- CMBS conduit spreads have tightened significantly, with AAA bonds now pricing at 78 basis points above Treasuries, levels last seen in January 2024.

- Improved pricing has lowered loan coupons to 6.62% on recent deals, compared to 7.67% in mid-2023.

- Strong investor demand, disciplined underwriting, and recent Fed rate cuts are supporting higher issuance expectations for 2025.

Spreads Tighten

Spreads on CMBS conduit bonds have returned to early-2024 levels. A recent $741M deal priced its AAA class at 78 bps over Treasuries, down from 108 bps in April and 125 bps in mid-2023, per Trepp.

This allows lenders to lower loan coupons while preserving profitability, with the latest deal averaging 6.62%.

Issuance Up

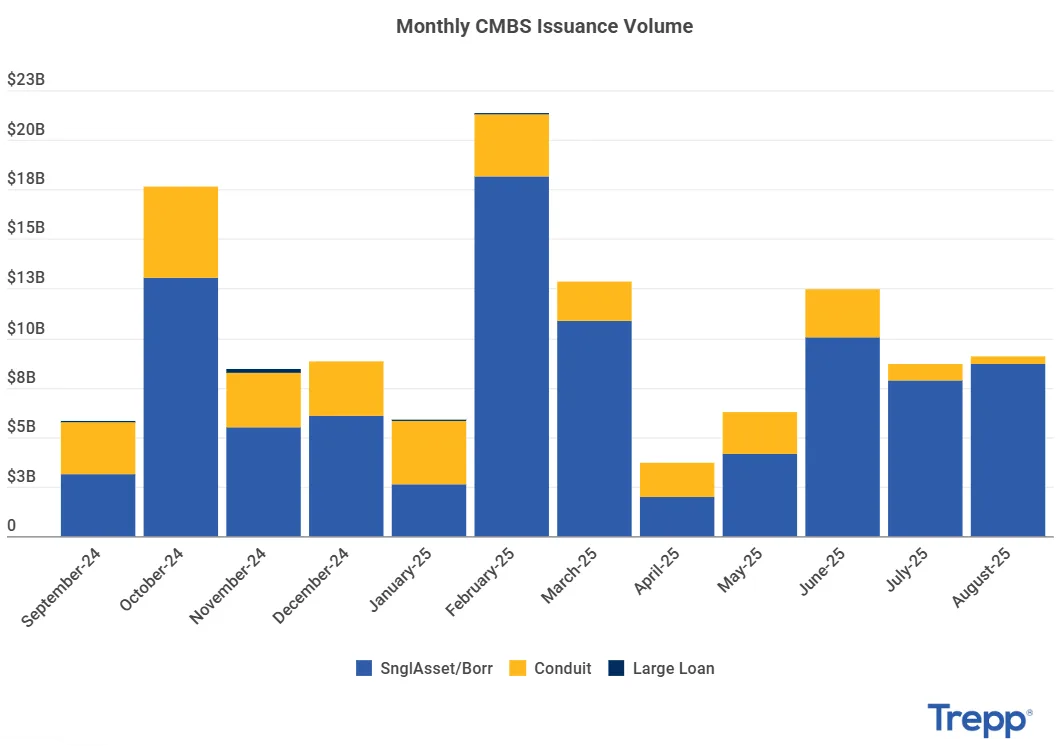

Though conduit deals remain modest in size, strong investor demand is absorbing them quickly. With the Fed recently cutting rates, demand may grow further. Trepp data shows $80B in CMBS issued so far in 2025, putting the market on track to surpass 2024’s $104B total.

Underwriting Holds

Despite tighter spreads, issuers are maintaining discipline. Most LTVs stay below 60%, and DSCRs remain above 1.5x. AAA spreads for 5- and 10-year bonds have narrowed significantly over the past year, while DSCRs have fluctuated due to smaller deal sizes.

Why It Matters

The tightening in spreads reflects improved market confidence and better pricing conditions for lenders. Cautious underwriting suggests the market is expanding without sacrificing credit quality.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes