three years.

A Recovery in Progress

Even with this positive momentum, March’s new lease trade-out rate landed at 0%, indicating that rents for new leases were on par with what the previous tenant paid. While not fully back to positive trade-outs, the current position marks a substantial improvement from November 2024, when leases were signing for rents about 4% lower than prior agreements — one of the largest drops in recent history.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Rent Pricing Improves, But Still Below Historical Norms

Broad apartment leasing and rent pricing also showed signs of recovery. Between the fourth quarter of 2024 and the first quarter of 2025, effective asking rents rose by 34 basis points. This contrasts with 2023 and 2024, when rent growth between these quarters typically showed declines.

However, while encouraging, the 34 bps increase still lags behind the 2010s decade average, when quarterly acceleration in apartment leasing rents often approached 60 bps.

Why It Matters

The momentum seen in early 2025 suggests that while challenges persist, the US apartment market is stabilizing faster than many expected. Continued recovery could help landlords regain pricing power heading into the traditionally strong spring and summer leasing seasons.