- Tech-centric metros such as the Bay Area, Denver, and Austin have shifted from top job creators to markets with declining or stagnating employment.

- AI disruption, economic uncertainty, and a correction from pandemic-era over-hiring are driving the pullback in job growth.

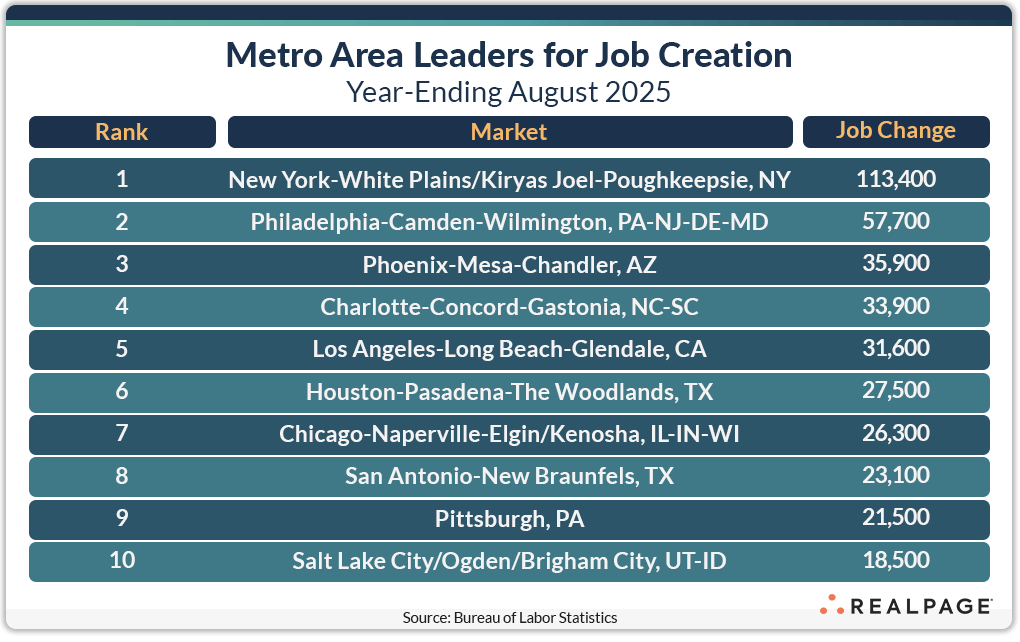

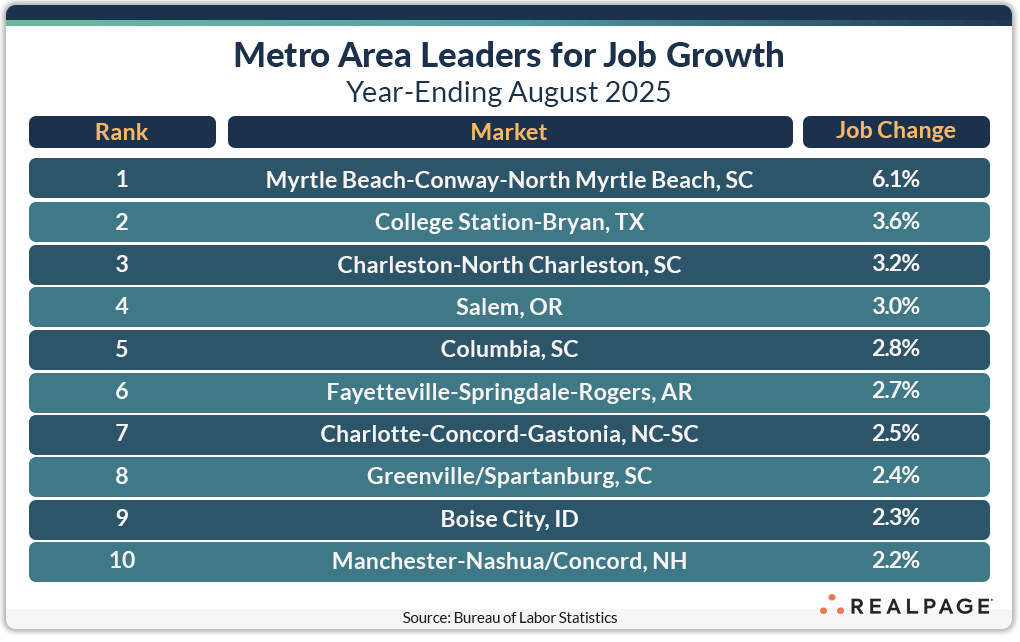

- Cities like New York, Philadelphia, and Phoenix are leading in total job creation, while smaller markets, especially in the Carolinas, are leading in job growth rate.

- Nationally, 26 of the top 150 US markets reported annual job losses in August, with job growth slowing across even the strongest metros.

Tech Hubs Cool Off

Once seen as job magnets, markets like San Francisco, Austin, and Seattle are now slipping. The Bay Area lost 13,600 jobs over the past year, and Denver dropped 3,800 jobs in August alone, according to RealPage analysis.

Austin, Dallas, and Seattle, all previously in the top 10 for job creation, have now fallen outside the top 25. Austin ranked behind Honolulu and just ahead of Myrtle Beach.

What’s Driving The Drop

The job pullback is driven by a mix of factors, including AI adoption reshaping labor needs, economic headwinds, and the tech industry’s course correction after pandemic over-hiring. This shift has led to a notable exodus of talent from certain metros as job opportunities decline.

Compared to a year ago, key tech markets collectively generated around 100,000 fewer jobs.

New Leaders Emerge

Despite broader slowdowns, not all tech-heavy cities are losing steam. Salt Lake City and Boston posted job growth year-over-year, collectively adding over 26,000 jobs more than the same period last year.

New York remains the dominant force in national job growth, adding 113,400 jobs in the 12 months ending in August. Philadelphia held the #2 spot for the fourth straight month, while Phoenix rose to #3 from #7.

Smaller Cities Show Strongest Growth

While large markets top total job gains, smaller cities are leading in job growth by percentage. Myrtle Beach, SC retained the #1 spot for job growth rate, despite a slight slowdown. Other strong performers included:

- College towns like College Station, TX and Fayetteville, AR

- State capitals such as Salem, OR and Concord, NH

- Southeastern markets including Charleston and Greenville/Spartanburg, SC

Eight of the top 10 markets for job growth rate saw stronger growth than a year ago. In total, 71 markets beat the national job growth rate of 0.8%, though that number declined by 15 from the previous month.

Why It Matters

The rebalancing of job growth away from traditional tech hubs underscores shifting dynamics in the US labor market. While innovation remains a key driver, cost of living, remote work, and AI automation are reshaping where talent and opportunities are concentrated.

What’s Next

Expect continued unevenness in job growth across metros. While tech hubs recalibrate, emerging markets, especially those with diversified economies and livable costs, are increasingly capturing talent and job investment. RealPage notes that job creation is slowing even in top markets, suggesting a broader deceleration could be underway.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes