- Retail foot traffic rose 6.1% year-over-year for the week ending April 20, fueled by rising tax refunds, pre-tariff buying, and the Easter holiday.

- Specialty food, apparel, and jewelry stores led growth, with some categories seeing double-digit increases in traffic.

- Experts say tariffs are prompting consumers to accelerate purchases ahead of potential price hikes, though some analysts argue broader economic factors are at play.

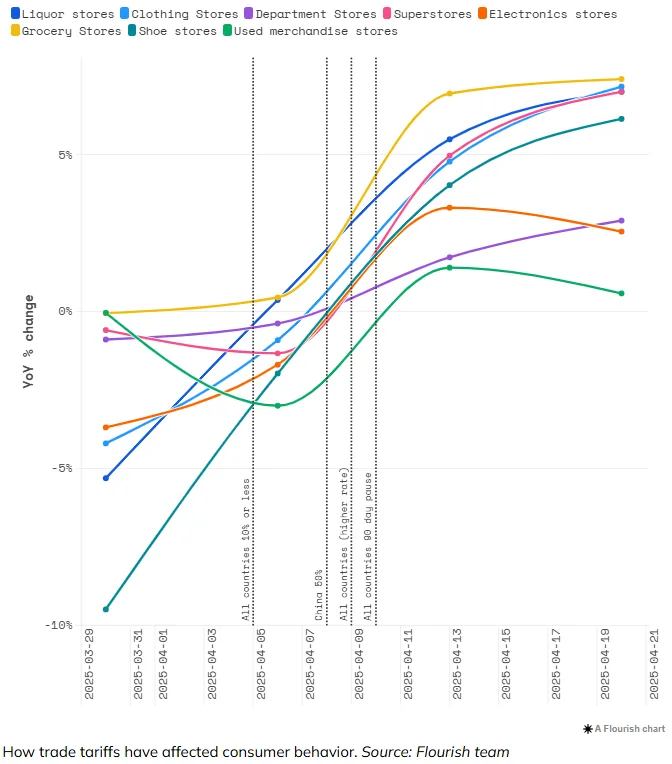

Recent data from pass_by shows in-store foot traffic accelerating for the second straight week in April, with a 6.1% year-over-year gain — nearly double the prior week’s increase, according to Commercial Search. The surge is being attributed to multiple factors, including early buying ahead of anticipated tariff-driven price hikes.

What’s Driving The Spike

- Tariff anxiety: Consumers are pulling forward purchases of discretionary and import-heavy items like jewelry and apparel.

- Tax refunds: Average refunds are up 3.6% year-over-year, putting more disposable income into the hands of shoppers.

- Holiday effects: The Easter holiday spurred a notable bump in grocery and superstore traffic.

Category Highlights

- Specialty food store visits jumped 36.8% YoY.

- Apparel traffic rose 7.2%, while jewelry saw a 14.9% increase.

- Electronics and furnishings, however, posted YoY declines, potentially due to holiday-related store closures.

Expert Views

While some analysts caution against over-attributing the increase to tariffs, others say the consumer response is strategic and signals a broader behavioral shift.

“It’s clear that shoppers aren’t just reacting to tariffs — they’re anticipating them,” said James Ewen of pass_by. Doug Ressler from Yardi added that physical store visits also spur impulse buying, compounding the effects.

Why It Matters

The data points to a more nuanced retail recovery, where consumer sentiment is influenced by both economic policy and seasonal spending. If tariffs take effect, a temporary dip in demand could follow this front-loaded activity, reshaping how retailers and landlords plan for the coming quarters.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes