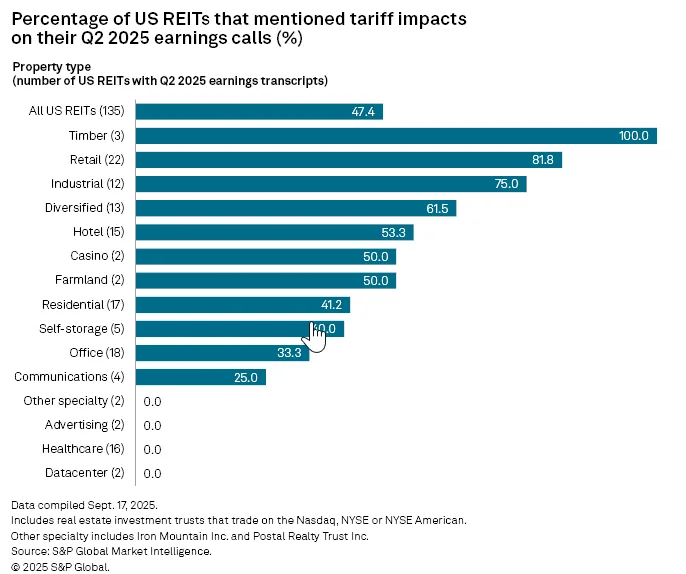

- 47% of US REITs mentioned tariffs in Q2 2025 earnings calls, but the majority saw only limited operational impact.

- Timber and cold storage REITs were the most affected, while retail and industrial REITs mostly maintained stable activity despite macro uncertainty.

- Construction costs remained stable or declined slightly, with developers benefitting from increased contractor competition.

- Timber REITs remain bullish on US lumber pricing due to Canadian import tariffs.

Tariff Impacts Vary Across REIT Sectors

Despite rising inflation and ongoing trade tensions, most US REITs reported limited fallout from tariffs during the second quarter, according to data from S&P Global Market Intelligence.

Of the REITs analyzed, 64-nearly half, discussed tariffs in their Q2 earnings calls.

Sector Insights

Industrial REITs: Tariffs and macro uncertainty are delaying tenant capital decisions, especially for larger leases. Rent growth and leasing timelines are seeing pressure, but many expect delayed decisions to eventually resume.

Cold Storage REITs: Americold and Lineage stood out for citing more substantial headwinds, including lower inventory levels and cautious second-half outlooks.

Retail REITs: Leasing remained steady, with retailers continuing to invest in physical locations. The COVID-19 experience appears to have pushed retailers to diversify supply chains, mitigating tariff effects.

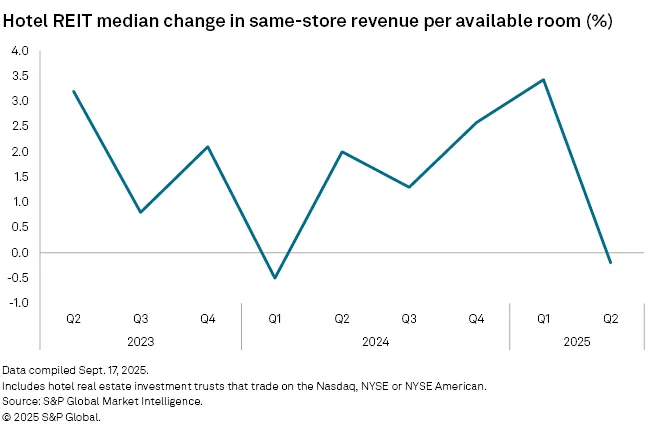

Hotel REITs: Tariffs added to broader macro pressures, leading to softer demand from both group and leisure segments. RevPAR dipped a modest 0.2% year-over-year in Q2.

Timber REITs: All three major players—Weyerhaeuser, Rayonier, and PotlatchDeltic—expressed optimism that tariffs and higher Canadian duties would support stronger US lumber pricing in the back half of the year. Lumber prices fell in Q2, but REITs expect a rebound.

Why It Matters

Tariff discussions have become a recurring theme in REIT earnings calls, but the impact has been uneven. While timber and cold storage sectors are more exposed, overall development costs remain under control thanks to competitive contractor pricing in a slower development market.

What’s Next

Expect continued monitoring of tariff policy as REITs assess its evolving impact on supply chains, material costs, and leasing strategies. Timber REITs, in particular, may benefit from long-term structural changes in the US lumber market.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes