- Tariff-related uncertainty is prompting firms to pivot to bonded warehousing and explore reshoring or alternative sourcing locations outside China.

- Miami led the nation with 9.8% annual rent growth, driven by international trade and limited space for new development.

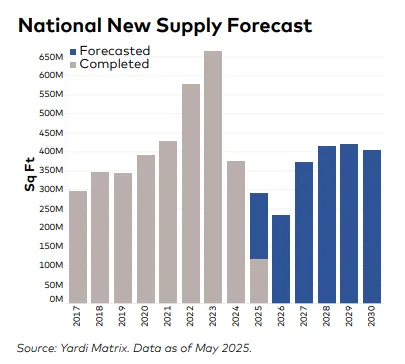

- Construction starts have slowed significantly, with 2025 on pace for the lowest new supply this decade amid steel tariffs and high borrowing costs.

Trade Turbulence Reshapes Strategies

A sharp 135% tariff on Chinese imports introduced in April has upended supply chains, with import volumes dropping nearly 20% in April alone, reports Yardi Matrix. Ports like Los Angeles reported a 25% shortfall in expected cargo volumes in May. In response, businesses are racing to stockpile goods ahead of future tariffs, and bonded industrial warehouses—where goods can be stored tariff-free until release—are seeing renewed interest despite their conversion costs.

Miami Stands Out Amid National Rent Growth

In-place rents for industrial space averaged $8.54 PSF nationally in May 2025, up 6.3% YoY. Miami outpaced all markets with a 9.8% rise, hitting $12.72 PSF, thanks to its trade ties with Latin America and a constrained development pipeline. New leases in Miami command a premium of $3.82 PSF above the market average—among the highest in the US.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply Drops To Decade Lows

Only 86.9M SF of new industrial starts were recorded through May, putting 2025 on track for the weakest supply pipeline in over 10 years. Contributing factors include tariff volatility, steel import tariffs (now at 50%), and fewer-than-expected interest rate cuts, all discouraging construction. Just 1.7% of national stock is currently under construction.

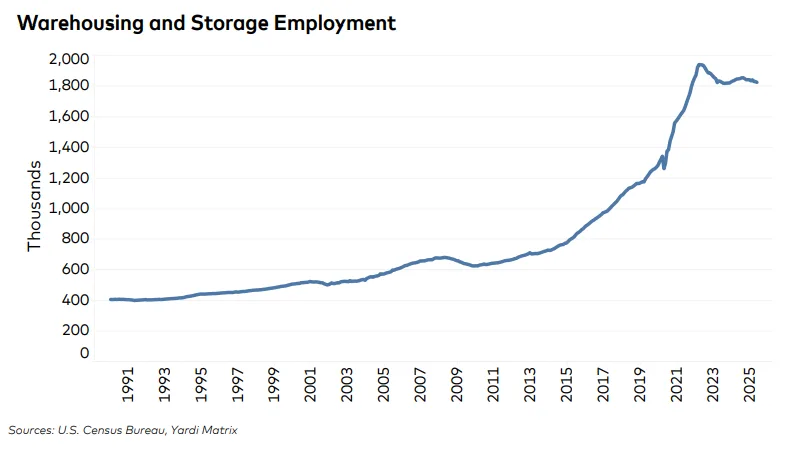

Warehousing Jobs Decline But Wages Rise

The warehousing and storage sector shed 5,100 jobs in May, down 1.2% YoY, yet remains 42.3% above pre-pandemic employment levels. Firms are favoring automation over labor expansion, especially given ongoing economic uncertainty.

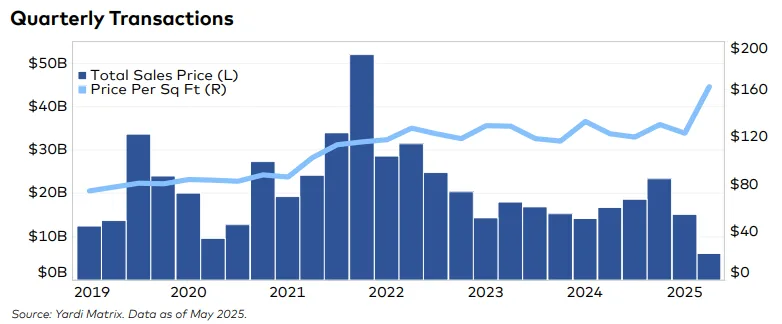

Investor Spotlight On Phoenix

Phoenix remains a top industrial investment market, logging $862M in transactions year-to-date—6th highest nationwide—despite being only the 10th-largest by SF. Prices have surged to $187 PSF, up 14.2% from 2024.

What’s Next

Expect continued volatility in trade policy to influence industrial strategies, with a mix of short-term warehousing solutions and long-term production relocation. Meanwhile, rent premiums in constrained markets and declining starts point to tightening conditions for occupiers in select metros.