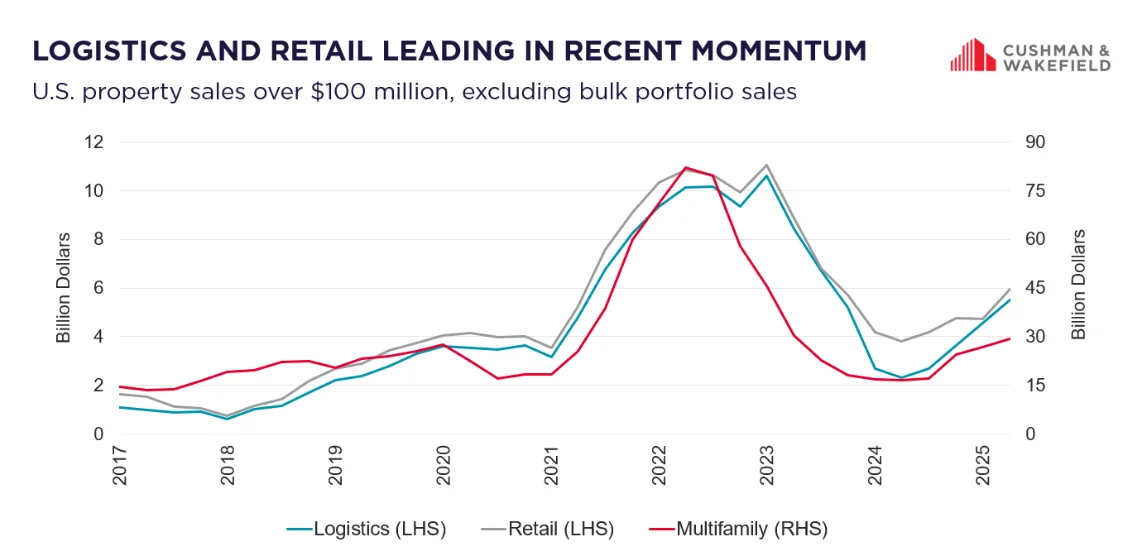

- Large single-asset deals over $100M in logistics, retail, and multifamily surged in Q2 2025, defying broader market sluggishness.

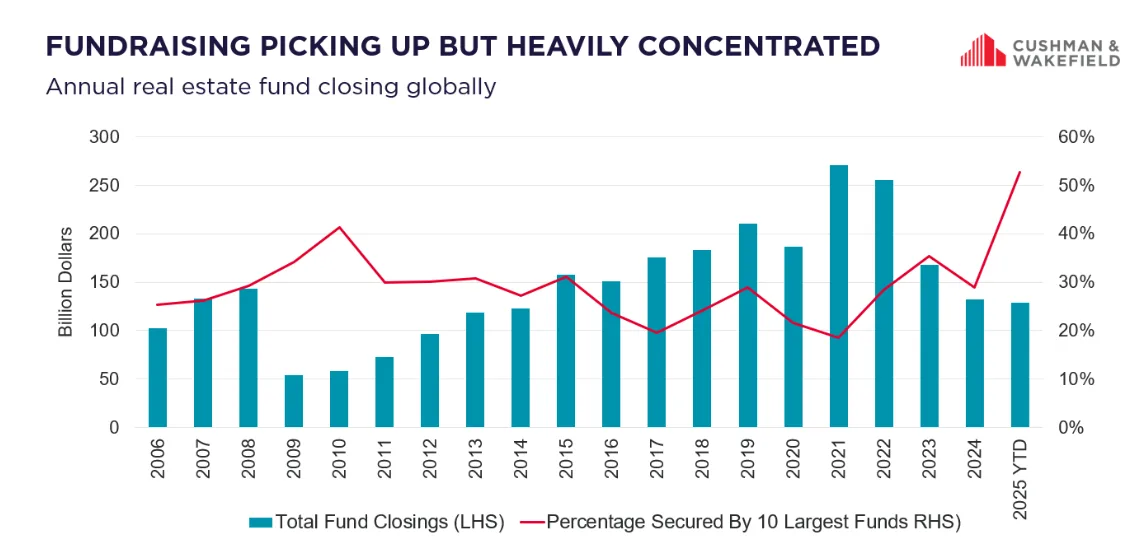

- More than 50% of real estate fund capital raised this year has been concentrated among just 10 fund managers.

- Office sales, once the leader in high-value deals, continue to trail multifamily and logistics post-pandemic.

Capital Shifts the Market

Investors with ample capital reserves are reshaping parts of the commercial real estate landscape, per Globe St.

While total CRE sales remain about 20% below 2019 levels, new data from Cushman & Wakefield shows a decisive uptick in single-asset deals—especially those above $100M—in the logistics, multifamily, and even retail sectors.

Spotlight on Single-Asset Transactions

Despite economic headwinds and weak portfolio activity, big-ticket deals are booming. In Q2 2025 alone, these large transactions in logistics, multifamily, and retail climbed to record levels—excluding the mid-pandemic peak.

This trend is particularly noticeable in logistics and multifamily, where a surge in development between 2021 and 2023 added more high-quality properties to the market. But the retail sector, with minimal new construction, is also seeing elevated activity, hinting at changing investor preferences.

Fundraising Powerhouse Effect

One major driver: fundraising is back—but highly concentrated. Over half of all capital raised this year went to just 10 large fund managers. These players are targeting resilient, top-tier assets, focusing their firepower on fewer, but larger, deals.

This focus has widened the gap between single-asset transactions and portfolio deals. While large individual sales are thriving, multi-property portfolios have stayed flat, a signal of persistent caution in a market still grappling with elevated vacancy rates and shifting fundamentals.

Office No Longer King

Pre-2020, office properties dominated high-value sales. Today, they lag far behind. Office deals over $100M totaled just $14B in the past 12 months—down sharply from the $40–50B annual norm pre-pandemic. Multifamily now leads, followed by logistics and select retail.

Waiting on Confidence

Cushman & Wakefield suggests that once leasing activity picks up and market confidence returns, bulk portfolio sales could rebound quickly. Until then, investors are expected to continue favoring single, high-quality assets offering safer returns in an uncertain economic environment.

Why It Matters

The shift toward large, single-property transactions signals a more cautious but targeted deployment of capital in CRE. With institutional investors prioritizing quality over quantity, sectors like multifamily and logistics are well-positioned to benefit—especially as portfolio deals wait in the wings for a broader market recovery.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes