- Self storage revenues dipped 0.3% YoY in Q2 2025, with flat rent growth and declining occupancy.

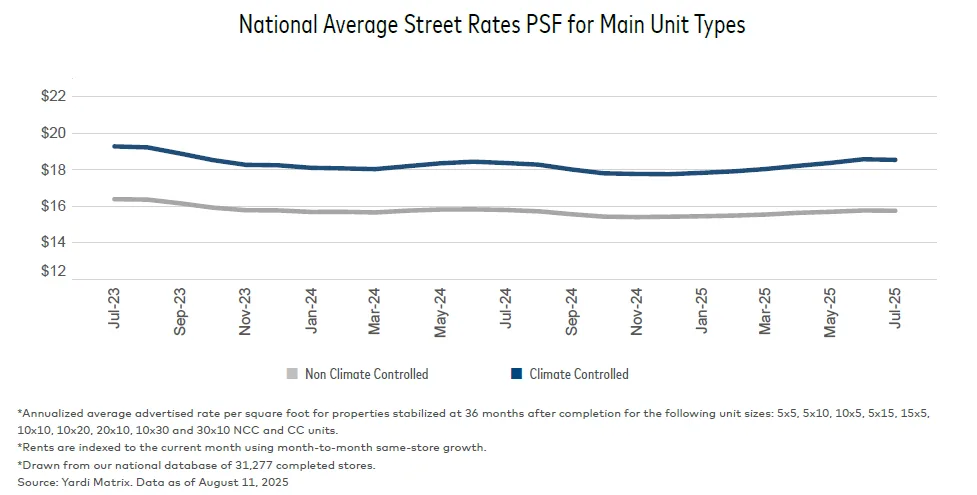

- Climate-controlled units outperformed non-climate-controlled units in annual rent growth.

- Oversupply continues to pressure Sun Belt markets like Austin, Phoenix, and Las Vegas.

- National construction starts are slowing, signaling long-term easing of supply headwinds.

The national self storage sector is treading cautiously toward stabilization in mid-2025, reports Yardi Matrix. According to an August report, REITs and private operators are facing a challenging environment. Rents remain stagnant, while operating costs continue to rise. Recovery trends vary significantly across regions.

A Closer Look At The Fundamentals

Q2 2025 showed a slight deterioration in fundamentals. Same-store revenues declined by 0.3%, compared to a 0.2% drop in Q1. The decline was driven by a 40-basis-point decrease in average occupancy and flat rent growth. Operators revised full-year guidance, with revenues expected to range from -1.2% to 0.6% and NOI from -2.9% to -0.4%.

Housing and migration trends remain sluggish, especially in Sun Belt regions. In contrast, urban and coastal metros are seeing modest revenue gains. These gains are supported by stronger stability in in-place rents.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Top Markets Split On Performance

National street rates remained flat year-over-year in July at $16.91 PSF. But market-level trends diverged:

- Los Angeles led with a 2.7% YoY increase, fueled by REIT-driven pricing power and wildfire-related rent restrictions.

- Tampa, Chicago, Charleston, and Minneapolis also posted gains exceeding 2%.

- Austin (-4.2%), San Diego (-2.8%), and Las Vegas (-2.6%) were among the worst performers due to demand weakness or oversupply.

Supply Pipeline & Leasing Headwinds

Over the past three years, 9.3% of national inventory was delivered, with another 2.8% added in the past 12 months. Metros like Orlando (15.2%), Charlotte (15.3%), and Tampa (14.3%) face the steepest lease-up pressure.

Meanwhile, active construction remains elevated in Las Vegas (6.6%), Phoenix (5.9%), and Orlando (5.5%), despite a 13.2% YoY drop in nationwide construction starts in H1 2025. This signals a challenging near-term outlook for rent growth in oversupplied markets.

Why It Matters

Self storage remains a resilient asset class, but the days of pandemic-driven demand spikes are behind us. Operators are adapting to slower leasing seasons, muted housing mobility, and regional imbalances that demand a hyper-local strategy.

What’s Next

With fewer deliveries projected ahead and improving rent trends in select metros, the path to recovery hinges on a rebound in housing and migration. Savvy investors will be watching for signals from urban gateway markets while closely tracking lease-up progress in overbuilt regions.