- Austin, TX tops the list of “move-easy” metros with 54% of renters relocating within two years, driven by rapid population and apartment growth.

- Charleston, SC saw the largest spike in short-term moves, with a 44% increase in renters moving within two years.

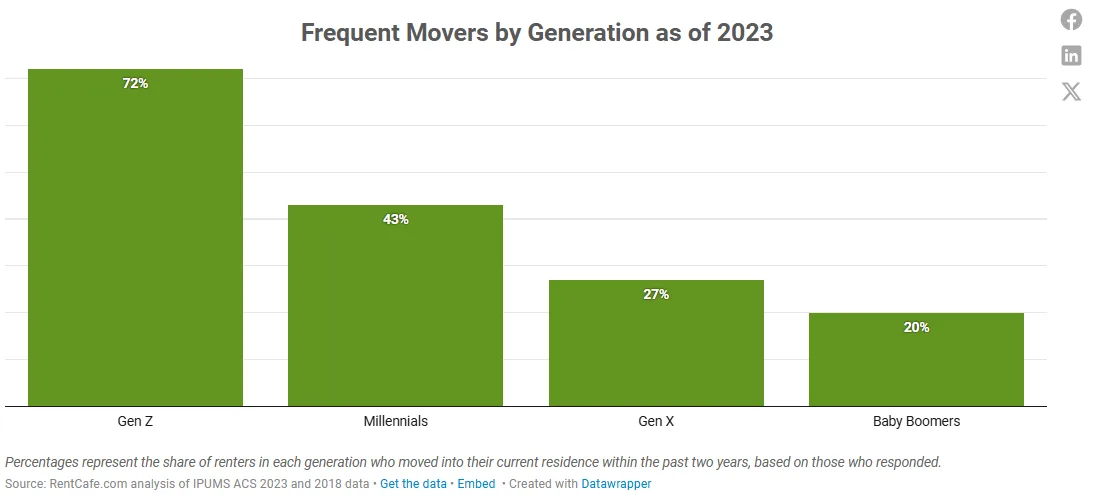

- Gen Z renters are the most mobile, with 72% nationwide moving within two years, although their mobility has slightly declined since 2018.

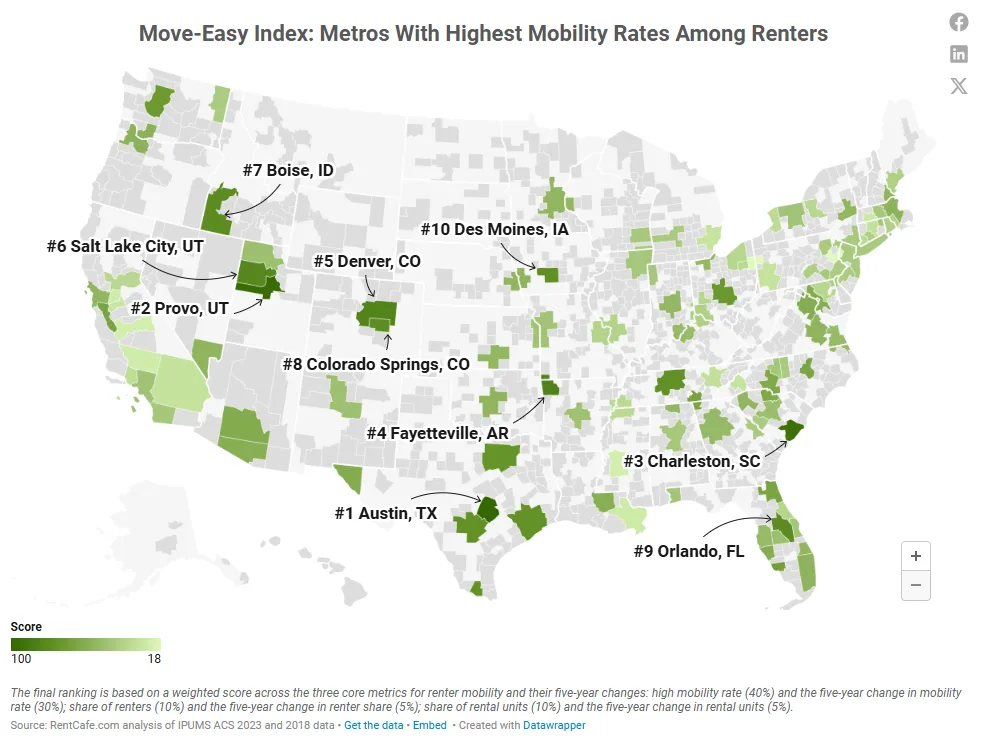

- The Southeast dominates the top 30 “move-easy” metros, while no Northeast cities made the list due to tighter housing supply and lower turnover.

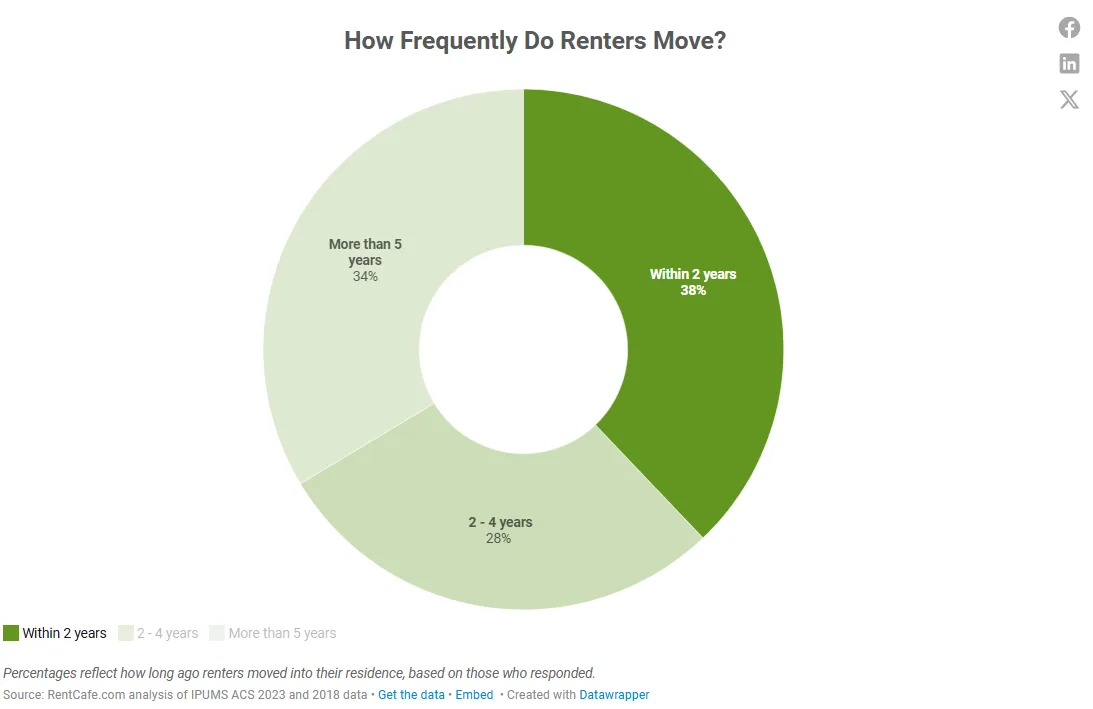

Short-Term Renters on the Rise

A significant share of US renters aren’t staying put for long. Nationwide, 38% of renters moved to a new apartment within the same metro in less than two years, according to RentCafe.

Among Gen Z renters, that number climbs to a staggering 72%.

The analysis looked at renter turnover in 105 US metros between 2018 and 2023, revealing where Americans are most likely to change apartments quickly, and why.

Top Move-Easy Metros

- Austin, TX ranked #1, with over half (54%) of renters moving frequently, up 34.4% since 2018. Fueled by a 32.4% increase in apartment supply and a booming tech scene, Austin’s renter churn is high, especially among Gen Z (83%).

- Provo, UT claimed the #2 spot with the highest overall mobility rate (60%). The college town and tech hub saw a 30% surge in renters and a 33% rise in apartment supply over five years.

- Charleston, SC ranked #3 nationally and #1 for mobility growth, with a 44% jump in short-term moves. Despite a slight dip in renter share, the city’s job growth and relative affordability make it a magnet for transplants across age groups.

Other metros in the top 10 include Fayetteville, AR; Denver, CO; Salt Lake City, UT; Boise, ID; Colorado Springs, CO; Orlando, FL; and Des Moines, IA—the only Midwest entry.

Why So Many Moves?

Several factors drive these high turnover rates:

- Economic shifts during and after the pandemic encouraged renters to seek lower costs or new jobs.

- Remote work and return-to-office trends altered housing preferences, prompting frequent moves.

- Younger renters, especially Gen Z, are more mobile by nature, often driven by life transitions like school, career starts, and relationship changes.

- New apartment supply in growing metros offers more options and incentives, encouraging renters to shop around.

The Generational Breakdown

- Gen Z: 72% moved within two years in 2023—down from 83% in 2018, but still the most mobile group.

- Millennials: 43% moved frequently, showing more stability as they settle into careers and family life.

- Gen X & Boomers: Far less mobile, with just 27% and 20% moving within two years, respectively.

Southeast Shines, Northeast Lags

The Southeast dominates the “move-easy” rankings with 12 cities in the top 30, including Orlando, Nashville, Jacksonville, and Chattanooga. In contrast, the Northeast was completely absent from the top 30—likely due to limited housing supply and lower apartment turnover.

Why It Matters

Frequent renter movement indicates a dynamic housing market and signals where jobs, affordability, and new construction are reshaping metro-level demographics. For developers and property managers, understanding these patterns can help tailor leasing strategies, amenities, and unit mix to a more mobile renter base.

What’s Next?

Expect renter mobility to remain high in fast-growing metros with strong job markets, robust apartment construction, and appeal to younger generations. However, economic headwinds and housing costs may moderate some of the hyper-mobility trends in the years ahead.

As Gen Z renters age into longer tenancies and affordability tightens in hotspot cities, the pace of change may slow, but for now, the nation’s renter class is still on the move.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes