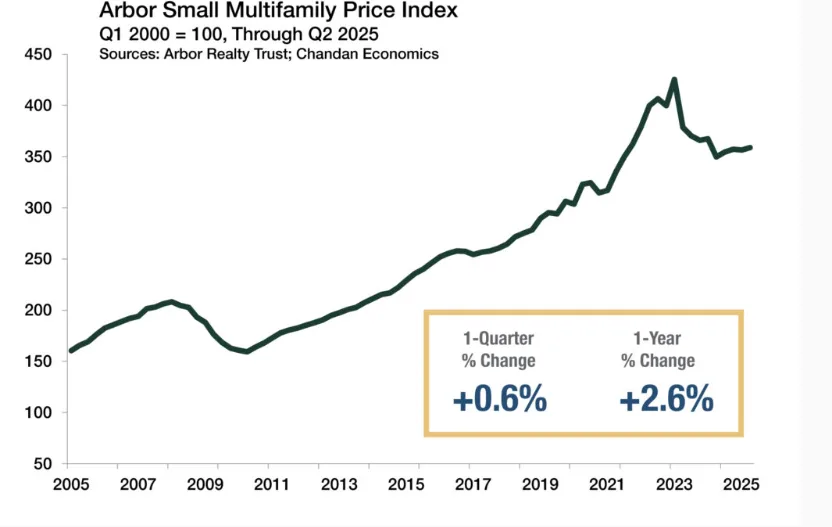

- Asset valuations rose year-over-year for the first time since 2023, signaling renewed investor confidence.

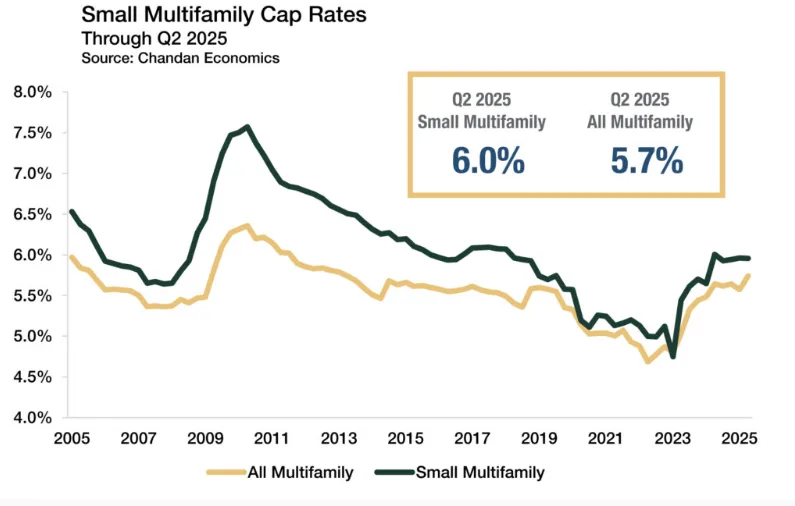

- Cap rates held steady at 6.0%, marking five consecutive quarters of stability despite continued rate volatility.

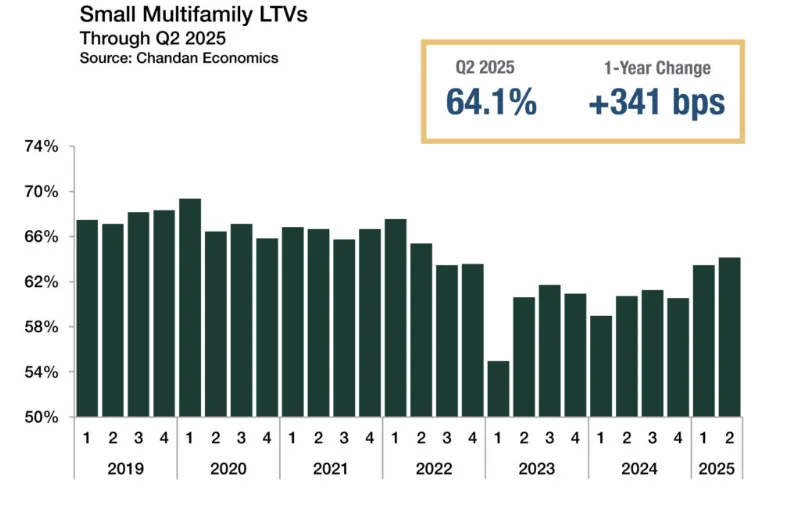

- Loan-to-value ratios climbed to 64.1%, as lenders resumed more normalized underwriting standards.

State Of The Market

Small multifamily showed clear signs of recovery in Q2 2025, reports Arbor. This improvement came despite ongoing economic uncertainty. Inflationary pressures from new US tariffs continued to weigh on market sentiment.

While the Fed has yet to make its next move, futures markets are increasingly pricing in rate cuts starting as soon as September. In the meantime, small multifamily fundamentals have remained resilient. Stable demand, higher rents, and steady debt availability have all contributed to the sector’s strength.

The National Multifamily Housing Council’s July 2025 survey indicated improving origination activity and easing credit standards. Collectively, these trends helped boost valuations, lending volumes, and borrower leverage metrics across the board.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

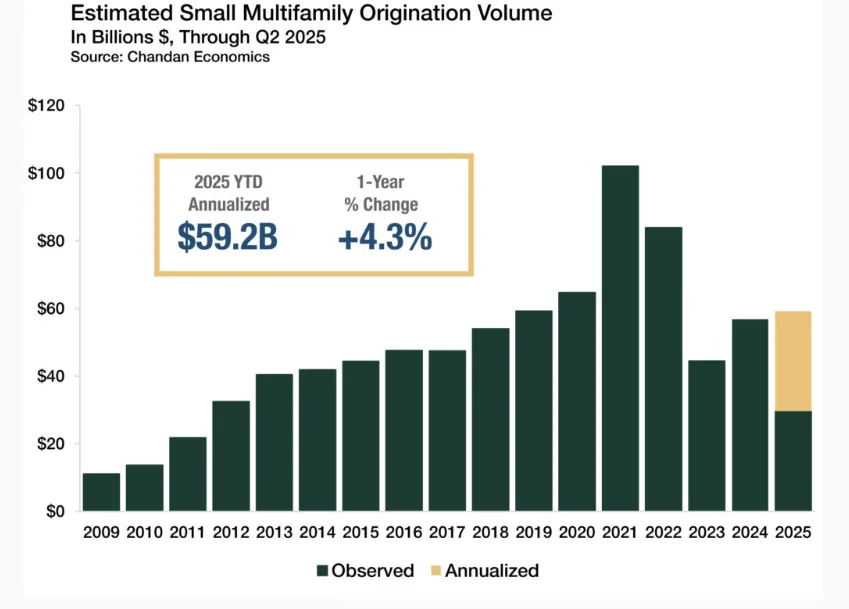

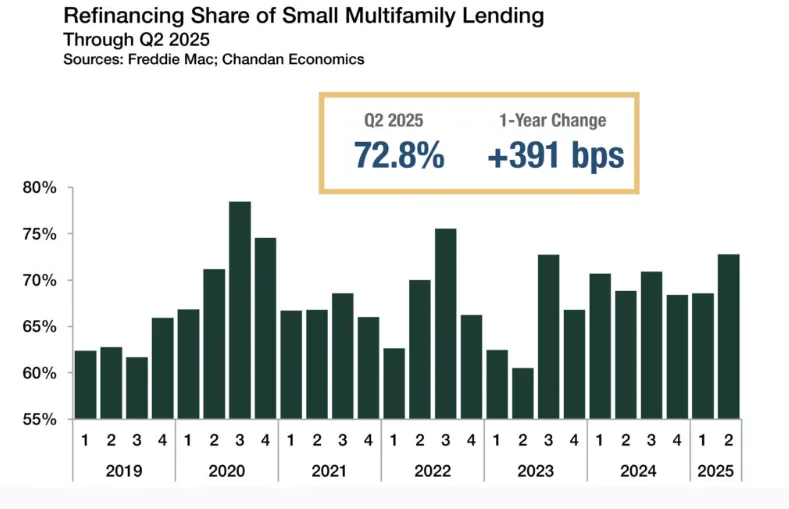

Lending Volume & Purpose

Total annualized small multifamily loan originations reached $59.2B by mid-2025. This marked a 4.3% increase from 2024’s year-end total. Although volumes remain below the peak levels seen during the pandemic era, they are now closely aligned with historical pre-2020 averages.

Notably, refinancing activity rebounded significantly, with refi loans comprising 72.8% of originations in Q2 — their highest share since 2022. Despite elevated rates, capital needs and maturing debt have kept refinancing demand strong.

Valuations & Cap Rates

According to the Arbor Small Multifamily Price Index, asset valuations grew 2.6% year-over-year in Q2 2025. This marked the first positive annual growth since early 2023. Higher rents and falling expense ratios helped push prices higher, despite a slight dip in occupancy to 96.8%.

Cap rates held flat at 6.0%, extending a five-quarter streak of stability. Compared to the early 2023 low of 4.8%, cap rates have risen meaningfully, improving returns but previously dragging down values. The risk premium over the 10-year Treasury widened slightly to 159 bps, still well below pre-pandemic norms.

Occupancy & Expense Trends

Occupancy remained high at 96.8%, though down 38 bps from Q1. Even with the decline, small multifamily assets continue to outperform the broader multifamily sector, driven by tenant stability and favorable landlord-tenant dynamics.

Expense ratios dropped to 41.2%, falling 119 bps from Q1. Operating efficiencies and strong rent growth helped offset inflationary pressures in the quarter.

Leverage & Debt Yields

Loan-to-value ratios continued climbing, reaching 64.1% — the highest level since mid-2022. This reflects improving lender sentiment and borrower willingness to take on more leverage.

Debt yields remained steady at 9.4%, while the debt-per-dollar-of-NOI ratio settled at $10.62, slightly down from the prior quarter. The spread between cap rates and debt yields rose modestly to 346 bps, indicating relative stability in financing terms.

Outlook

The second half of 2025 looks promising for the small multifamily sector. Even as macro risks persist, small multifamily remains well-positioned. Rising construction tariffs, now at 27.7%, and ongoing inflation concerns continue to pose challenges. However, the sector’s adaptable lease structure offers strong protection against rising costs.

Valuations are still 15% below peak 2023 levels, but financing conditions are improving. As a result, small multifamily remains an appealing, inflation-resilient option for investors seeking durable returns and long-term upside.