- Telecommunications claimed the highest share of assets under management at 17%, surpassing residential’s 16% share.

- Office REIT allocations have rebounded to match their FTSE Nareit All Equity Index weight for the first time post-pandemic.

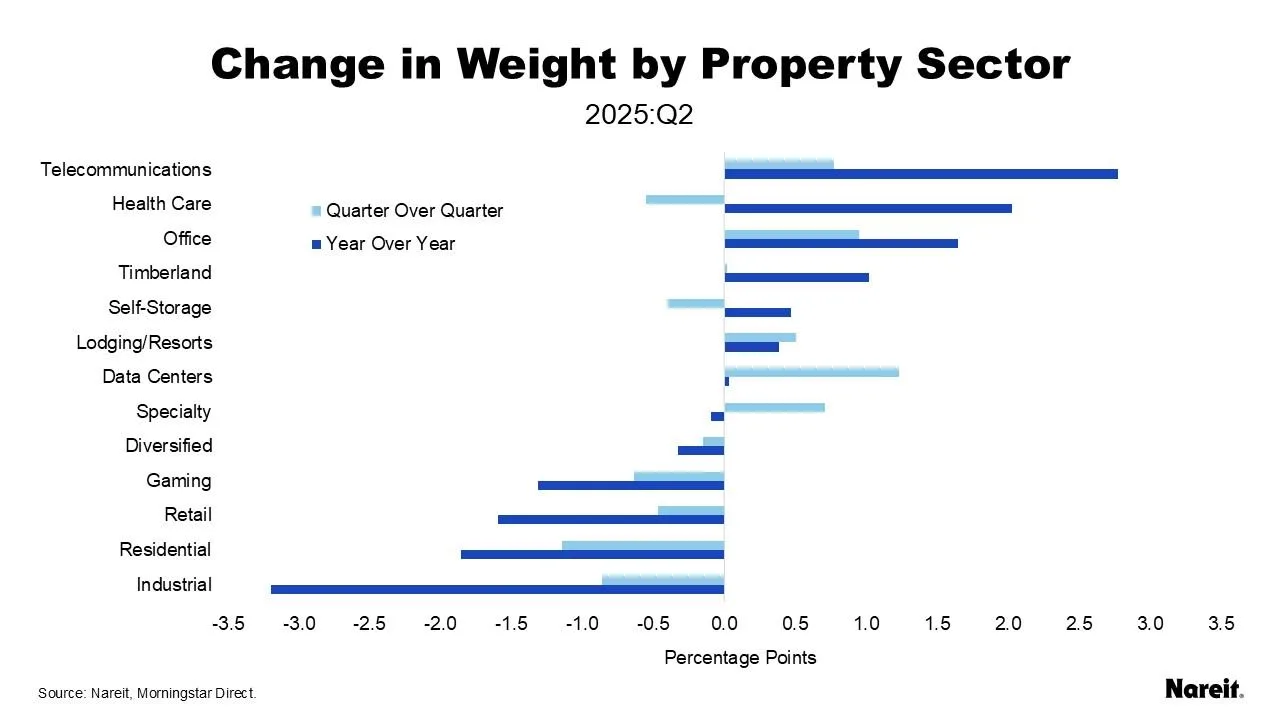

- Data centers saw the largest quarterly increase, while residential and industrial posted notable declines.

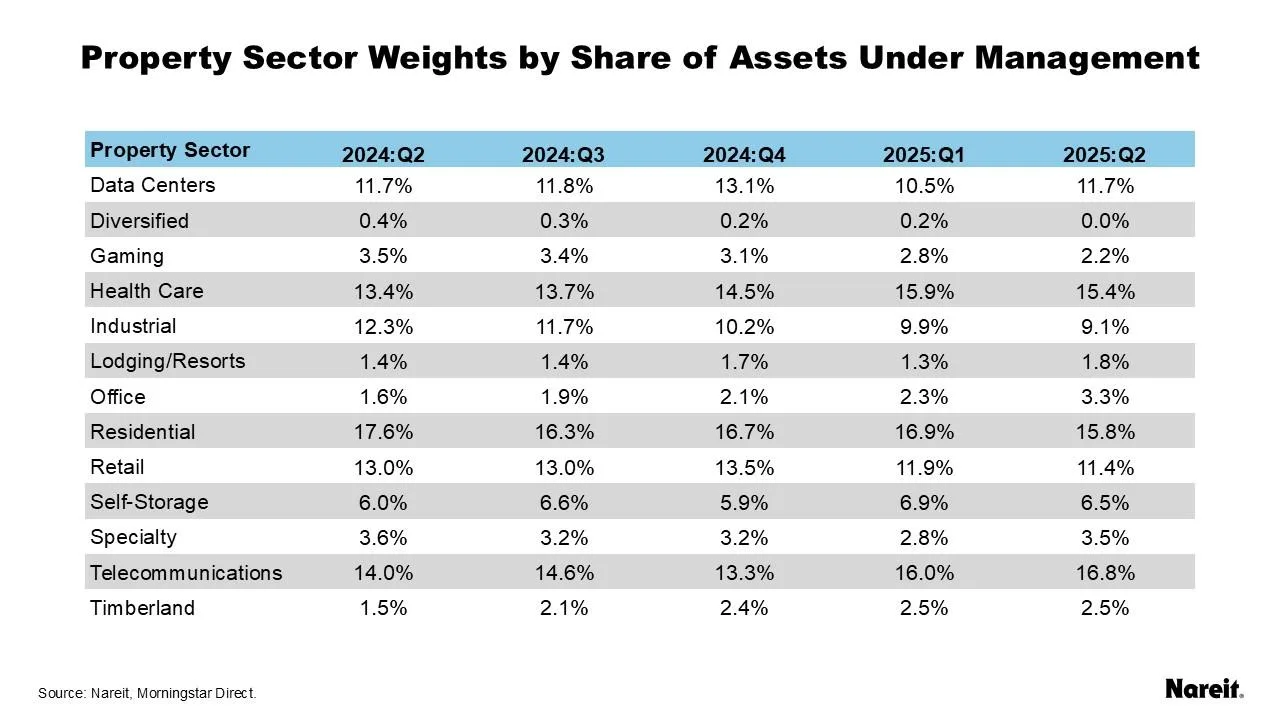

Nareit’s Q2 2025 Actively Managed Real Estate Fund Tracker shows a major sector shift: telecommunications REITs have overtaken residential REITs for the largest share of assets under management in actively managed funds. The change breaks residential’s uninterrupted run at the top dating back to mid-2017.

A shake-up at the top

Telecommunications now holds a 17% allocation, edging past residential’s 16%. Health care took the third spot at 15%, followed by data centers (12%) and retail (11%). Office REITs, long underweighted post-pandemic, rose from under 2% a year ago to just over 3%, matching their index share.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Performance drivers

- Telecommunications was the most overweight sector relative to the FTSE Nareit All Equity REITs Index, at 136% of its index share, with a 2.8-point year-over-year gain.

- Data centers posted the largest quarterly gain (1.2 points) after a sharp drop last quarter, and remain the second most overweight sector (129% of index share).

- Office logged the second highest quarterly gain (nearly 1 point) and is up 1.7 points year-over-year.

- Timberlands ranked third in overweight status at 119% of index share, continuing steady gains since late 2024.

Sectors losing ground

Residential allocations fell 1.1 points for the quarter and are down 1.9 points year-over-year. Industrial continued its nine-quarter decline, dropping 0.9 points in Q2 and 3.2 points annually. Retail saw back-to-back quarterly drops, while gaming fell for the fifth straight quarter.

Why it matters

The sector rebalancing suggests active managers are tilting toward telecommunications and data infrastructure plays, while rotating away from industrial and retail properties. Office’s recovery to index weight signals improving sentiment toward the long-struggling segment.

Outlook

If current trends hold, technology-linked property sectors could retain their overweight status, while previously favored categories like residential may remain under allocation pressure.