- Self storage sales reached $755M in Q2 2025, with prices rising 19% year-over-year to an average of $123 PSF.

- Urban infill and high-growth suburbs led demand, with New York City and Canyon, TX, posting record valuations.

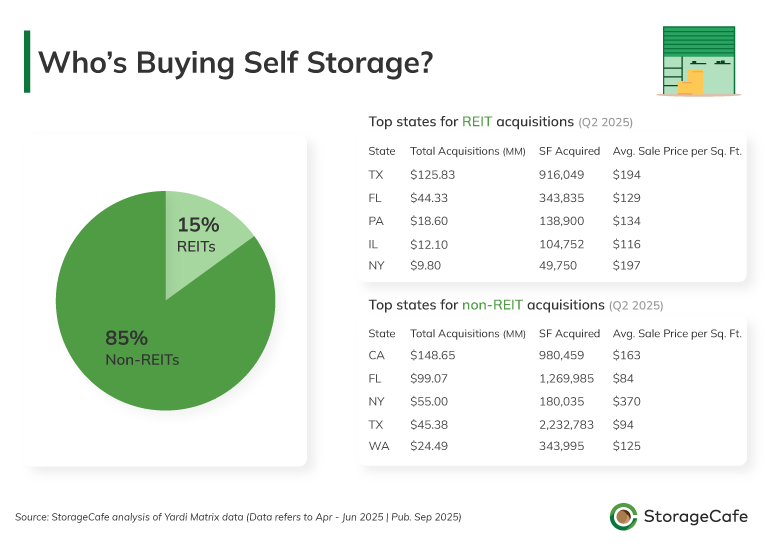

- REITs paid a 40% premium over non-REITs, focusing on Sun Belt markets and dense, supply-constrained metros.

- Investors favored demand certainty over scale, targeting markets with population growth, limited supply, or strong turnover dynamics.

Capital Flows Hold Steady, Even As Deal Volume Tightens

Despite higher borrowing costs and tighter credit markets, Q2 2025 demonstrated that self storage remains a resilient asset class, reports StorageCafe. Nationwide transaction volume reached $755M, with investors paying a 19% premium over last year on average. Rather than chasing volume, capital is zeroing in on targeted opportunities — particularly infill assets in supply-constrained metros and facilities in high-growth suburbs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Where the Money Went: Top Q2 Deals By City

- New York City, NY

- Deal: $50M for 91,700 SF ($545/SF)

- Why it matters: The quarter’s most expensive deal reflects investors’ willingness to pay for certainty in dense, underbuilt markets. NYC has just 2.4 SF of storage per capita.

- Deal: $50M for 91,700 SF ($545/SF)

- Walnut Creek, CA

- Deal: $47M for 220,240 SF ($213/SF)

- Why it matters: Nearly half the city’s inventory changed hands. Entitlement hurdles and high incomes help preserve pricing power.

- Deal: $47M for 220,240 SF ($213/SF)

- Houston, TX

- Deal: $39.4M for 410,390 SF ($265/SF)

- Why it matters: High supply is offset by churn. Job growth and mobility make Houston a reliable storage market despite 6.9 SF per capita.

- Deal: $39.4M for 410,390 SF ($265/SF)

- Spring, TX

- Deal: $35.3M for 236,740 SF ($149/SF)

- Why it matters: With 22% population growth since 2014, storage is essential infrastructure — even in higher-supplied areas.

- Deal: $35.3M for 236,740 SF ($149/SF)

- South San Francisco, CA

- Deal: $30.3M for 86,610 SF ($349/SF)

- Why it matters: Just 1 SF of storage per capita in a biotech-heavy city. Investors are buying scarcity, not growth.

- Deal: $30.3M for 86,610 SF ($349/SF)

REITs VS. Non-REITs

REITs made fewer acquisitions than smaller operators but paid significantly more. On average, REITs paid $157/SF, compared to $112/SF for non-REIT buyers. Their focus: urban infill, Sun Belt cities, and high-barrier-to-entry locations.

- Texas: 8 REIT-led deals totaling 916K SF; non-REITs added 38 transactions worth $45M.

- Florida: REITs acquired portfolios in Kissimmee, Tallahassee, and Panama City Beach.

- California: Just 14 deals, but $149M in combined volume — most involving premium urban or coastal stock.

Market Drivers

Urban Infill Markets:

Investors paid top dollar in markets like NYC, South San Francisco, and Sonoma, CA — where land is limited, entitlement timelines are long, and household mobility keeps occupancy steady.

High-Growth Suburbs:

In places like Canyon, TX ($279/SF), Oregon, WI ($271/SF), and Kissimmee, FL ($119/SF), strong population and household formation metrics supported above-average valuations — even in markets with higher supply levels.

What’s Next For Self Storage Investors?

“Underserved markets with low per capita supply — like Plantation, Florida — offer the strongest growth opportunities,” says Doug Ressler, Business Intelligence Manager at Yardi Matrix.

His advice for operators: “Embrace operational tech to stay competitive.” For investors? “Watch interest rates closely and be prepared for refinancing risk in the back half of the decade.”

Conclusion

Q2 2025 proved that self storage remains a conviction play, not a momentum trade. Investors favored quality over quantity, rewarding dense cities and high-growth suburbs with strong fundamentals. Whether paying $545 per foot in Brooklyn or $279 in Canyon, TX, the common theme was underwriting certainty of demand in a market shaped by mobility, barriers, and resilience.

As self storage continues to evolve into a core real estate asset class, expect precision, not volume, to define deal-making in the quarters ahead.