- 100% Bonus Depreciation Reinstated: A 2025 tax reform made full bonus depreciation permanent, boosting demand for equipment-heavy STNL assets such as car washes and QSRs.

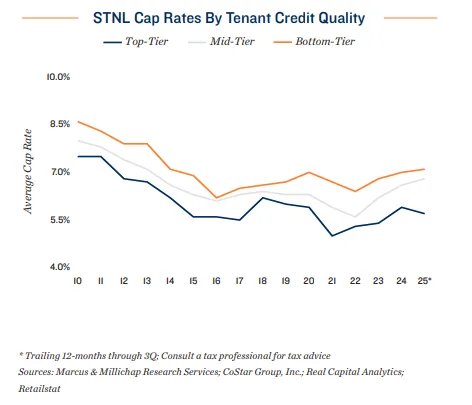

- Tenant Credit Drives Cap Rates: Cap rates are significantly lower for high-credit tenants, with properties leased to them trading in the mid-5% range versus over 7% for low-credit tenants.

- Transaction Volume Surges: STNL deal flow climbed 18% year-over-year through September, marking the third-highest total on record.

- Private Investors Dominate: Individuals made up 64% of STNL buyers, favoring the simplicity and steady income these assets offer, especially for estate or retirement planning.

Demand Boosted By Tax Incentives

Single-tenant net lease (STNL) properties attract investors after 100% bonus depreciation is permanently reinstated in 2025, reports IREI. The tax break had phased down to 60% in 2024. It now allows investors to immediately deduct the full cost of qualifying improvements. This benefit applies especially to equipment-heavy assets like car washes, QSRs, and auto service centers.

This incentive, paired with 1031 exchange benefits, positions STNL as a compelling, tax-efficient investment option.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cap Rates Reflect Credit And Lease Length

Tenant creditworthiness remains the key variable in determining cap rates:

- Top-tier credit tenants: Mid-5% range

- Mid-tier tenants: High-6% range

- Lower-tier tenants: Around 7%

Lease length also plays a role. Properties with less than five years remaining traded at a 7.7% average cap rate, while those with over 15 years left saw that figure fall to 6.1%.

Investors Flock To Simplicity And Stability

The appeal of STNL assets lies in their simplicity. With tenants covering taxes, insurance, and maintenance (except structural elements), landlords enjoy predictable, low-maintenance income. That’s particularly attractive for private investors—who drove 64% of deals over the past year—and those planning for retirement or legacy investment strategies.

Market Activity Near Record High

STNL transaction activity jumped 18% year-over-year through September and was 43% higher than the 2014–2019 average. That makes 2025 the third-highest transaction year on record, trailing only the post-COVID surges in 2021 and 2022.

Despite some institutional and REIT participation, the space is increasingly dominated by individual investors seeking stable, long-term returns.

Outlook

With favorable tax treatment, strong investor appetite, and the premium placed on tenant credit, STNL is likely to remain a standout asset class heading into 2026.