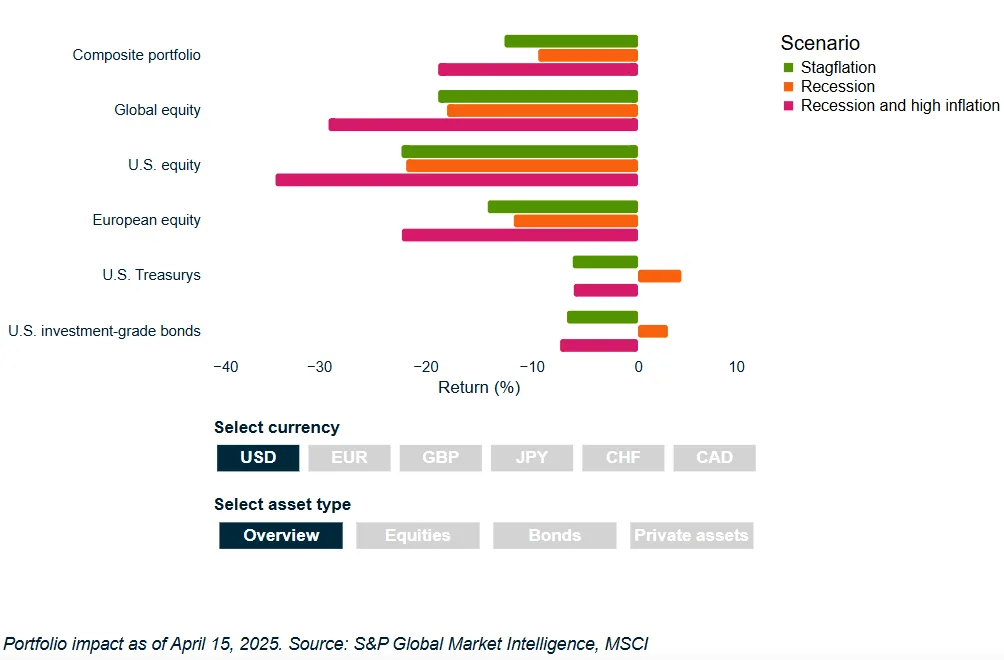

- MSCI models the effects of three macro scenarios — stagflation, recession, and an inflationary recession — following the US tariff announcement on April 2.

- In the worst-case scenario, US equities could drop nearly 35%, with diversified portfolios losing as much as 19%.

- Rising inflation with declining growth could limit the Federal Reserve’s ability to cut rates, increasing the risk of simultaneous losses in both equities and bonds.

Following the April 2 announcement of new US tariffs, MSCI has modeled the potential economic and portfolio impacts under three forward-looking macroeconomic scenarios.

These include a mild recession, a period of stagflation, and a combined recession with rising inflation — the most severe outlook, according to MSCI.

Scenario breakdown

- Stagflation: Growth flatlines at 0% and inflation climbs by 200 basis points. Rate hikes to fight inflation weigh on long-term economic activity. Equities and bonds both decline due to persistent inflation and limited central bank stimulus.

- Recession: A 3% economic contraction is accompanied by easing inflation. The Federal Reserve cuts rates, supporting a quicker recovery. In this scenario, bonds rally and partially offset equity losses.

- Recession + High Inflation: The worst-case scenario resembles 1970s-style stagflation, with a 3% drop in GDP and inflation rising 200 basis points. Equity losses reach 34%, while bonds also fall due to rising yields.

Portfolio implications

A diversified portfolio of global equities, US bonds, and real estate could lose:

- 19% in the inflationary recession scenario

- 13% under stagflation

- 9% during a typical recession

Why It Matters

With elevated US equity valuations and rising trade tensions, investors are exposed to heightened downside risk — especially if growth stalls while inflation persists. The study highlights how macroeconomic volatility can simultaneously impact traditionally uncorrelated asset classes.

Potential Upside

A reversal back to earlier 2025 market highs could result in a 15% equity recovery, though that outcome depends on policy clarity and a normalization of growth and inflation expectations.

What’s Next

As macro conditions evolve, MSCI emphasizes the need for scenario-based portfolio stress testing — especially in environments where central banks have limited room to respond to dual shocks of inflation and stagnation.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes