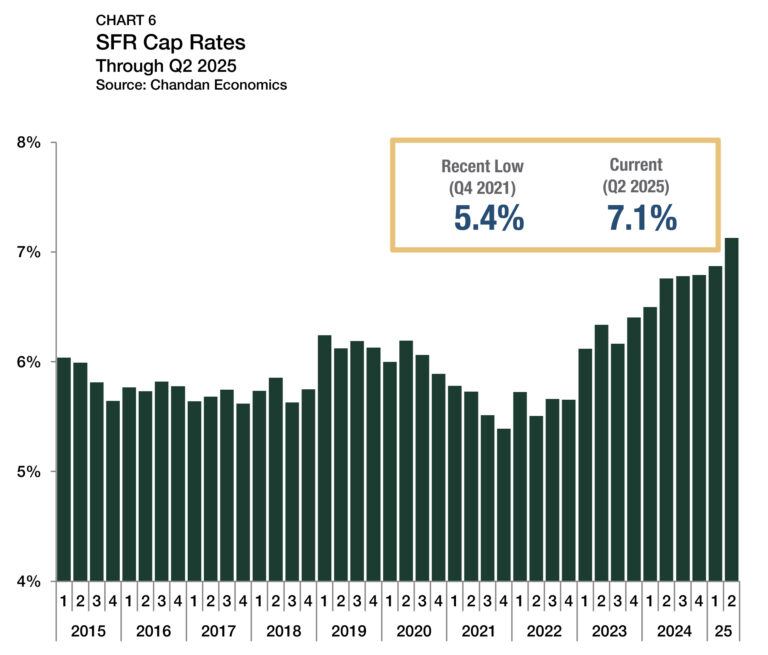

- Cap rates for single-family rentals (SFRs) rose to 7.1% in Q2 2025, as property prices softened and rent growth remained positive, boosting yields.

- Occupancy and lease renewal rates improved notably, breaking a year-long trend of declines and signaling a return to pre-pandemic performance levels.

- SFR delinquency rates fell to 0.9%, significantly outperforming broader housing market metrics, even amid higher interest rates.

State of the Market

The SFR sector entered Q3 2025 with renewed operational strength, according to Arbor. As homeownership costs hit record highs — with the average U.S. household needing 48% of income to afford a home — rental demand surged. Suburban home prices dipped slightly, while rents continued to rise, enhancing cash flow returns for investors.

Despite a slight cooldown, build-to-rent momentum remains high compared to historical standards. With a maturing market, SFR is settling into a phase of more stable, long-term growth after years of accelerated expansion.

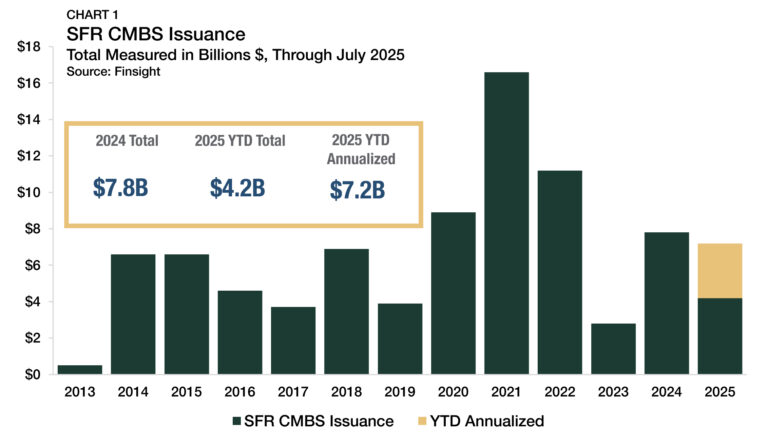

Performance Metrics: CMBS Issuance

Through July 2025, SFR CMBS issuance reached $4.2 billion, on pace for $7.2 billion annually — just shy of last year’s $7.8 billion total, which tripled 2023’s volume. Issuance has held steady despite fluctuations in deal size and frequency.

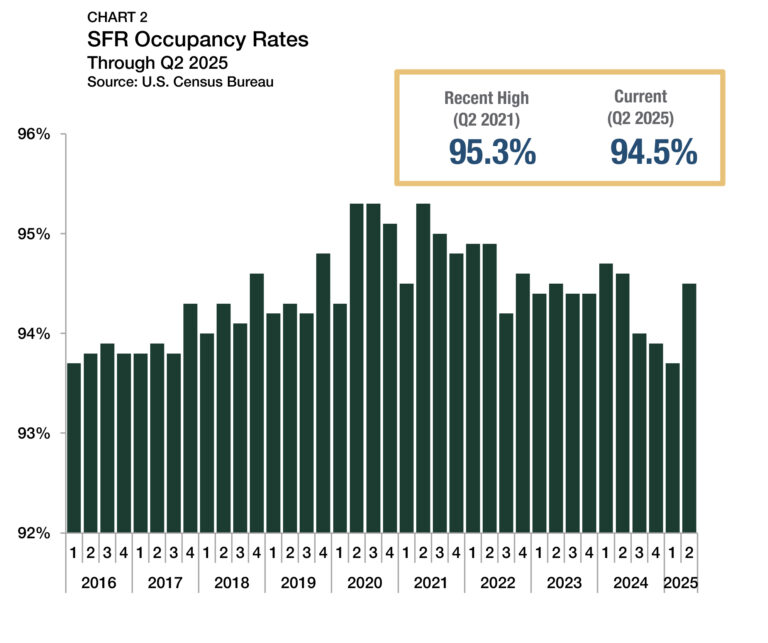

Occupancy & Retention

Occupancy rates rebounded to 94.5% in Q2, up 80 bps from Q1 and above pre-pandemic averages (2015–2019). Lease renewal rates also reversed a multi-year decline, rising from a low of 79.2% in April 2024 to above 82% by mid-2025.

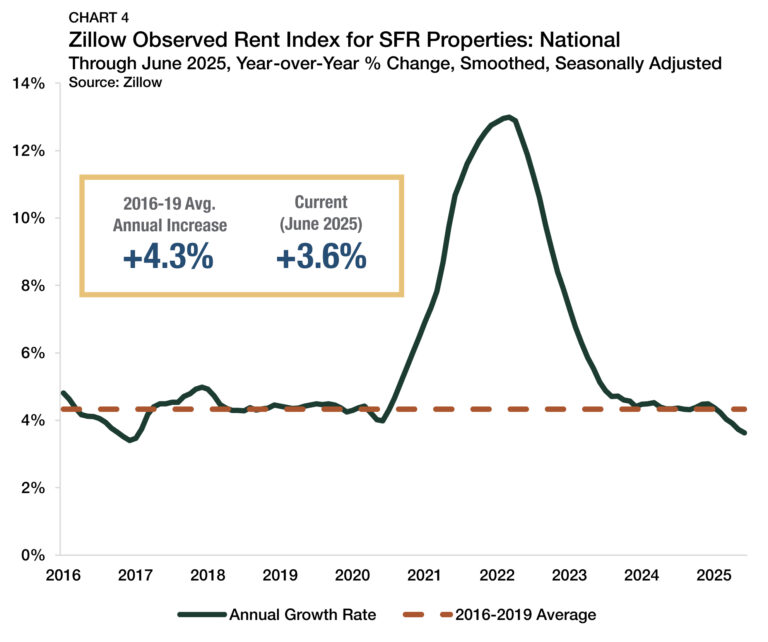

Rent Growth

Nationally, SFR rents rose 3.6% YoY through June 2025 — below recent highs but close to pre-pandemic norms. The Midwest and Northeast led metro-level rent growth, while the Sun Belt saw deceleration, with Austin (-0.2%) and San Antonio (+0.7%) at the bottom.

Cap Rates

SFR cap rates increased for a second consecutive quarter, hitting 7.1%. Rising 174 bps from 2021 lows, the spread over 10-year Treasury yields also widened to 277 bps — improving the sector’s risk-adjusted return profile.

Home Pricing

Home values rose just 0.6% YoY through June 2025 and fell for four straight months on a monthly basis. Zillow forecasts a further 1.0% decline over the next 12 months, indicating continued pricing pressure.

Debt Yields & Leverage

Debt yields rose to 11.1%, up 257 bps from 2022, reducing available leverage. Investors now borrow $8.99 for every $1 of NOI, down $2.71 from peak levels — prompting a pivot to stabilized, income-producing assets.

Delinquency Trends

SFR delinquency rates dropped to 0.9% in April, outperforming the broader market. While overall U.S. mortgage delinquencies inched up to 1.3%, strong underlying borrower fundamentals and low average mortgage rates (4.3%) have kept distress muted.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply & Demand Conditions

BTR starts hit 71,000 over the past year, comprising 7.2% of SFR starts — a modest pullback from recent highs but still above the five-year average. BTR continues to be the main engine for purpose-built rental supply, offering scale and product consistency for institutional investors.

Outlook

SFR is poised for continued growth, powered by sustained housing affordability challenges, elevated mortgage rates, and steady renter demand. Although localized oversupply and macroeconomic uncertainty may test the sector, the long-term fundamentals remain strong.

Expect investor focus to shift toward stabilized portfolios and cash-flow resilience as leverage tightens. With homeownership increasingly out of reach, demand for high-quality rental housing in suburban neighborhoods is unlikely to wane.