- Simon Property Group raised its full-year FFO guidance after posting Q2 net income of $556.1M and 96% occupancy across its retail portfolio.

- Funds from operations hit $1.15B in Q2, up from $1.11B in Q1, signaling consistent demand across its national footprint.

- Despite rising performance metrics, Simon remains cautious about ongoing tariff volatility, which has begun to weigh on leasing volume.

Strong Earnings And Raised Guidance

Simon Property Group, the largest US mall operator, boosted its full-year financial guidance following a solid second quarter performance. Net income rose to $556.1M, up from $413.7M in Q1 and $493.5M year-over-year, reports Commercial Observer.

The company also reported $1.15B in real estate funds from operations (FFO) for the quarter, exceeding both the previous quarter and last year’s Q2.

In response, Simon modestly raised its minimum 2025 FFO guidance to $12.45 per share, up from $12.40.

Occupancy And Leasing Activity

Portfolio-wide occupancy came in strong at 96%, climbing 10 basis points from Q1 and 40 basis points year-over-year. While that points to continued tenant demand, leasing activity slowed slightly. Simon closed 1K leases totaling 3.6M SF in the second quarter. That’s down from 1,300 deals covering 5M SF in the first quarter.

Base minimum rent PSF edged down slightly to $58.70.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Strategic Acquisitions And Market Caution

Simon made only one major acquisition in the second quarter. It purchased Swire Properties’ majority stake in Miami’s Brickell City Centre, a 500K SF trophy asset, for $512M.

Despite this activity, CEO David Simon warned of ongoing risks: “Tariffs are a real cost of doing business… and the only consistent thing about tariffs is that they’re consistently changing.”

Still, the company expects tariff-related uncertainty to subside by 2026 as trade policy stabilizes.

Why It Matters

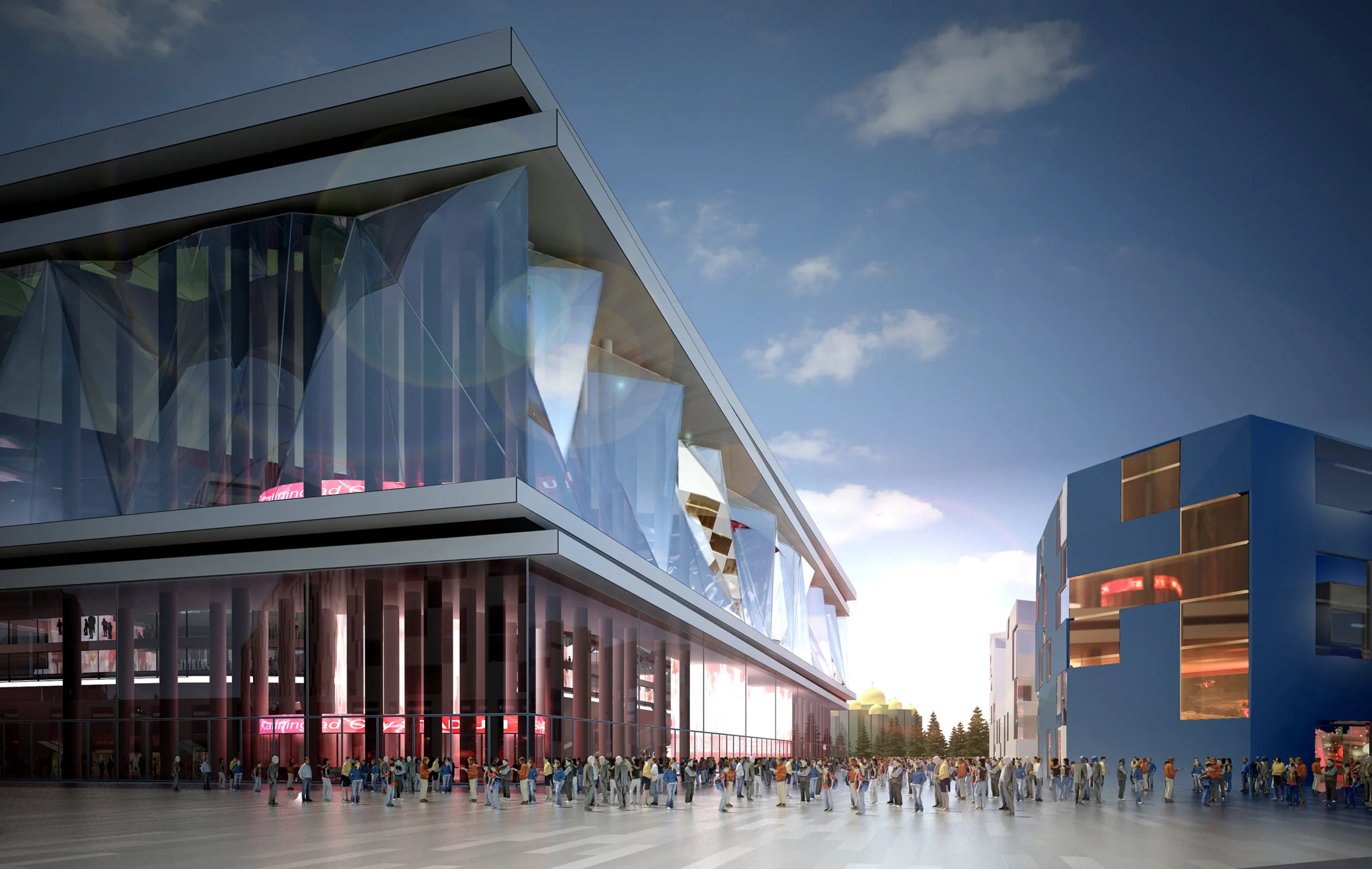

Simon Property Group’s performance reinforces the durability of retail real estate. This is especially true for high-end malls, even amid broader economic uncertainty. Retail remains one of the most resilient real estate sectors in 2025, and Simon’s numbers suggest that physical retail continues to attract both tenants and shoppers.

As David Simon put it: “The physical shopping environment continues to be the place to be.”

What’s Next

Simon’s cautious optimism mirrors broader sentiment across retail-focused REITs. If tariff conditions improve and consumer spending holds, the firm could outperform even its raised guidance. Meanwhile, further acquisitions and leasing velocity will be key to watch in the back half of the year.