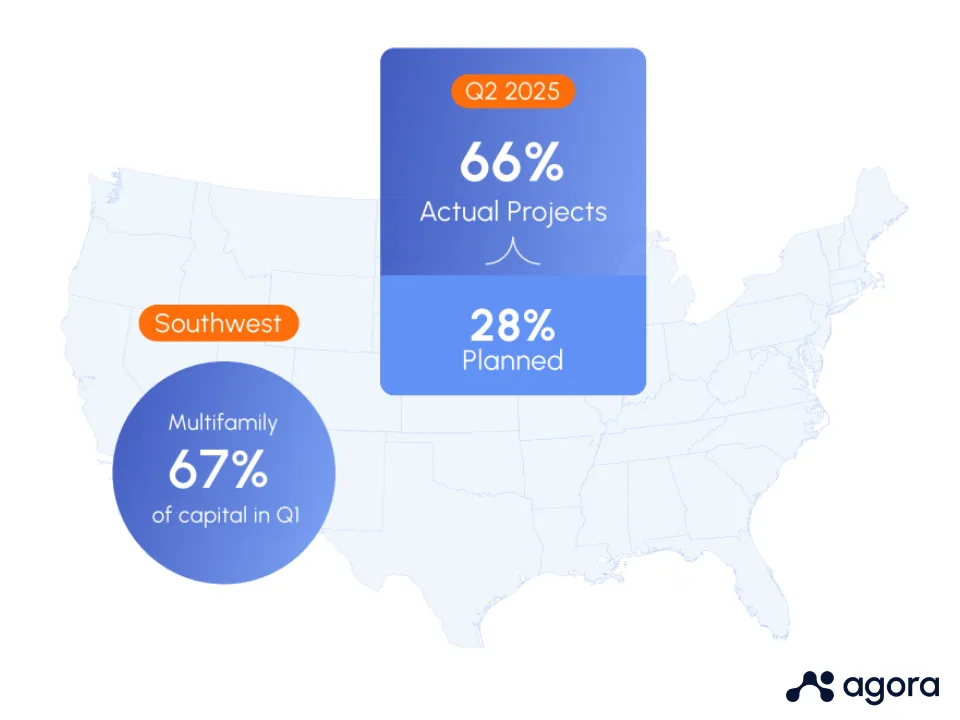

- Southeast commands CRE attention, capturing over 66% of Q2 project activity and nearly a third of all capital invested, according to Agora’s 2025 sentiment and platform data.

- Multifamily leads the pack, drawing 67.6% of capital in Q1 and remaining the most popular asset class among investors, despite shifting capital allocations in Q2.

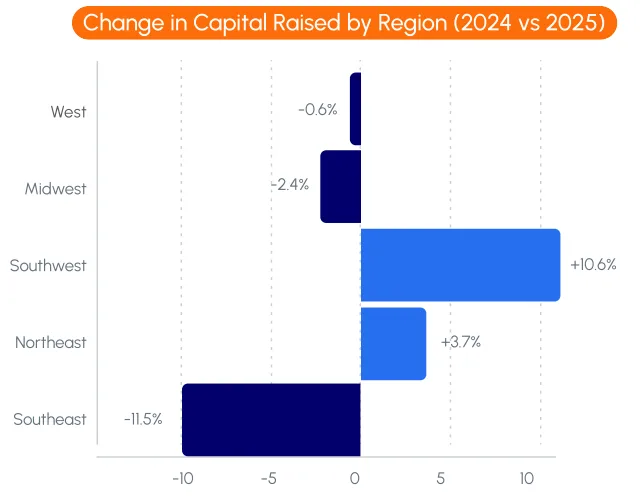

- Fundraising sentiment varies sharply by region, with the Southwest showing the most improvement, while the West and Northeast face heightened challenges.

Market Overview: Plans vs. Reality

In early 2025, Agora surveyed 200 US CRE professionals on their expectations around fundraising, asset preferences, and regional focus.

The results were then measured against actual data from Agora’s platform in Q1 and Q2 to assess alignment between sentiment and execution.

While investors broadly identified the Southeast and multifamily as focal points, the real data reveals some mismatches, particularly in capital allocation across asset classes.

Southeast Leads, But Capital Slips

The Southeast not only matched investor intent but surpassed it in execution. Although only 28% of respondents said they would prioritize the region, it claimed 42.7% of projects in Q1 and surged to 66.2% in Q2.

However, the region’s capital share slipped from 42% in 2024 to just over 30% in the first half of 2025—a drop of 11.5%—reflecting tightening fundraising conditions even amid strong activity.

Region-by-Region Performance

Southwest: While only 26% of respondents planned to focus here, the region benefited from improving fundraising conditions. Capital share rose 10.6% year-over-year, and it held the second-highest share of projects.

Northeast: Despite 59% of investors citing tougher conditions, capital share increased by 3.7%, suggesting institutional confidence or legacy deals playing through.

Midwest & West: Both regions saw diminished capital inflows, despite the West having more project starts. Investor sentiment was aligned here, as most respondents reported increasing difficulty in raising funds.

Multifamily Leads, “Other” Gains Ground

Multifamily remained the standout asset class. Over half (51%) of investors said they were prioritizing it, and the sector accounted for nearly a third of all projects in H1 2025 and over two-thirds of capital in Q1.

However, residential and “other” categories—like land, car washes, and unclassified developments—quietly represented 60% of project volume. These were not included in the sentiment survey, highlighting a blind spot in investor self-reporting.

Meanwhile:

- Mixed-use: Despite 33% of respondents planning to invest, it accounted for less than 1% of activity.

- Industrial, Office, Retail, Hospitality: All underperformed relative to stated interest, each capturing between 1–7% of capital and low single-digit shares of project count.

Fundraising Conditions by Region

Across the board, CRE professionals cited fundraising as a challenge:

- Southeast: Despite activity strength, fundraising became more difficult, with capital share dropping.

- Southwest: Stood out for improvement, supported by a 10.6% capital increase.

- Northeast, Midwest, West: All reported increased difficulty, with the West showing a 6% decline in capital share.

Why It Matters

The data shows that investor sentiment doesn’t always predict capital flow, particularly in underreported or fast-shifting sectors. While multifamily continues to dominate, the rise of “other” property types and regional disparities in fundraising success point to evolving strategies amid tighter capital conditions.

What’s Ahead

As fundraising hurdles persist and investor sentiment adjusts to real-time market pressures, the back half of 2025 may see further divergence between intent and execution. CRE professionals who adapt quickly to regional and sectoral shifts, especially outside traditional core asset classes, may have the edge.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes