- Storage REITs report first YOY street rate growth since 2022, indicating a return of pricing power in the sector.

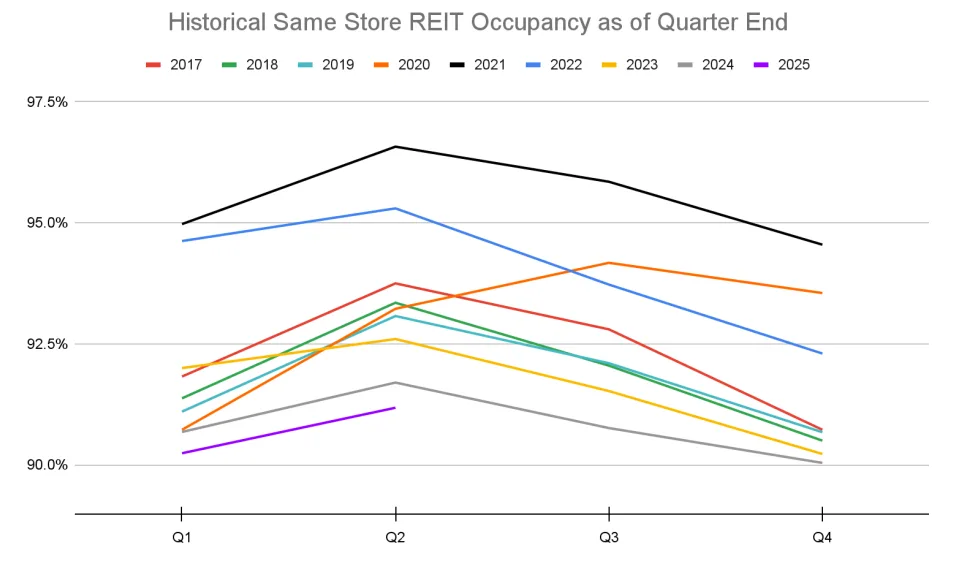

- Occupancy levels remain historically low, but seasonal leasing performance shows signs of stabilization.

- New supply is slowing, narrowing the gap between advertised and achieved rents and aiding rate recovery.

- AI adoption is rising, with NSA resolving 15% of customer calls without human interaction.

A Stronger Leasing Season

Q2 2025 brought cautious optimism to the self-storage sector, reports TractIQ. Industry-wide leasing showed improvement over 2024. REITs cited healthy existing customer behavior, with low delinquencies and strong ECRI acceptance.

Pricing Momentum Returns

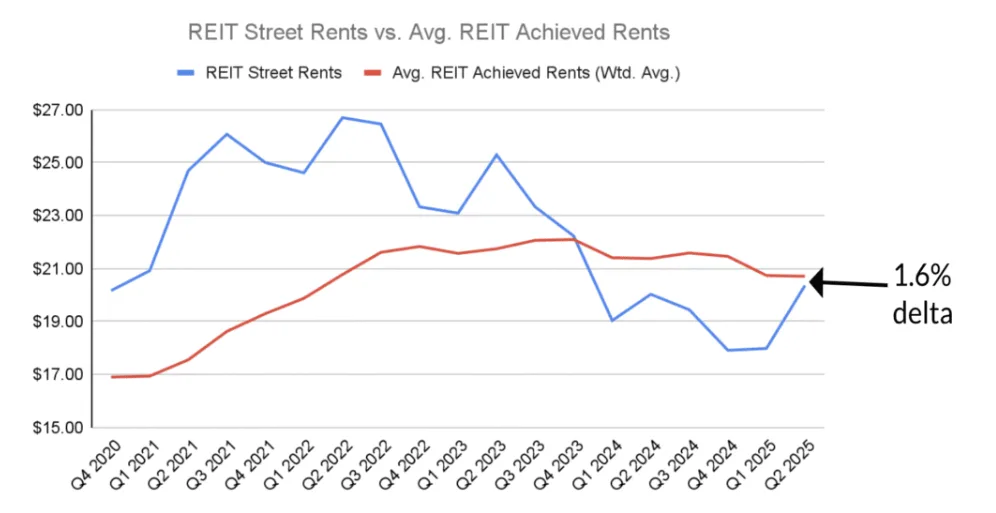

Street rates for REITs rose 1.7% year-over-year, the first positive growth since Q3 2022. Achieved rents were down 3.1% YoY but remained mostly flat compared to Q1, suggesting stabilization.

The spread between street and achieved rents dropped significantly to 1.6%, down from 6.3% a year ago, improving underwriting predictability.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Sunbelt Drag VS. Core Market Resilience

High supply in Sunbelt markets like Atlanta, Dallas, and Phoenix continued to suppress revenue growth. However, rent gains were recorded in select MSAs:

- Los Angeles: +23.31% YoY street rate growth (10×10 NCC units)

- Chicago: +24.29% YoY (10×10 CC units)

- Cincinnati: +20.75% YoY (10×10 NCC units)

Public Storage noted improving fundamentals in Florida and the West Coast, while Charlotte, Cape Coral, and Oklahoma City saw mixed performance.

Construction Slows, Transactions Scarce

REITs continued to face headwinds in new development. High borrowing costs and construction expenses have made new deals hard to pencil.

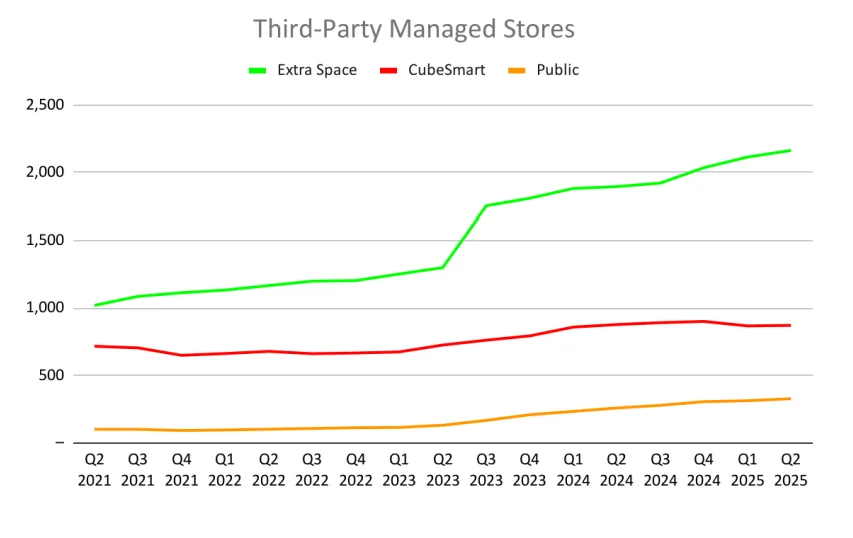

- Public Storage remains the most active, acquiring 25 facilities and developing 5 so far in 2025.

- NSA sold a 10-property portfolio for a sub-6% cap rate, highlighting ongoing buyer appetite despite tight margins.

- Extra Space made just one acquisition this quarter, citing “overpriced” market conditions.

Expense Growth Weighs On NOI

All REITs reported YOY increases in same-store expenses, with property taxes and marketing as primary drivers:

- NSA: +4.6% YOY expense growth

- Extra Space: +8.6%

- CubeSmart: +1.2%

- Public Storage: +2.9%

Marketing spend rose sharply, with NSA noting a 39.3% YOY increase. Despite these efforts, NOI was down across all REITs, with NSA posting a 6.1% YOY decrease.

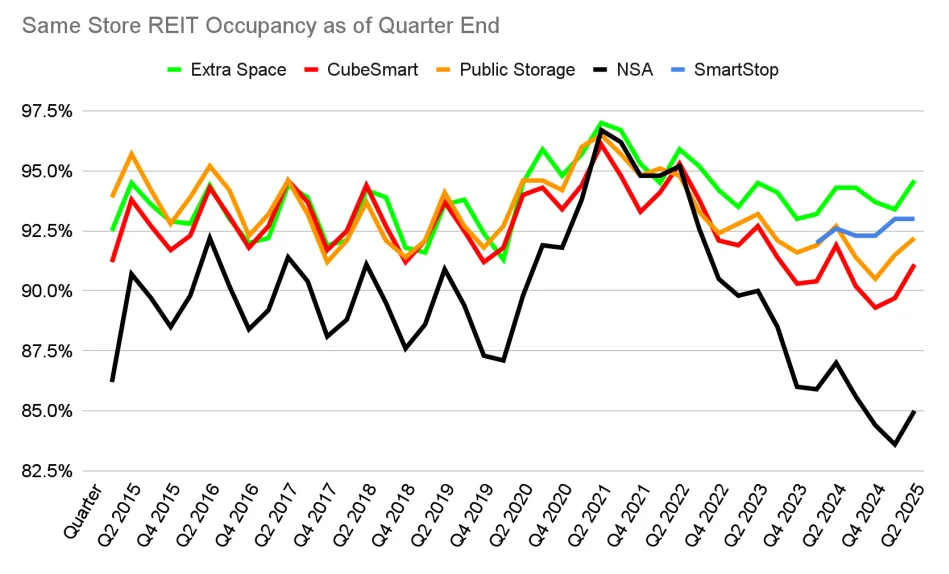

Occupancy And Rents Under Pressure

Occupancy levels remain historically low:

- NSA: 85.0% in Q2 2025 (down 2.0 pp YoY)

- Public Storage: 92.2% (down 0.5 pp)

- Extra Space: 94.6% (up 0.3 pp)

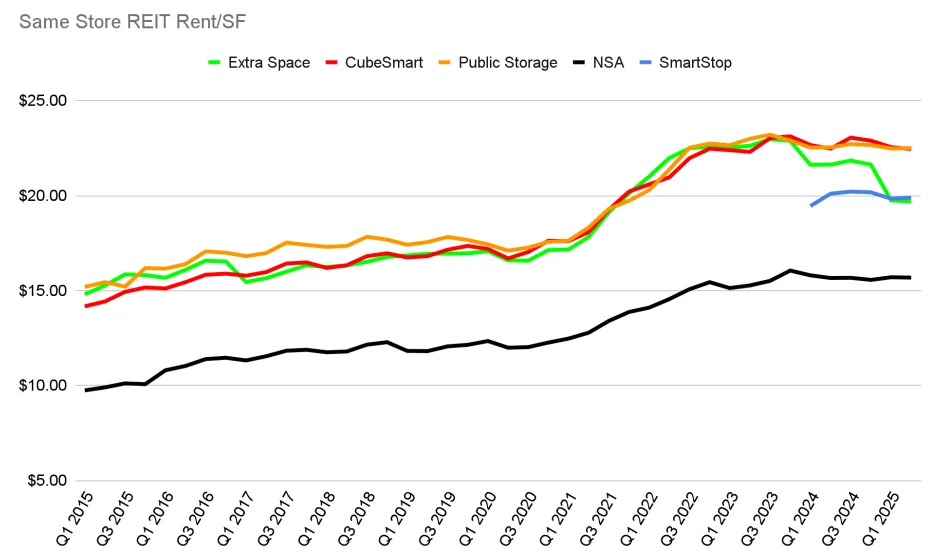

Rents per occupied square foot also declined for most REITs:

- Extra Space: $19.68 (down 9.0% YoY)

- CubeSmart/Public: Flat YOY

- NSA: $15.68 (up slightly)

Why It Matters

While revenue and NOI are still under pressure, the narrowing rent spread, stabilizing achieved rents, and improving leasing season signal that the worst may be behind. Operators appear to be finding a bottom, and pricing power is beginning to return in some markets.

What’s Next

The second half of 2025 could set the tone for a broader recovery. According to TractIQ’s market insights:

- Fundamentals are stabilizing in several high-supply markets.

- Reduced new construction should continue to support rent growth.

- The adoption of AI and digital tools is enhancing operational efficiency and tenant experience.

REITs remain cautious, but with early signs of pricing power returning and leasing momentum improving, the storage sector may be turning a corner.