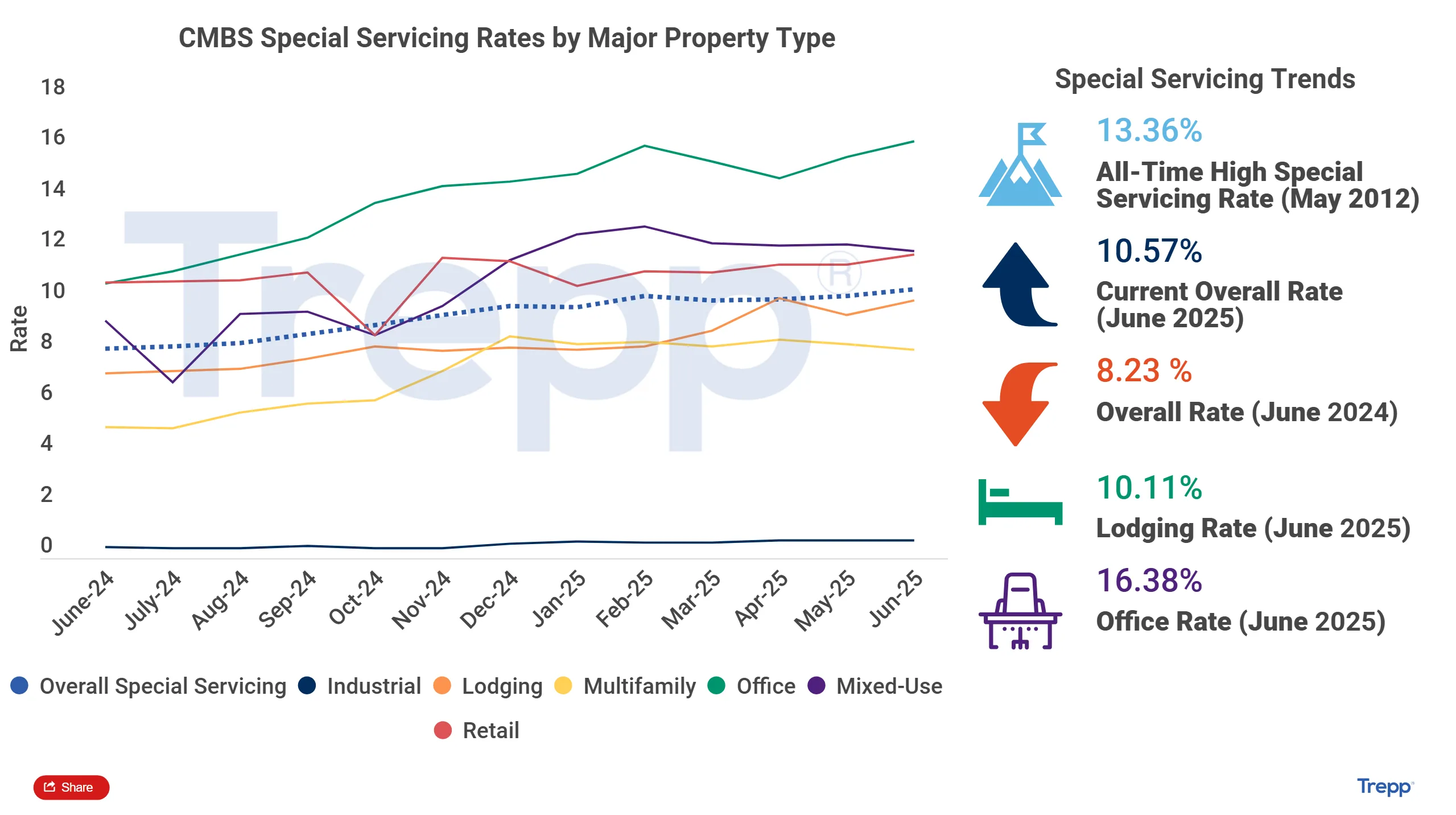

- The overall CMBS special servicing rate climbed to 10.57% in June, the highest since May 2013.

- Office loans saw the biggest increase, jumping to a record 16.38%.

- $2.9B in loans were newly transferred to special servicing in June, with office making up over half.

- Two large loans, totaling over $1B, were key drivers of the rise.

Distress Keeps Climbing

As reported by Trepp, the CMBS special servicing rate rose by 27 basis points in June to reach 10.57%. This marked the third straight monthly increase and the highest level seen since 2013. Over the past year, the rate has risen by nearly 225 basis points. While the total balance of outstanding CMBS loans fell by $8.2B, the balance of loans in special servicing increased by $750M.

Breaking Down the Numbers

Among the main property types, office loans saw the sharpest rise. The special servicing rate for office jumped 62 basis points to 16.38%—a new record. This increase was largely due to ongoing issues with leasing and maturing loans.

Retail also moved higher, rising 41 basis points to 11.94%, its highest since early 2022. Lodging, which had improved in May, went back up by 54 basis points to 10.11% in June.

On the other hand, multifamily and mixed-use properties saw small improvements. Multifamily dropped by 25 basis points to 8.18%, while mixed-use fell 28 basis points to 12.05%. Industrial remained stable, holding steady at just 0.71%.

Loan Transfers Rise Again

In June, $2.9B worth of loans were newly transferred to special servicing. Office properties made up the largest share—about $1.7B, or 57% of the total. Lodging and retail followed, with $712M and $361M, respectively. Overall, 70 loans were newly transferred.

Notably, two large loans made up a third of the monthly total:

- Ashford Highland Portfolio ($590.3M): This loan backed 22 hotel properties across the US. It was transferred due to an expected payment failure. Although the portfolio showed a 1.41x debt coverage ratio, it was only 56% occupied.

- 1440 Broadway ($415.3M): This loan backed a mixed-use building in New York City. The property faced a balloon payment default after a forbearance period. As of mid-2024, occupancy had dropped to 59%, and its top tenant, WeWork, had reduced its lease.

Understanding CMBS 1.0 vs. 2.0+

The jump in special servicing was seen in both older and newer CMBS loans.

- CMBS 1.0 (issued before 2008) had a special servicing rate of 67.28%, up sharply from 27.98% a year ago.

- CMBS 2.0+ (issued after the financial crisis) stood at 10.46%, compared to 8.10% in June 2024.

CMBS 2.0+ loans were created with better standards and more oversight, but even those are now showing signs of stress.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

The rising distress rate highlights ongoing trouble in commercial real estate, especially in sectors hit hard by remote work and changing consumer habits. Developers and owners are struggling to refinance loans as interest rates remain high and property values fall.

What’s Next?

Looking ahead, more loans are likely to transfer to special servicing as maturities approach and leasing challenges continue. While industrial and some multifamily properties remain steady, office and retail will remain under pressure. Investors will need to watch how special servicers handle workouts in the second half of 2025.