- Multifamily vacancies held steady at 6.3% nationally in Q1 2025, with average US rents reaching $1,926, per Moody’s.

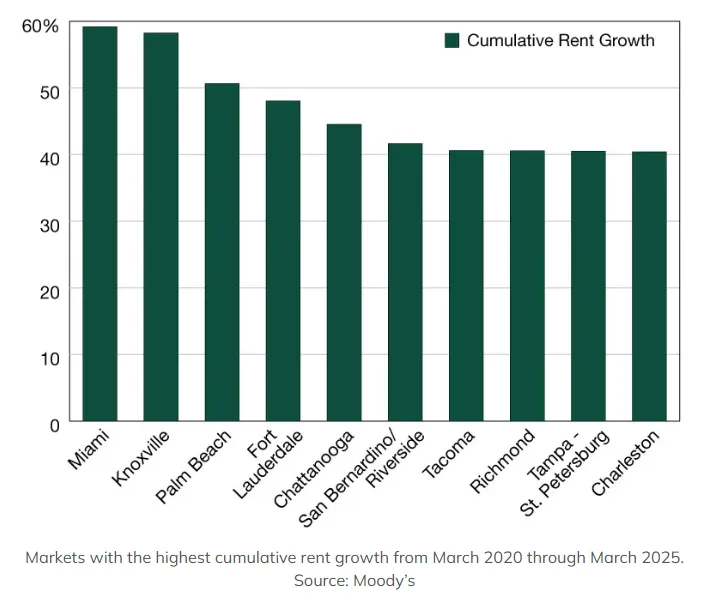

- Miami, Palm Beach, and Fort Lauderdale posted the highest cumulative rent growth from March 2020 to March 2025 — all exceeding 48%.

- Austin led in inventory growth at 30.2% over five years but also saw the sharpest rise in vacancy rates, peaking at 11.6% this quarter.

Five years after the pandemic reshaped housing patterns, multifamily fundamentals reflect the long-term effects of migration trends, especially into the Sun Belt. As remote work and affordability reshaped demand, metros like Austin and Miami saw dramatic changes in rents, supply, and occupancy, per MHN.

Metro-Specific Trends

- Austin added the most new units over the past five years, growing its inventory by 30.2%. That expansion drove vacancies to 11.6%, though they eased slightly in Q1 2025.

- South Florida metros — Miami, Palm Beach, and Fort Lauderdale — experienced the highest cumulative rent increases since March 2020, fueled by robust in-migration and limited new supply.

Affordability Pressures Grow

The constrained supply in many high-demand metros continues to push rents higher, raising affordability concerns despite economic and population growth.

However, all top 10 metros for rent growth also recorded positive year-over-year rent gains in early 2025, indicating persistent demand strength.

Why It Matters

The pandemic-triggered shift in living preferences continues to define the multifamily landscape. Sun Belt metros, while benefiting from population growth, now face challenges balancing supply with affordability — a trend that could shape development priorities and investment strategies in the coming years.

These long-term shifts underscore how demographic momentum and regional migration have redefined multifamily market performance. As developers respond with new supply, investors are closely watching how demand holds up amid evolving economic conditions.