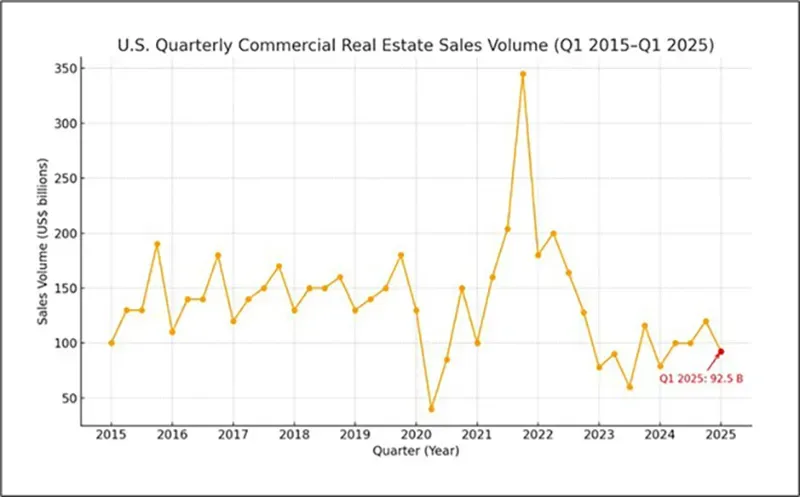

- CRE transaction volume is historically low, not because of a lack of capital or recession fears, but due to mismatched expectations and strategic stalling.

- Key drags include unrealistic owner expectations, tighter risk pricing by equity investors, and widespread “extend and pretend” strategies by lenders.

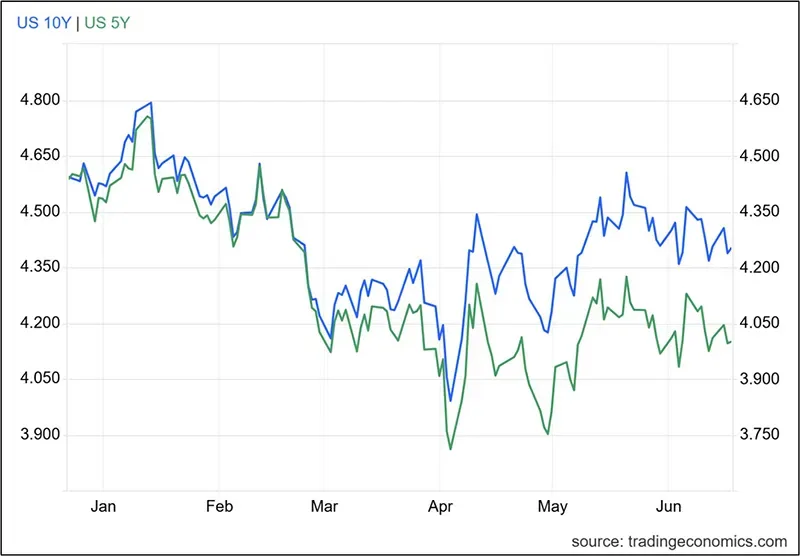

- While short-term rates remain elevated, the long end of the yield curve has stabilized, creating headwinds for refinancing and acquisitions at pre-2022 valuations.

- A wave of loan extensions, modifications, and risk repricing has led to value erosion across asset classes, particularly for older multifamily properties.

What’s Really Behind the CRE Slowdown?

CPE reports that unlike past CRE downturns triggered by capital constraints or economic recessions, today’s sluggish transaction volume is being driven by structural mismatches and investor psychology.

According to Shlomi Ronen of Dekel Capital, three forces are suppressing deal flow:

- Unrealistic Pricing Expectations: Many owners are holding out for a return to pre-2023 interest rate levels, which remains unlikely in the near term.

- Cautious Equity Markets: Investors have become more conservative in how they price risk, leading to reduced acquisition appetite.

- “Extend and Pretend” Lending: Lenders and owners are modifying or extending maturing loans rather than recognizing losses, which delays price discovery.

Liquidity Is There, But Banks Are Pulling Back

Publicly traded US banks, which account for about 40% of CRE debt, have reduced their exposure year-over-year. Wells Fargo, US Bancorp, and M&T Bank all cut CRE loan balances in Q1 2025 compared to Q1 2024—freeing capacity but signaling tighter lending standards.

Despite this pullback, CRE delinquencies remain moderate at around 1.49%, indicating a market in limbo rather than in distress.

Rate Pressure Continues to Reshape Underwriting

The Fed’s target rate currently sits between 4.25% and 4.5%, with slight reductions possible in late 2025. However, 10-year Treasury yields remain around 4.3%, keeping loan coupons elevated between 5.25% and 7.5%—well above the sub-4% rates seen during the pandemic.

This has led to a bifurcation in risk pricing. For example:

- Class B/C Multifamily (Phoenix): Cap rates rose from 3.75–4.25% in 2022 to mid-6% in 2025.

- Class A Multifamily: Cap rates moved from around 4% in 2022 to low-5% in 2025, showing a clearer premium for lower-risk assets.

The Great Modification Era

Many bridge loans issued during the 2021–2022 boom were short-term and highly leveraged. As these loans mature, equity positions have evaporated due to higher cap rates and weaker fundamentals.

Rather than foreclose, lenders have extended or modified loans, with the Mortgage Bankers Association reporting $384B in legacy loan extensions into 2025.

This is delaying distress-driven sales but also contributing to a stagnant market with little price discovery.

What’s Next: A Market Reset in Motion

Ronen expects activity to gradually return in the second half of 2026, driven by:

- Recapitalizations of distressed or maturing assets.

- Development Starts where land prices and construction costs align with higher exit cap rates.

- Loan Sales from lenders offloading underperforming debt.

Until then, transaction volume is likely to remain subdued as the market resets its expectations to align with a structurally higher rate environment.

Bottom Line

The CRE market is not suffering from a lack of capital or systemic distress—it’s stuck in a stalemate. Owners, lenders, and investors are all waiting for someone else to blink first. Only time, value adjustments, and strategic repositioning will break the impasse.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes