- The Q3 2025 Real Estate Roundtable Sentiment Index rose 13 points from last quarter to 67, reflecting a stronger outlook for operating conditions, asset values, and access to capital.

- Multifamily, data centers, and New York City office stand out as bright spots, while industrial faces oversupply challenges and office demand remains uneven outside NYC.

- Executives see asset values bottoming, with 59% expecting improvement over the next year. Debt capital availability has sharply rebounded, though equity remains harder to raise.

- Global investors show growing interest in European markets, reallocating some capital away from the US.

Sentiment Stabilizes

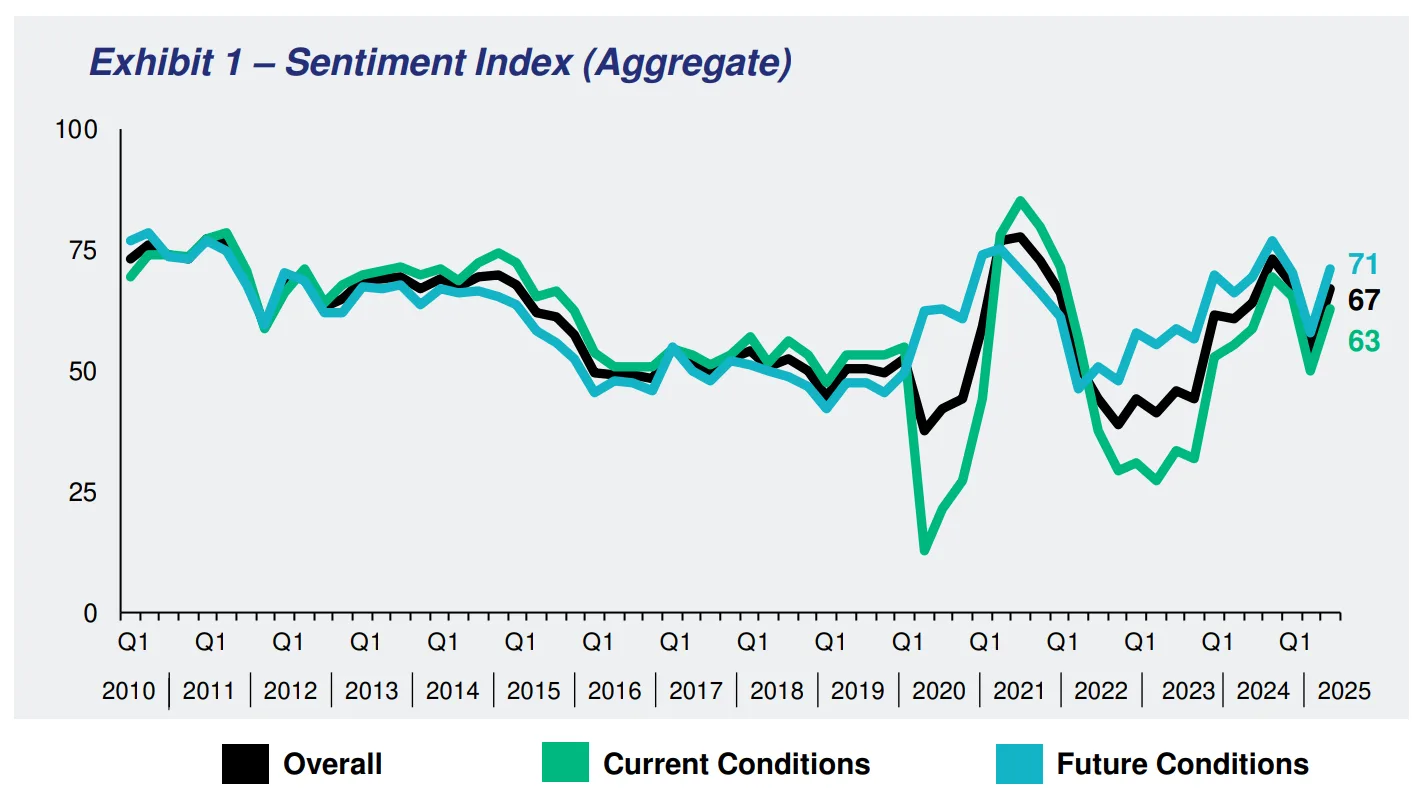

According to Globe St, the Real Estate Roundtable’s Q3 2025 Sentiment Index registered an overall score of 67, up 13 points from the second quarter. The Current Index hit 63 and the Future Index reached 71, both also 13 points higher. The gains suggest executives believe operating conditions have steadied, with occupancies and demand holding firm and values showing signs of bottoming.

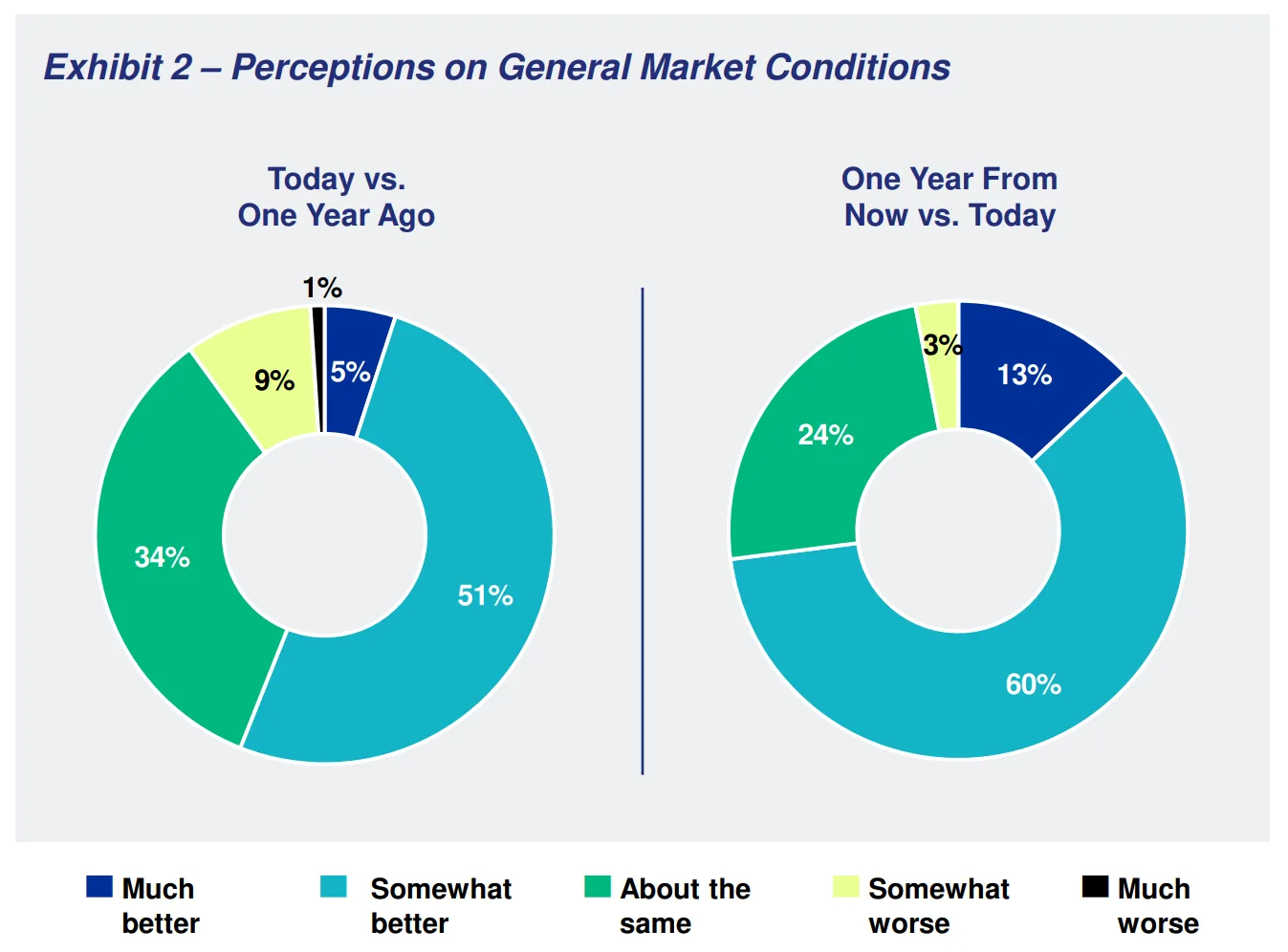

Nearly three-quarters (73%) of respondents expect market conditions to improve in the year ahead, while only 10% say conditions are worse than a year ago. Still, expectations fell short of earlier forecasts: in Q3 2024, 70% had predicted a stronger recovery than what materialized.

Sector Views: Bright Spots and Headwinds

Executives cited multifamily, data centers, and New York City office as outperformers. Multifamily is still seen as a strong long-term play, despite pockets of overbuilding. Data centers remain highly attractive, though rising power costs and operational complexity temper enthusiasm.

By contrast, industrial is working through a classic oversupply cycle, with vacancies dampening investor appetite. Strip retail near dense residential areas is performing steadily, while office demand remains muted—outside NYC, where Park Avenue remains one of the strongest office markets nationwide.

Some respondents also noted rising global interest: European living assets and office markets are attracting capital as investors diversify beyond the US.

Asset Values Show Signs of Bottoming

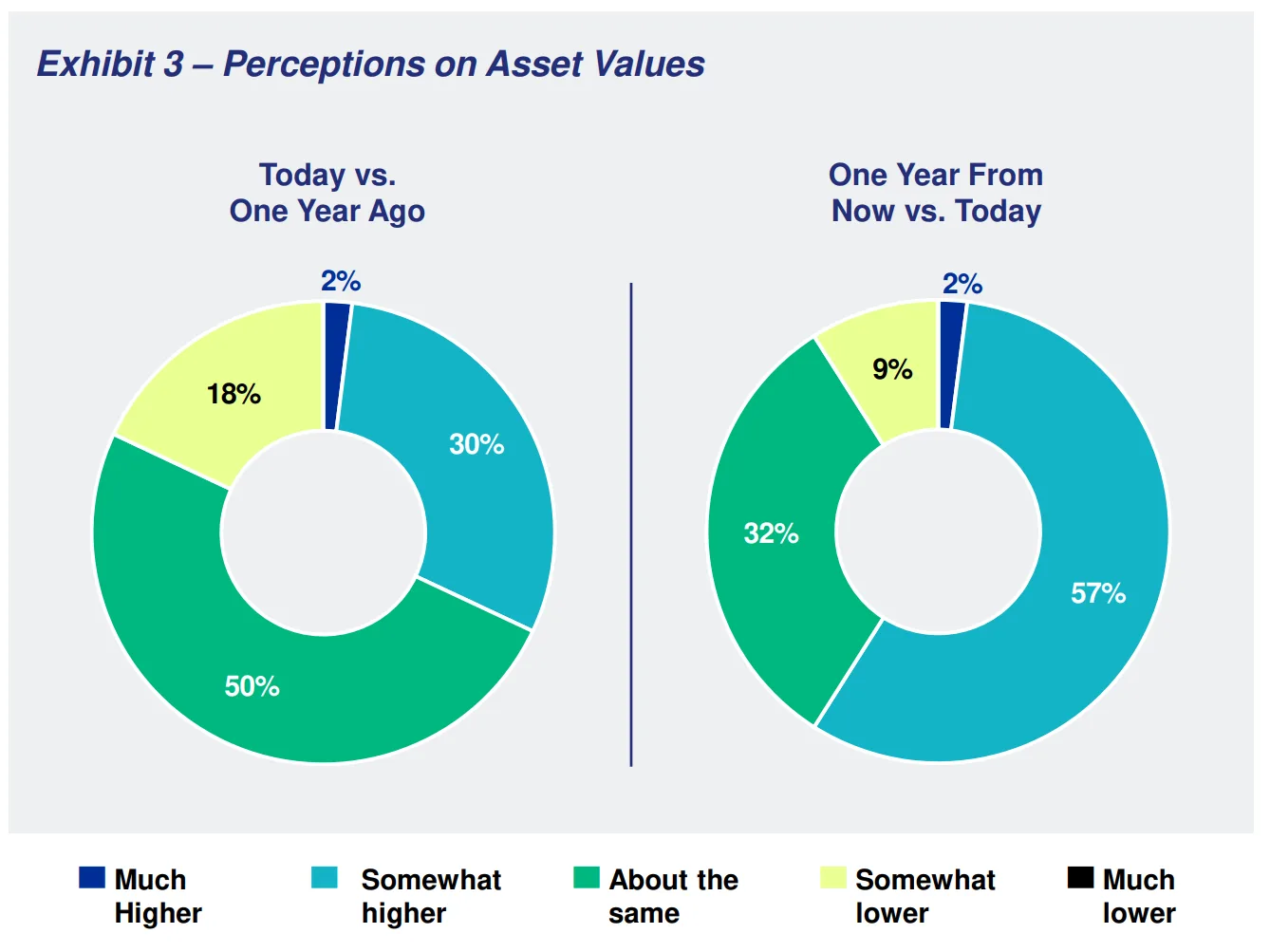

Half of respondents believe asset values are unchanged from last year, while 32% report increases and 18% decreases. Many acknowledged a lingering bid-ask spread, though more deals are progressing from auction to close.

Looking forward, 59% expect values to rise over the next year, 32% anticipate stability, and just 9% foresee declines. Respondents described today’s environment as one where “returns have been negative for three years, but valuations appear to be bottoming.”

Capital Flows Return—But Unevenly

Capital markets sentiment improved, particularly on the debt side. 65% of respondents said debt capital availability has risen over the past year, with 48% expecting further improvement. Equity, however, remains harder to secure—50% saw no change from last year, and fundraising remains slow.

“There is a growing disconnect between debt and equity providers,” one participant noted. “Debt has come back and everyone is hungry, but equity views this as a slow recovery, not a boom.”

Aggressive lending and loan-on-loan financing structures are providing flexibility, though high borrowing costs still prevent some deals from penciling. Continuation funds are becoming a go-to strategy for managers needing more time.

Why It Matters

The rebound in sentiment highlights a turning point for commercial real estate: conditions have steadied, capital is cautiously returning, and certain sectors are poised for growth. Yet the recovery remains sector- and market-specific, with uneven demand and cautious equity investors shaping deal activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes