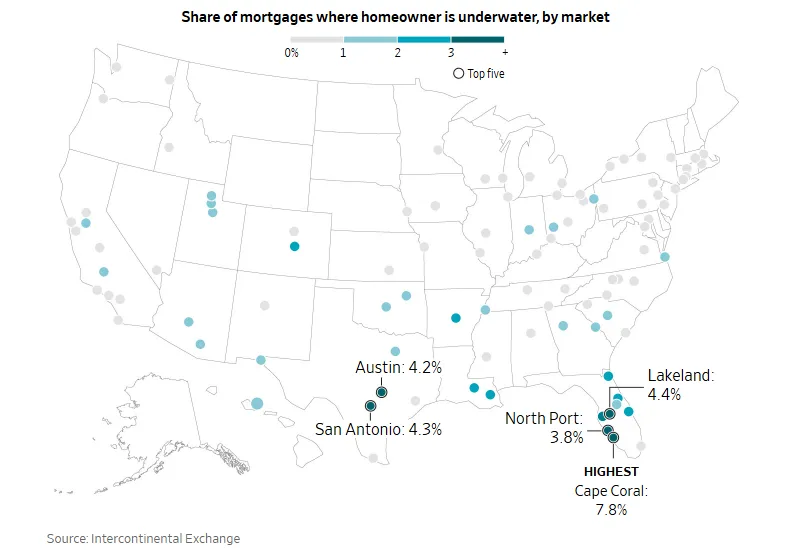

- Homeowners in markets like Cape Coral, San Antonio, and Austin are increasingly underwater on their mortgages as home values dip from pandemic-era highs.

- Over 500,000 US homeowners were underwater in April—the highest level for that month in five years, per Intercontinental Exchange.

- FHA and VA loan holders, many of whom made lower down payments, account for nearly 75% of underwater mortgages today.

Slipping Underwater

The number of US homeowners who owe more on their mortgages than their homes are worth is rising—especially among those who bought at the peak of the pandemic-fueled housing boom, per WSJ.

While the national share remains relatively small, new data shows that some Sunbelt boomtowns are seeing a sharp uptick in negative equity.

Cape Coral, Florida, tops the list with 7.8% of homes underwater, followed by Lakeland (4.4%), San Antonio (4.3%), Austin (4.2%), and North Port (3.8%), according to Intercontinental Exchange.

Pandemic Peaks, Post-Pandemic Pain

A surge in demand and limited supply during the early 2020s pushed prices up rapidly. That growth has since cooled due to higher mortgage rates, slower demand, and a construction boom that rebalanced supply. Homeowners who bought during the frenzy—particularly in high-growth areas—are now finding their property values trailing their mortgage balances.

For example, one Atlanta-area seller is listing his $400,000 home for $385,000 to exit before further declines. He’s not underwater—yet.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Who’s Most at Risk?

Owners with low-downpayment mortgages—particularly FHA and VA loans—are most vulnerable to price declines. These government-backed loans were popular among first-time and modest-income buyers during the boom, many of whom are now facing growing financial pressure.

According to ICE, FHA and VA borrowers account for nearly 75% of all underwater loans and virtually all of the increase in delinquencies over the past year.

Not 2008—But Still a Concern

Unlike the lead-up to the Great Recession, today’s homeowners are typically more creditworthy, and lending standards have remained tight. That makes a wave of foreclosures unlikely. Still, being underwater limits mobility—trapping owners who might otherwise sell or refinance.

Most underwater homeowners won’t feel financial pain if they stay put and keep making payments. But if prices slide further or unemployment ticks up, the financial strain could deepen.

What’s Next?

Redfin economist Chen Zhao forecasts a slight 1% national home price decline by year’s end, with further underwater cases likely. However, strong equity cushions built from pandemic-era down payments and tighter lending standards are expected to prevent broader fallout.

For now, the underwater trend is a warning sign—not a crisis. But for newer buyers in vulnerable markets, it underscores the importance of timing, equity, and affordability in housing decisions.