- AI dominates investment priorities, with 75% of leaders naming it a top focus—marking a decisive shift toward intelligent, automated supply chains.

- Regionalization is accelerating, with 77% of executives actively building self-sufficient supply networks closer to consumption hubs, largely due to rising energy concerns.

- Energy reliability is now a top strategic driver, surpassing labor costs and tariffs in site selection, as 89% of companies experienced power disruptions in the past year.

A Global Supply Chain At A Tipping Point

Prologis’ 2026 Supply Chain Outlook is based on a survey of over 1,800 global executives. The findings paint a clear picture – supply chains are undergoing their biggest overhaul in decades, reports Prologis. From AI implementation to reshoring operations, the industry is shifting away from just-in-time globalization toward risk-mitigated, tech-enabled resilience.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Goodbye Globalization, Hello Localization

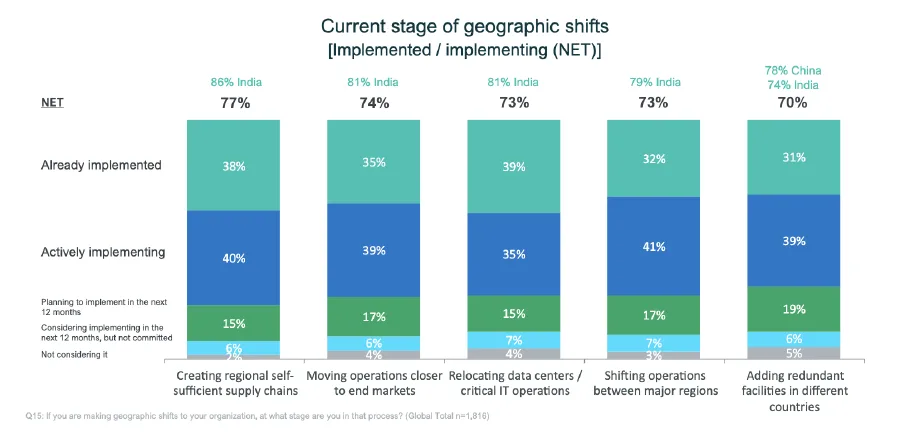

After years of chasing low-cost labor, the tide is turning. A full 58% of leaders forecast more regionalized supply chains by 2030, and 77% have already begun implementation. Cities are the new power centers—literally and logistically.

While cost was once king, energy reliability (40%) has overtaken labor (36%) as the top driver of location decisions. With rising tariffs and political instability adding uncertainty, companies are choosing control and proximity over cheap, far-flung production.

AI Leads The Way

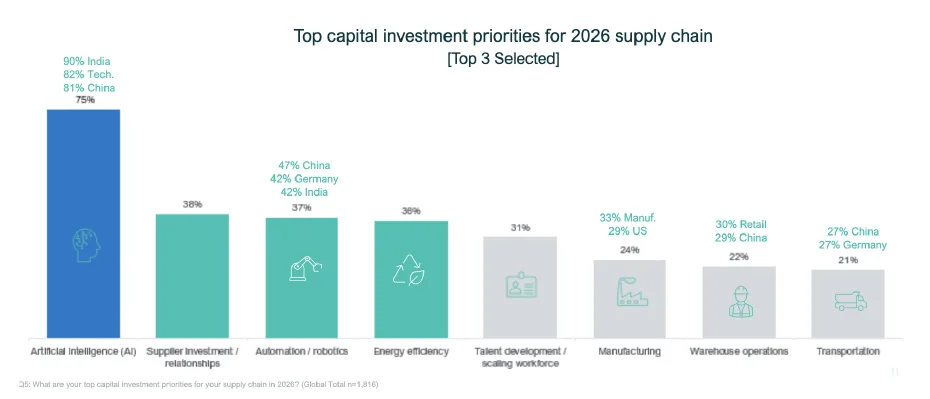

AI is no longer experimental—it’s essential. 70% of organizations report advanced or transformational AI in their supply chains, and 24% say AI now drives daily decisions. From predictive inventory to risk monitoring, AI is increasingly the core engine of supply chain agility.

India and the tech sector are leading the charge: 90% of Indian companies and 82% of tech firms rank AI as their #1 investment priority.

The Next Supply Chain Crisis? Power

Forget port delays—power outages are the new top concern. 89% of respondents experienced energy-related disruptions in the past year, and 83% believe energy reliability will be the next big supply chain crisis. Many companies remain underprepared, with just 27% having advanced power resilience plans.

Compounding the issue, 76% expect power needs to grow by 10–50% over the next five years, driven largely by energy-hungry AI operations.

What It Means For Industrial Real Estate

The pivot toward regional, energy-resilient operations is already influencing site selection. 90% of leaders say they’d pay premiums for energy-reliable locations, and nearly 80% would relocate facilities after just a few major power outages per year.

For developers and investors, this means increased demand for:

- Urban-adjacent, power-resilient logistics hubs

- Facilities equipped for AI and automation

- Properties offering energy infrastructure as a competitive differentiator

The Bottom Line

The global supply chain is being rebuilt in real time—smarter, closer, and more power-conscious than ever. Companies that embrace AI, invest in energy resilience, and regionalize their operations aren’t just managing risk—they’re redefining competitive advantage.

As Prologis puts it: “The question is not whether supply chains will evolve, but whether organizations will lead or follow.”