- Short-term rentals are shifting toward larger, group-friendly homes in suburban and vacation destinations, while urban demand remains below pre-pandemic levels.

- Hotels still outperform short-term rentals in urban areas where offerings are more similar, particularly in cleanliness and communication metrics.

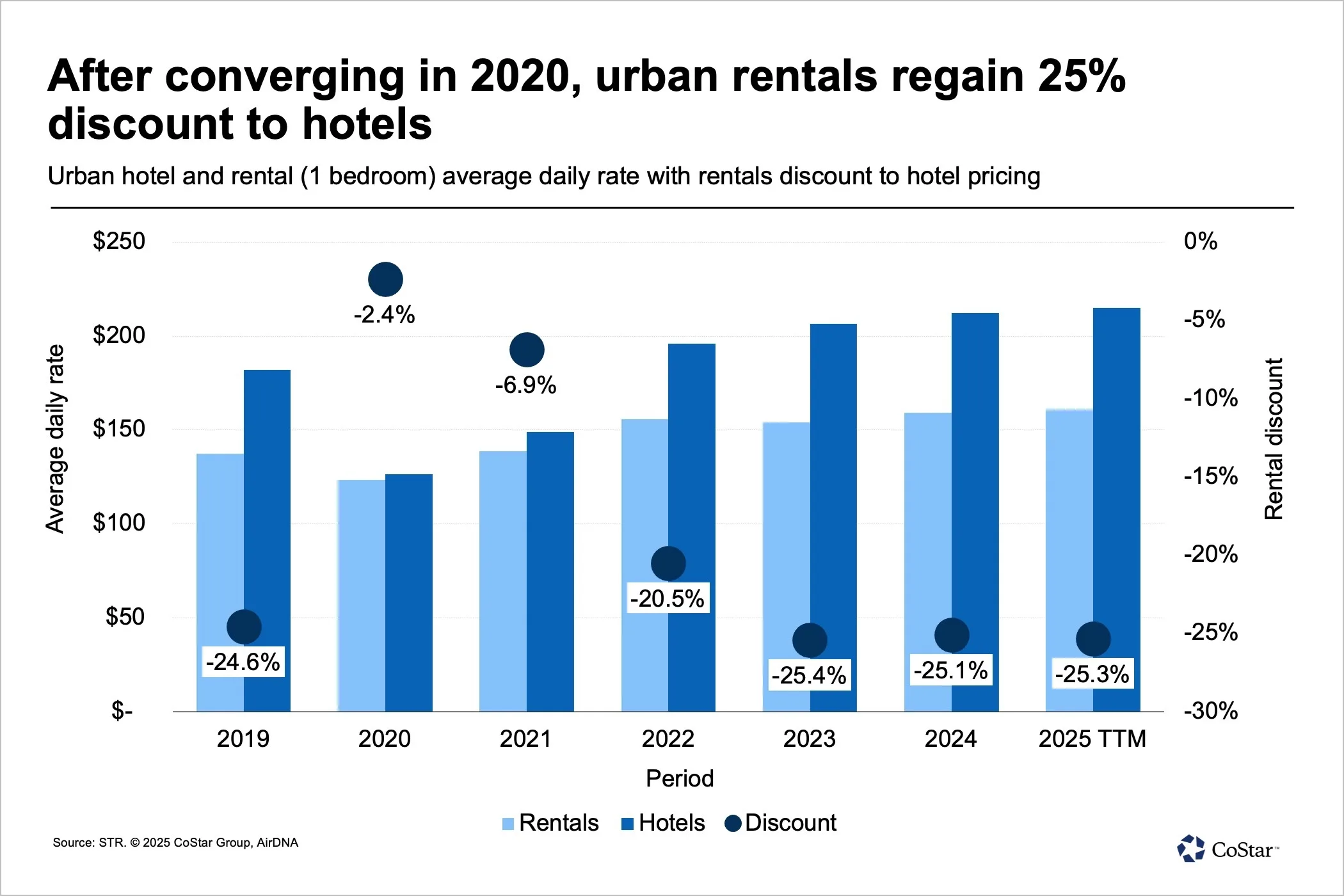

- While short-term rentals offer pricing advantages in cities, they’re now more expensive than hotels in suburban markets, driven by demand for larger homes.

Changing Shape Of The Market

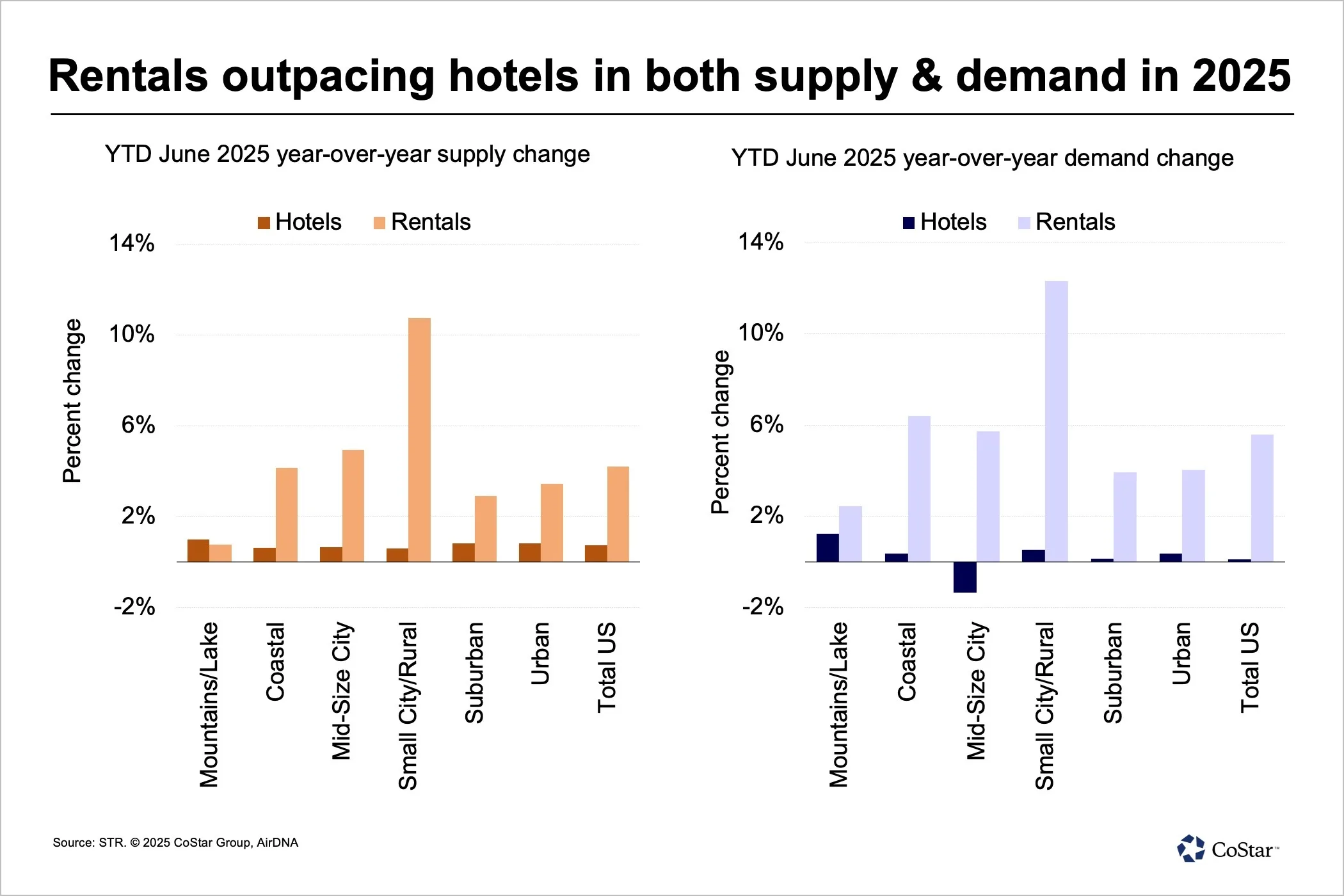

Short-term rentals are gaining momentum, but the growth isn’t uniform across the board, reports CoStar. Speaking at the 2025 Hotel Data Conference, Jamie Lane, chief economist at AirDNA, noted a shift in the success of short-term rentals. The category is now increasingly tied to larger, non-urban homes. Smaller, downtown one-bedroom units are no longer driving growth.

“The broader trend is less about cookie-cutter condos and more about unique stays,” Lane said. “When the rental product looks like a hotel room, hotels are winning.”

Suburban homes with 3+ bedrooms are now the backbone of short-term rental growth. Since 2019, these listings have surged by 137% in the top 50 US markets. Meanwhile, demand for urban rentals is still 16% below 2019 levels.

Demand Shifts By Size And Location

Smaller rental offerings — such as private rooms or one-bedroom units — have lost ground. Private room listings have dropped by 39%, now making up just 16% of urban inventory. In contrast, multi-bedroom homes dominate both demand and listing growth.

In the suburbs:

- One- and two-bedroom listings have doubled.

- Larger homes (3–5+ bedrooms) now make up 50% of the inventory.

Regulatory challenges in cities like New York are further pushing rental operators toward less restricted, suburban markets.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Hotels Still Win In Urban Head-To-Heads

Despite the rapid expansion of short-term rentals, hotels are holding their own — especially in urban centers. In places where rental properties directly compete with hotel products, hotels often come out ahead in guest satisfaction and operational consistency.

According to AirDNA and STR:

- Hotels outperform short-term rentals in cleanliness, communication, and overall value perception.

- Short-term rentals perform better in check-in (mostly due to keyless entry), listing accuracy, and location — especially in non-urban settings.

Price And Perception Drive Traveler Choice

Location and price remain the biggest decision factors for travelers. Rentals offer:

- 25% savings in urban markets vs. hotels.

- 5% price premium in suburban markets, reflecting demand for larger homes.

“Short-term rentals can pop up overnight where demand is,” Lane noted, unlike hotels that require years of planning and construction.

Still, hotels remain competitive by leveraging operational excellence and guest satisfaction — areas that travelers consistently reward.

Why It Matters

For hotel operators, the message is clear: adapt to shifting consumer preferences, especially in suburban markets. But in cities, the battle is far from lost — traditional hotels continue to dominate where their product aligns with traveler expectations.

As Claudia Alvarado Cruz of STR put it, “You can’t move your hotel, but you can improve how it’s valued by guests.”