- Sweaters and shoes from China and Vietnam could cost 8% to 93% more, depending on final tariffs.

- A Chinese-made men’s sweater could reach nearly $58 under a 145% tariff, up from $30.

- Retailers may try to offset costs, but many warn they can’t absorb them all.

Tariffs and Your Shopping Cart

According to CNBC, as Donald Trump revives tariff-based trade policy, imported goods are getting more expensive. New analysis by AlixPartners shows the tariff impact on consumers’ wallets—especially for clothing and footwear.

Price Models Show Big Increases

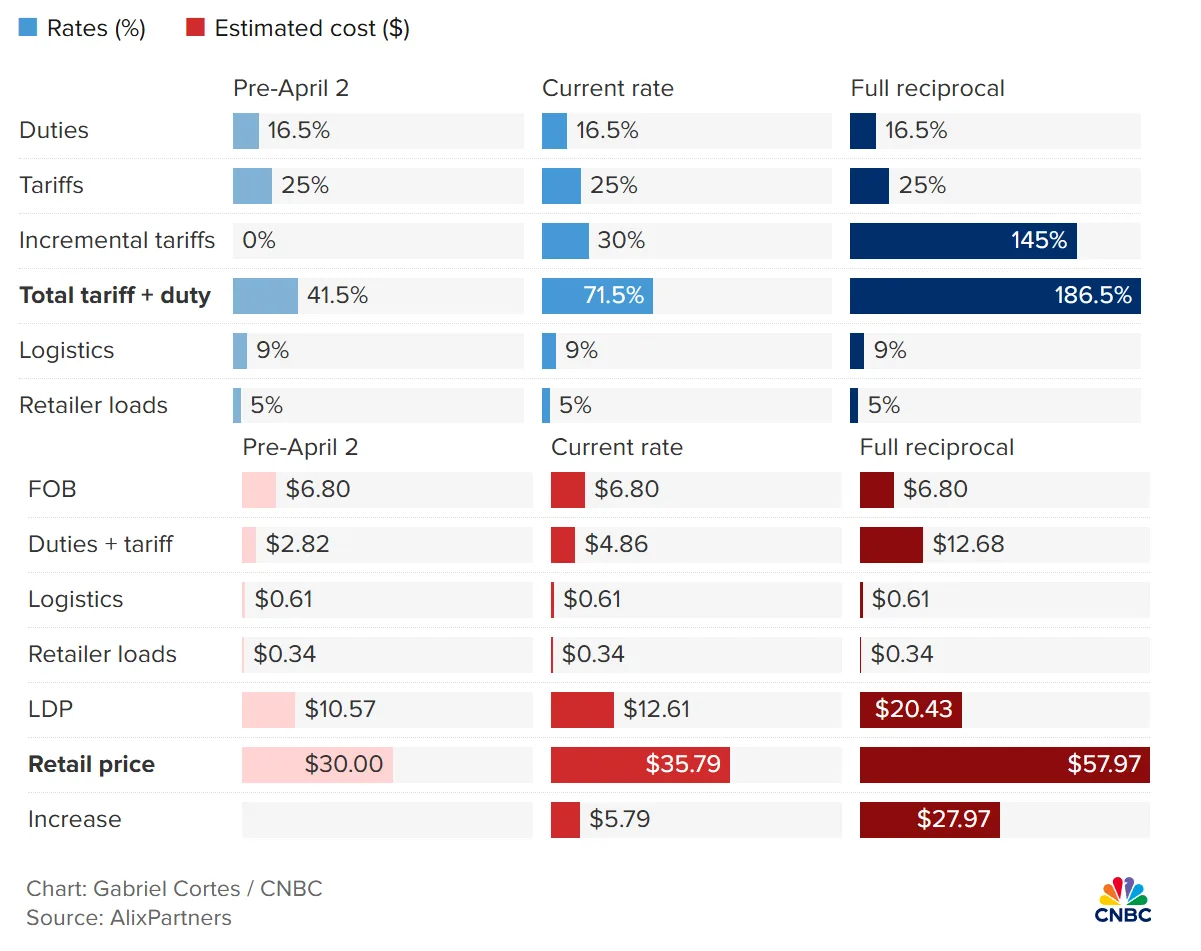

A cotton sweater made in China costs about $6.80 to make. Current tariffs and duties add $2.82. Logistics add 95 cents, bringing the total to $10.57. With a 65% gross margin, that sweater retails for $30.

Under current policy, the tariff impact pushes the price to $35.79—a 19% increase. If the suspended 145% tariff goes into effect, the price would rise to $57.97. That’s a 93% spike.

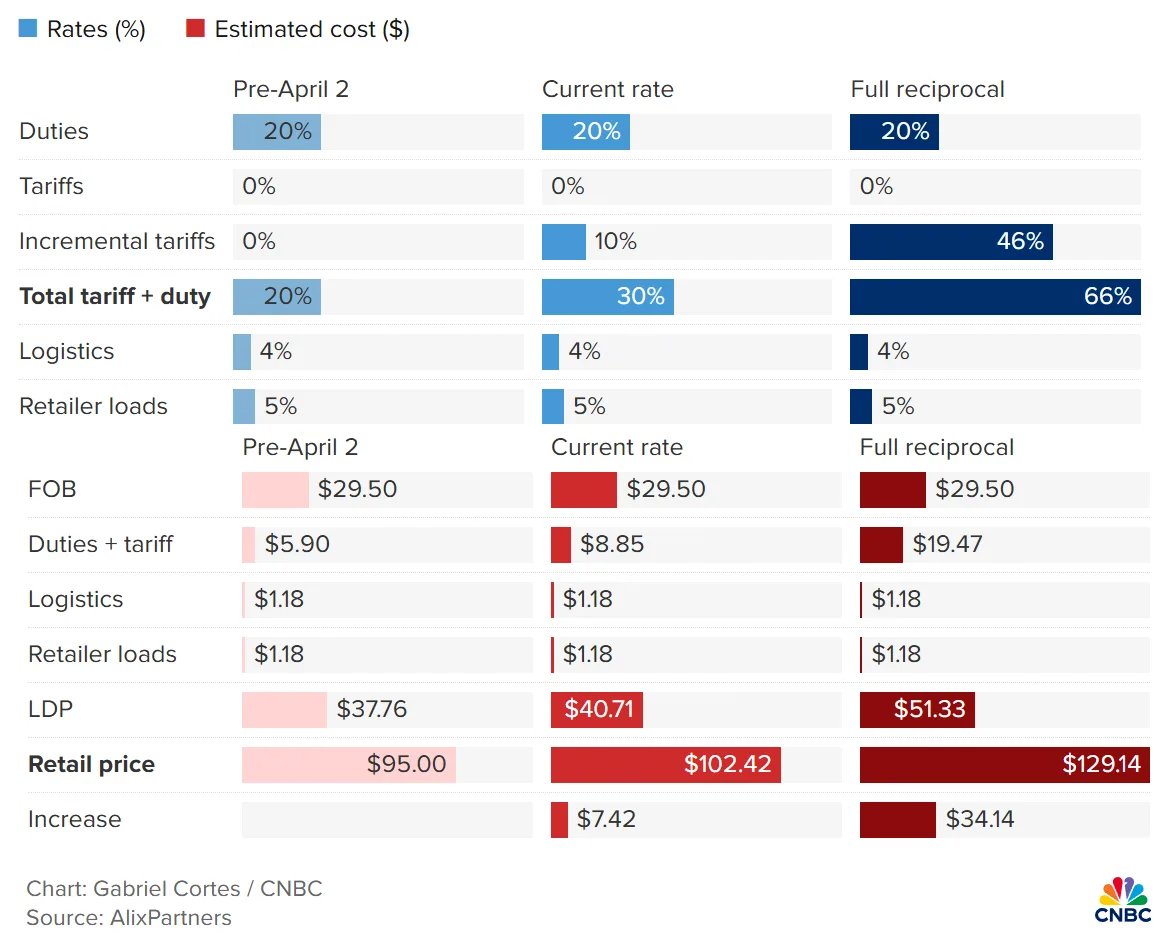

Men’s shoes made in Vietnam follow a similar pattern. Production costs $29.50. Tariffs and duties add $5.90. Logistics add $2.36, totaling $37.76. At a 60% margin, they retail for $95.

With a 10% tariff, the price rises 8% to $102.42. Under the proposed 46% tariff, the price would jump to $129.14—up 36%.

Retailers Are Trying to Adapt

Most retailers don’t want to raise prices. It reduces demand. But with profit margins averaging 5%, absorbing the full cost is hard.

Companies like Target and Walmart may shift sourcing to lower-tariff countries. Others may tweak product features or pricing strategies to soften the impact. Still, many say the growing tariff impact means they can’t avoid raising prices if duties increase.

Wider Economic Impact

Even if shoppers don’t feel the full brunt right away, tariffs carry other risks. The Penn Wharton Budget Model shows tariffs can lead to job losses and a drop in GDP. Retailers may respond to the tariff impact by reducing staff or delaying investments.

Large chains may use a “portfolio approach”—raising prices on less sensitive items to balance out costs. But that still means consumers pay more overall.

Bottom Line

If high tariffs return, prices on everyday goods like sweaters and shoes could climb fast. Retailers may shield consumers for a while, but not forever. The broader economic cost of tariffs is already starting to add up.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes