- Self storage rent growth turned negative nationally for the first time since COVID, down 0.2% year-over-year in January 2026.

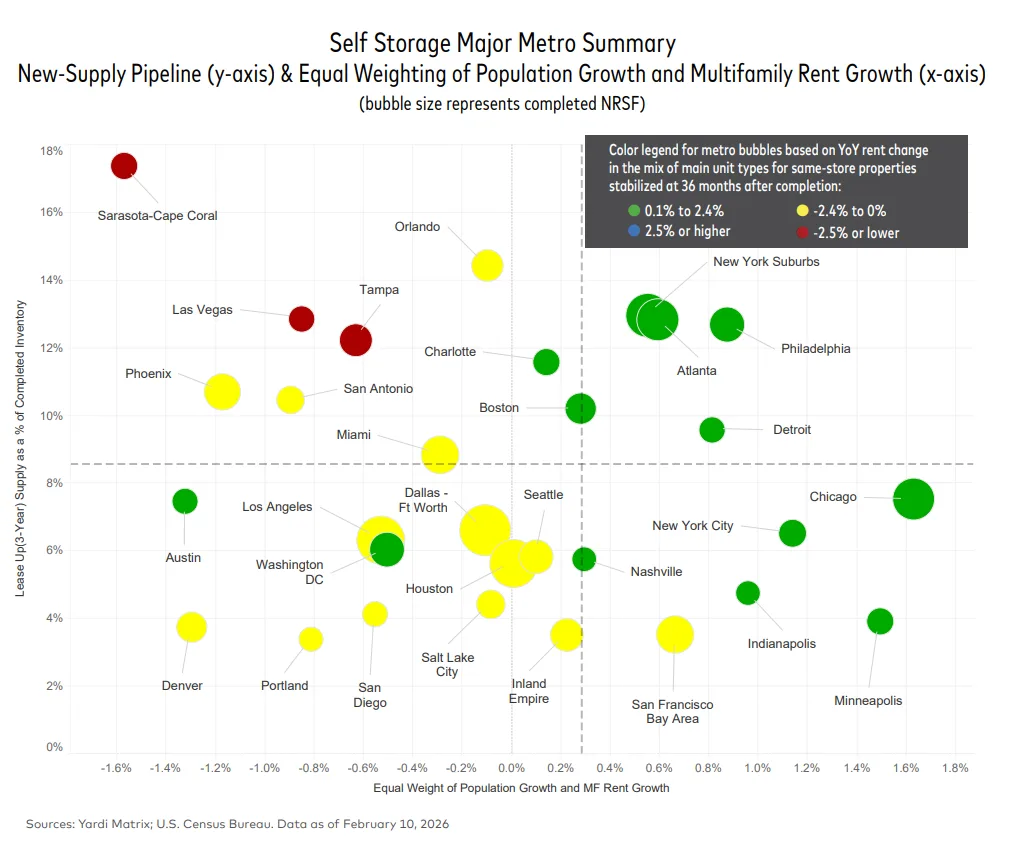

- New supply remains high, with 2.5% of inventory under construction, putting downward pressure on street rates in oversupplied markets.

- Midwest and Northeast metros outperformed Sun Belt markets due to improving migration and lower new deliveries.

- Operators are adjusting pricing strategies, with REITs pulling back on rates while non-REITs remain more aggressive in key metros.

Demand Weakens as Supply Grows

US self storage demand slowed in early 2026 amid an ongoing surge in new deliveries. Yardi Matrix data shows advertised street rates decreased 0.2% year-over-year in January, marking the sector’s first annual decline since COVID. This shift follows weaker population growth, lower net migration—especially in key Sun Belt states—and high levels of new construction.

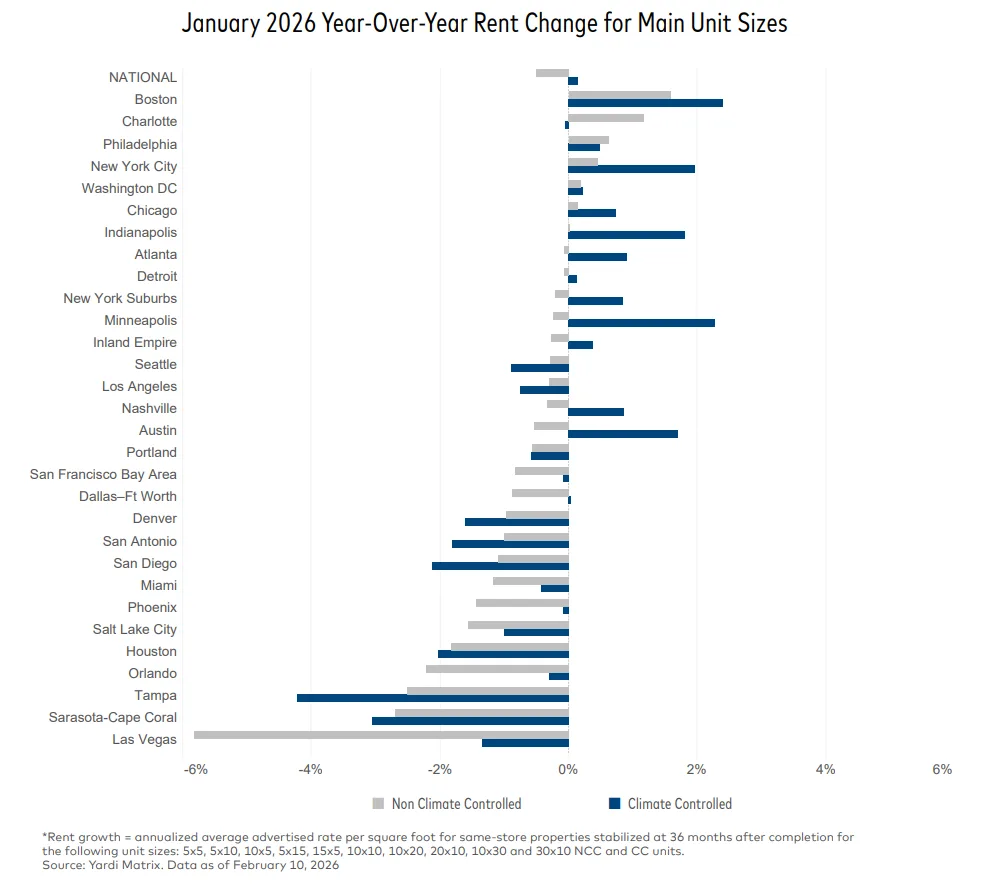

Regional Trends and Rent Performance

Midwest and Northeast metros outperformed Sun Belt peers in annual rate growth. Midwest markets like Chicago, Minneapolis, and Detroit posted better rent gains due to improved migration, while oversupplied Sun Belt markets such as Florida and Texas saw weakened demand and steeper rent declines. Only 6 of the top 30 metros recorded increases in non-climate-controlled (NCC) unit rates; climate-controlled (CC) units fared slightly better, with gains in 13 metros.

Monthly Rents and Metro Standouts

National average street rates PSF fell from $16.30 in December 2025 to $16.27 in January 2026, a 0.2% decrease typical for winter months. Notably, Austin reversed its trend, posting 0.7% monthly rent growth as new supply slowed and demand began to catch up. In contrast, markets such as Tampa, Sarasota–Cape Coral, and Las Vegas saw annualized rate declines exceeding 3% amid persistent supply.

Supply Pipeline and Operator Response

The national pipeline remains active, with over 50M net rentable SF under construction across the US. Although the share of projects as a percent of stock slipped slightly, ongoing construction continues to weigh on rent growth. This dynamic aligns with recent industry forecasts pointing to elevated deliveries in 2026 before a more meaningful slowdown takes hold. REIT operators have responded with slight annual rate cuts, while some non-REITs held or increased prices in select metros like Charlotte and New York City. Overall, supply is forecasted to decline modestly in the next two years, but near-term fundamentals remain challenged until demand sufficiently absorbs recent deliveries.

Looking Forward

Self storage supply is expected to decrease, with planned and prospective projects contracting, though delayed deliveries and high interest rates could continue to suppress transaction activity. Markets with stronger multifamily demand and lower supply will likely remain more resilient, while oversupplied regions may face further rate pressure as fundamentals stabilize.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes