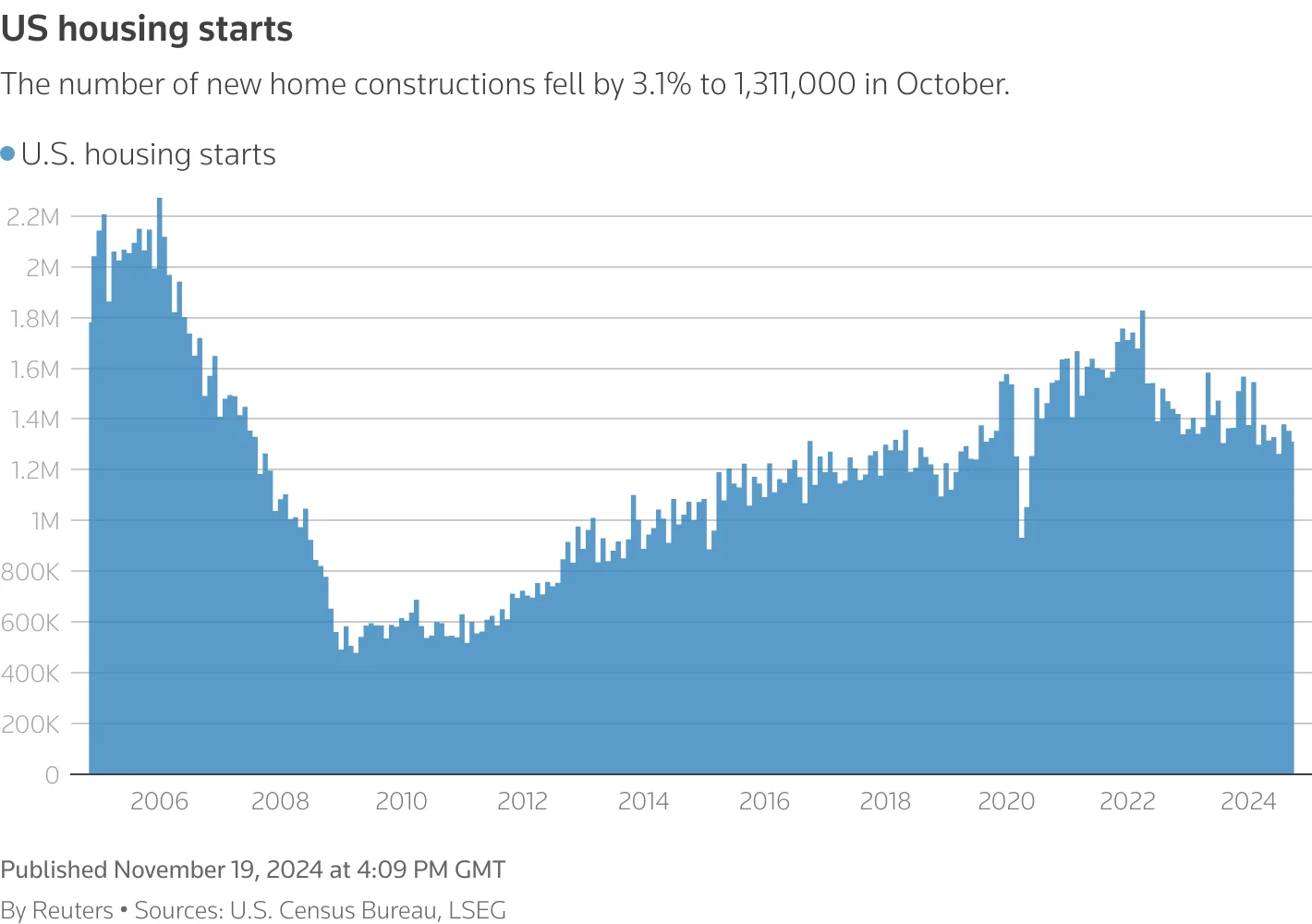

- Single-family housing starts fell 6.9% in October to a seasonally adjusted annual rate of 970K units.

- Multifamily housing starts rose 9.8%, while overall housing starts declined to 3.1%.

- Permits for single-family construction inched up 0.5%, reaching their highest level since April.

As reported by Reuters, U.S. single-family homebuilding slumped sharply in October, falling 6.9% MoM, according to the Commerce Department.

The decline was attributed in part to hurricanes in the Southeast, with Hurricane Helene and Milton completely interrupting construction in heavily affected areas.

Diving Deeper

The South saw a 10.2% drop in single-family housing starts, while the Northeast reported a 28.7% decline. Other regions showed mixed results, with starts rising 4.6% in both the Midwest and the West. On a YoY basis, single-family homebuilding was down 0.5%.

Meanwhile, multifamily housing starts surged 9.8%, revealing strong demand for rental properties as potential homebuyers continue to face serious affordability challenges.

Feeling The Pressure

Mortgage rates, which track the yield on the 10-year U.S. Treasury note, are still too high for most would-be homebuyers. In fact, they just reached their highest levels since July.

Naturally, higher borrowing costs have cut into demand, with many homeowners also reluctant to sell their homes due to their existing, historically low mortgage rates.

“Despite the weather impact on building down in the South, the recession in residential housing construction remains deep in the woods,” said Christopher Rupkey, chief economist at FWDBONDS.

Glimmers of Hope

The good news is that permits for future single-family construction rose 0.5% in October, reaching 968K units—the highest number since April. This growth was driven by gains in the Northeast and South, while permits in the Midwest and West declined.

However, permits for multifamily construction fell 3%, and overall building permits slipped 0.6%, signaling continued caution among builders.

Builder Sentiment, Outlook

A recent National Association of Home Builders survey showed increased confidence among builders, largely due to optimism about potential regulatory relief under the incoming Republican administration.

“Builders appear to be diverting resources to working through what had been a record backlog in 2022 and 2023,” said Daniel Vielhaber, an economist at Nationwide.

With mortgage rates still elevated and housing affordability under pressure, the housing market faces ongoing challenges. While single-family permits indicate some stabilization, higher borrowing costs and limited inventory of both new and existing homes are likely to constrain growth in the near term.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes