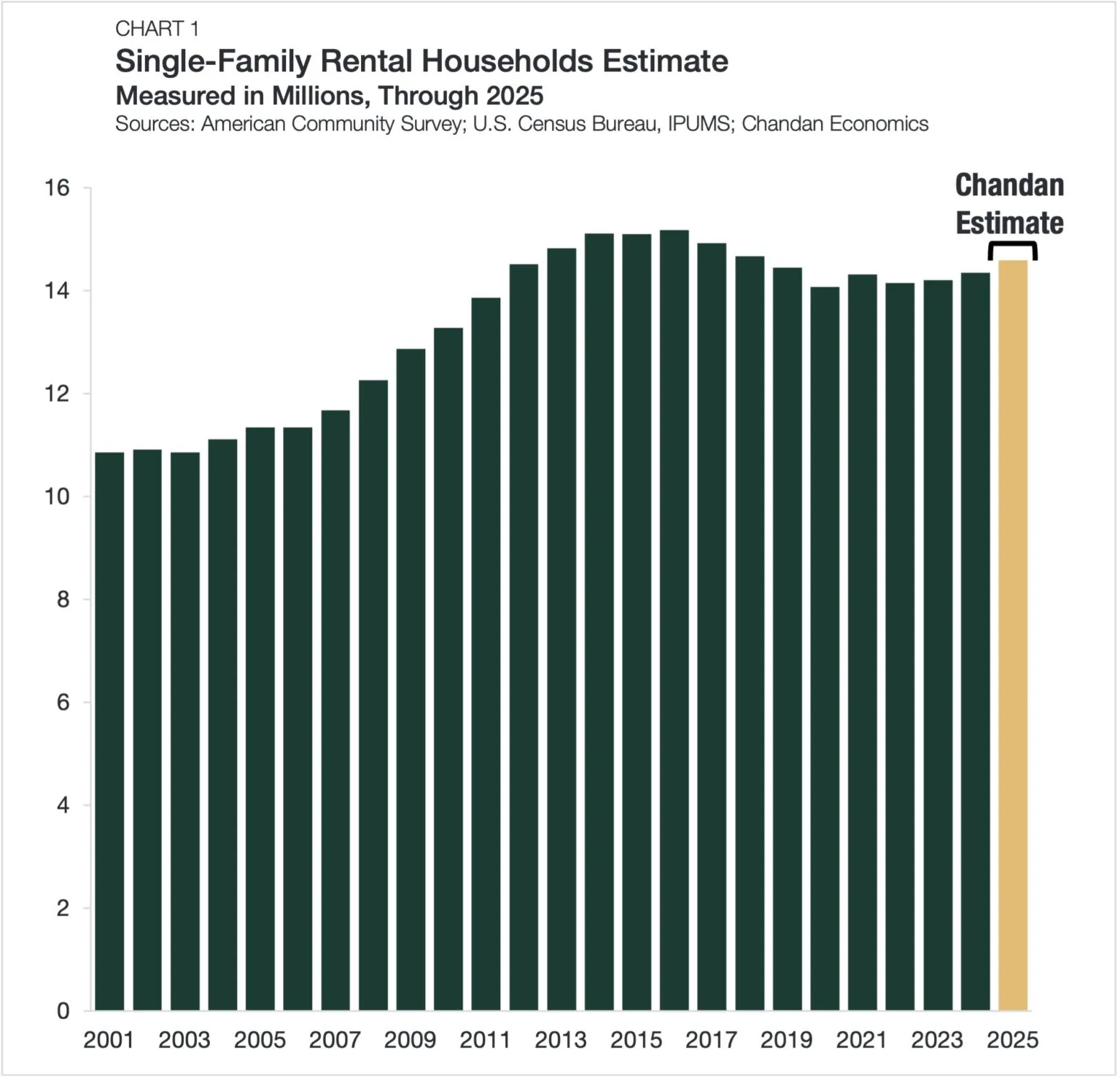

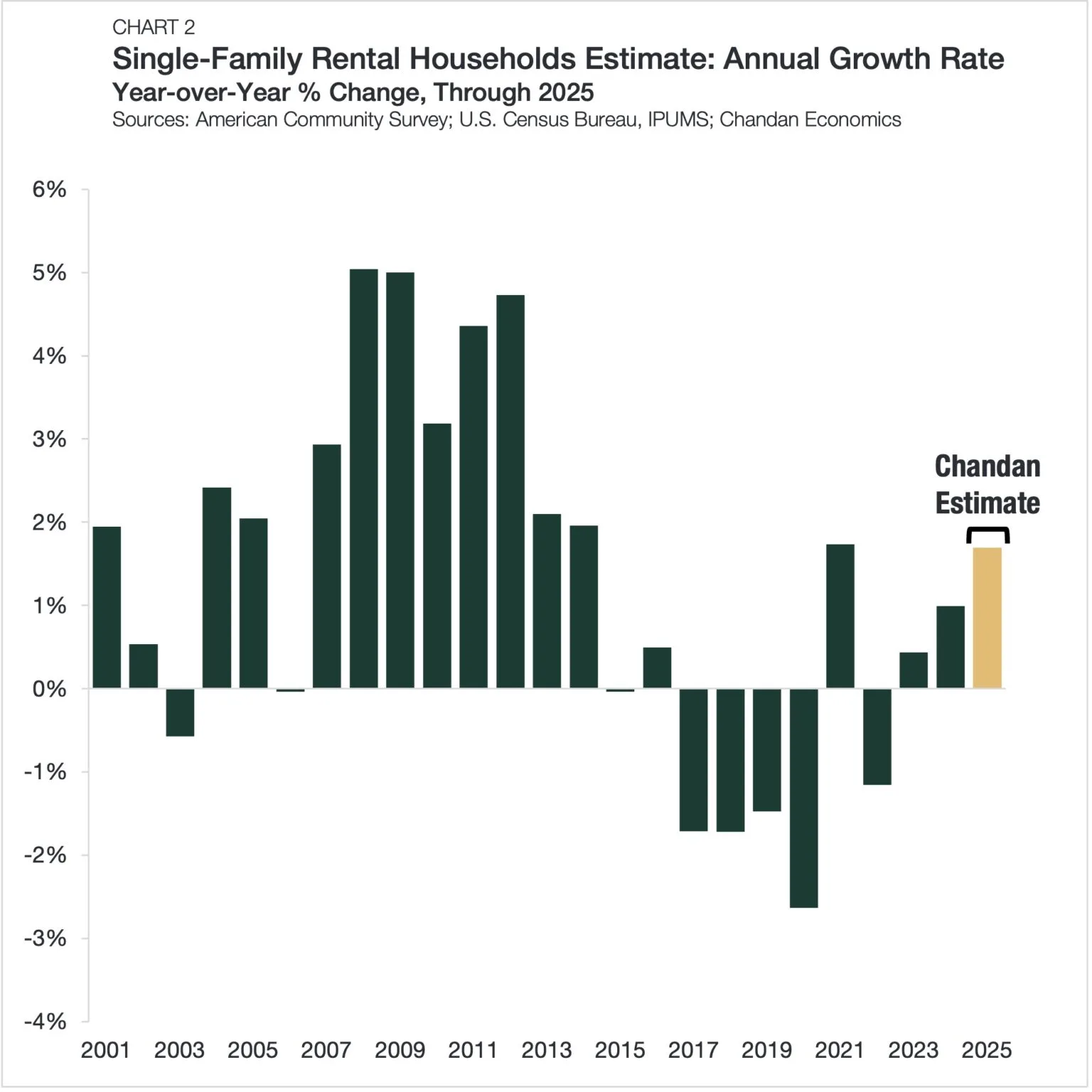

- Single-family homes for rent reached 14.6M in 2025, a 1.7% increase and the highest level since 2016.

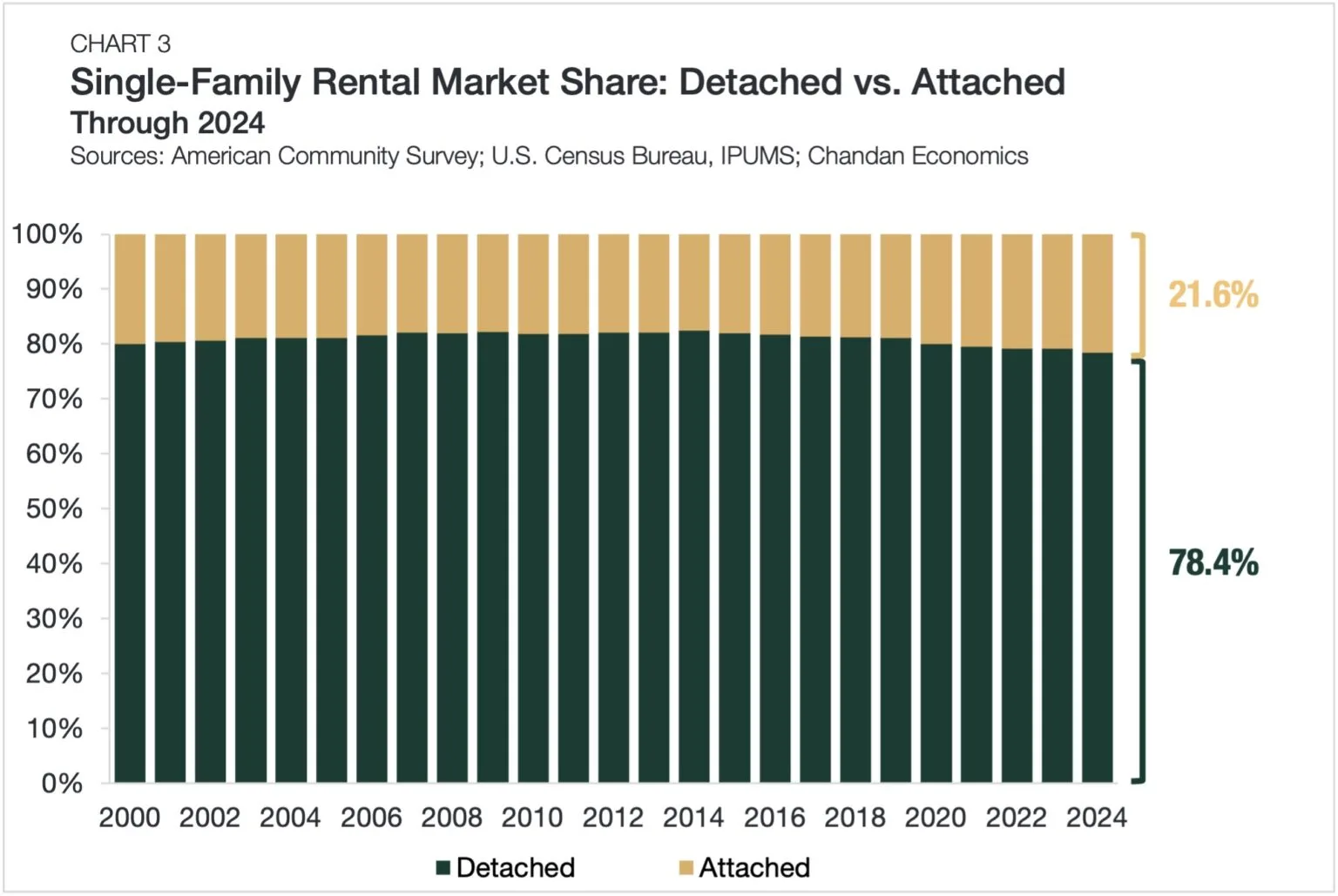

- Growth is largely driven by purpose-built, attached rentals favored in build-to-rent (BTR) communities.

- BTR construction now exceeds 7% of all single-family housing starts, up from 2.3% historically.

- Detached rental home growth has slowed, while attached rentals account for most sector expansion.

Single-Family Homes Rental Growth Accelerates

The number of single-family homes for rent is rising again after several sluggish years. According to preliminary estimates from Chandan Economics and Arbor Realty Trust, the sector grew 1.7% in 2025, adding about 243,000 new rental households and reaching 14.6M—a seven-year high. This rebound comes after a period of declining growth from 2017 through 2022, signaling renewed investor and tenant demand.

Build-to-Rent Activity Drives Expansion

The build-to-rent segment is now a key growth engine for single-family homes for rent. As build-to-rent expands, the segment has also attracted greater political and regulatory attention, particularly around zoning, affordability, and institutional ownership. Developers and investors now balance strong demand with a more complex policy environment shaping future community development.

BTR starts made up more than 7% of all single-family construction, up sharply from the historical 2.3% average. Attached single-family rental homes—often developed specifically for rent—expanded 4.3% in 2024, far outpacing growth in detached rentals, which saw only a 0.1% uptick. Nearly all SFR growth in 2024 was from attached units, reflecting the shift toward amenity-focused, purpose-built communities.

Long-Term Growth Outlook Remains Positive

Total single-family rentals remain below the 2016 peak, yet the recovery signals shifting renter preferences and investment strategies. Investors now direct more capital toward high-quality rental communities amid affordability pressures in the for-sale housing market.

Since 2023, developers added nearly half a million SFR households, strengthening the sector’s outlook for steady expansion. Consequently, demand continues to favor flexible single-family rentals, supporting sustained growth across purpose-built communities.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes