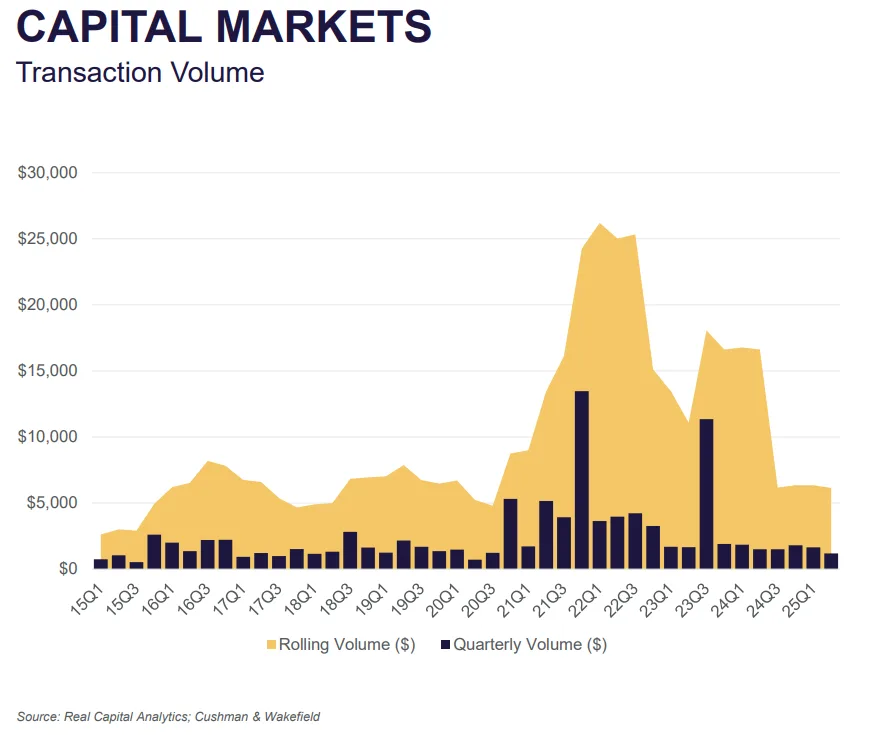

- Self storage transaction volume reached $2.85B in H1 2025, largely in line with pre-pandemic levels and less than 1% above H1 2023.

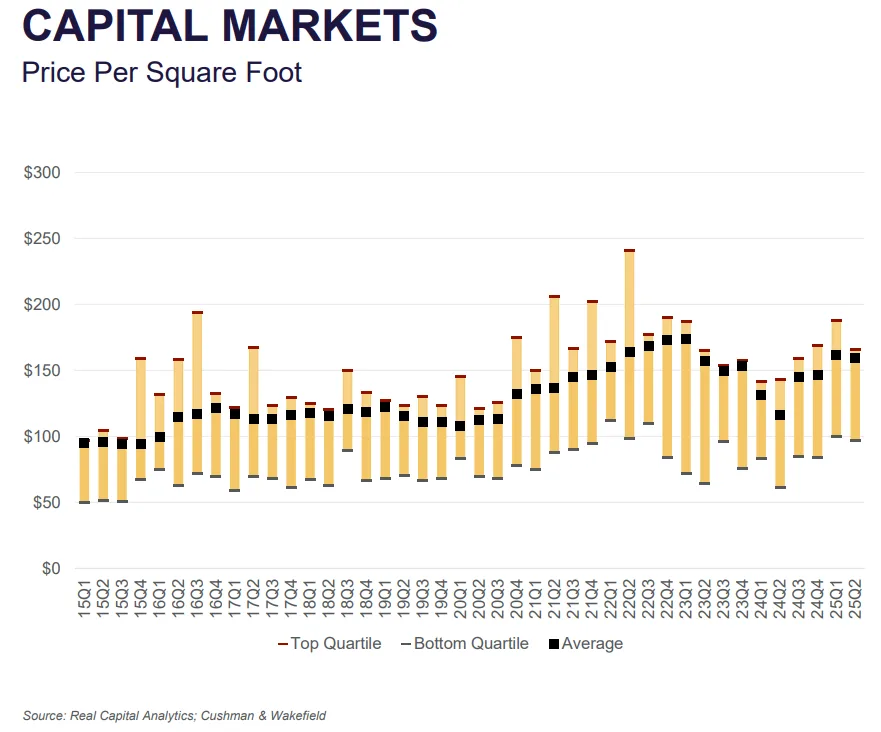

- Valuations continue to decline, with average prices falling 12% from their Q1 2023 peak of $174 PSF to $159 PSF in Q2 2025.

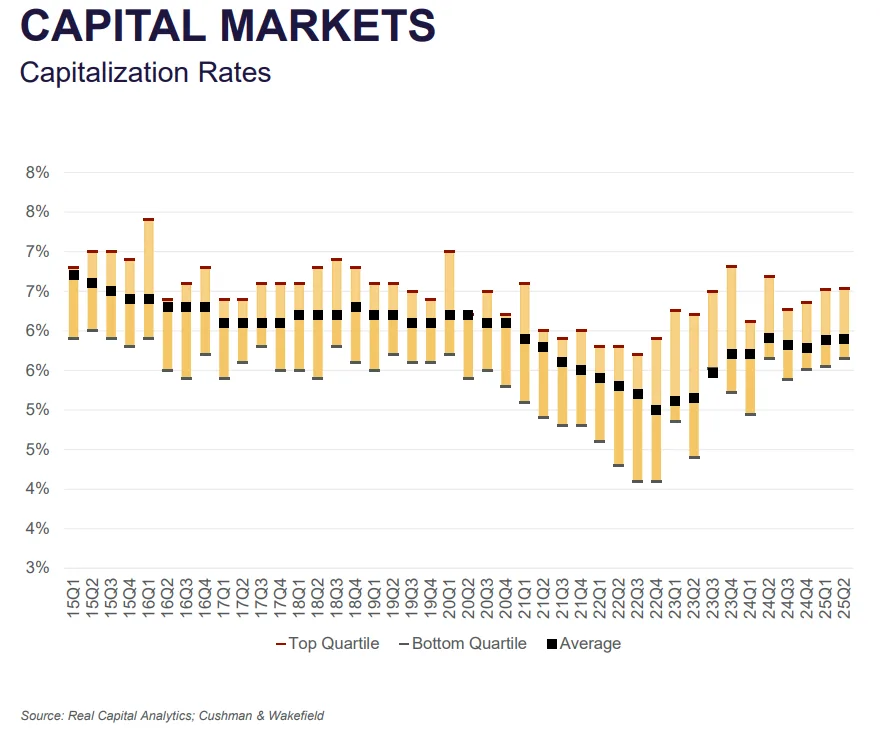

- Cap rates have stabilized around 5.8%, with investors expecting little change over the next year amid rising concerns over interest rates and the housing market.

A Post-Surge Reset

The post-pandemic surge in self storage investments appears to have plateaued, per Cushman & Wakefield. The sector saw nearly $50B in transaction volume between 2020 and 2022. In H1 2025, activity reflects more normalized trends. These levels are more in line with the market prior to 2020. The $2.85B in volume recorded aligns closely with figures from H1 2023.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Value Compression

Valuations peaked at $174 PSF in Q1 2023 and have steadily declined for six consecutive quarters to $159 PSF in Q2 2025. The average price over the past nine quarters now sits at $152 PSF. Cushman & Wakefield’s Performance Index also showed a 7.9% YoY decline, with index values currently at 146.3.

Cap Rates Hold Steady

Cap rates averaged 5.8% over the past six quarters, up from a record low of 5.0% in Q4 2022. Class A assets traded in the 5.0–5.5% range while Class B assets saw cap rates from 5.5–6.5%. More than half of survey respondents (56%) expect cap rates to remain unchanged through 2025.

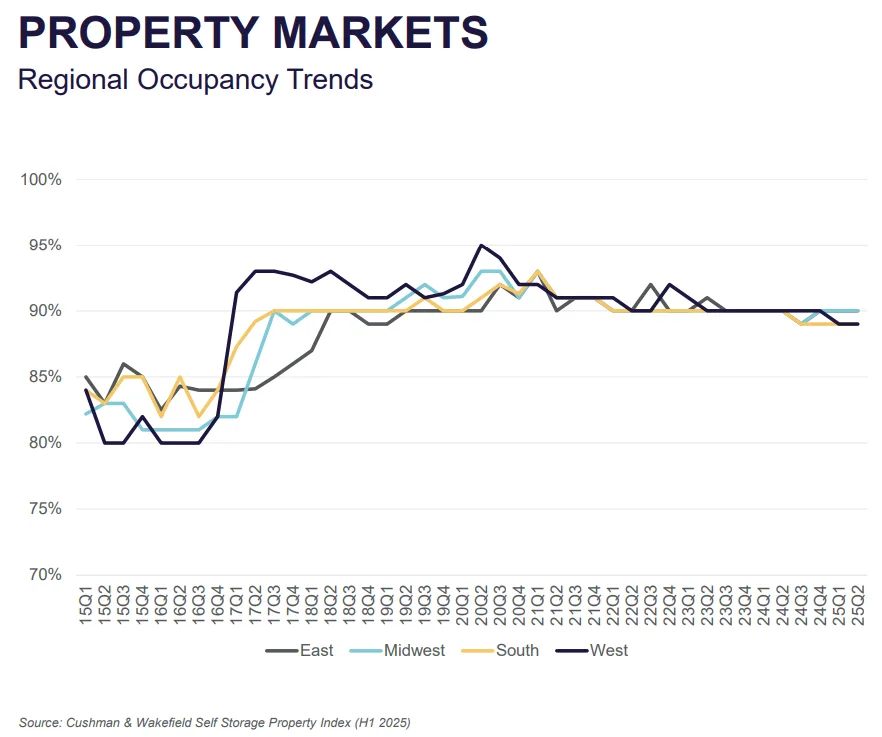

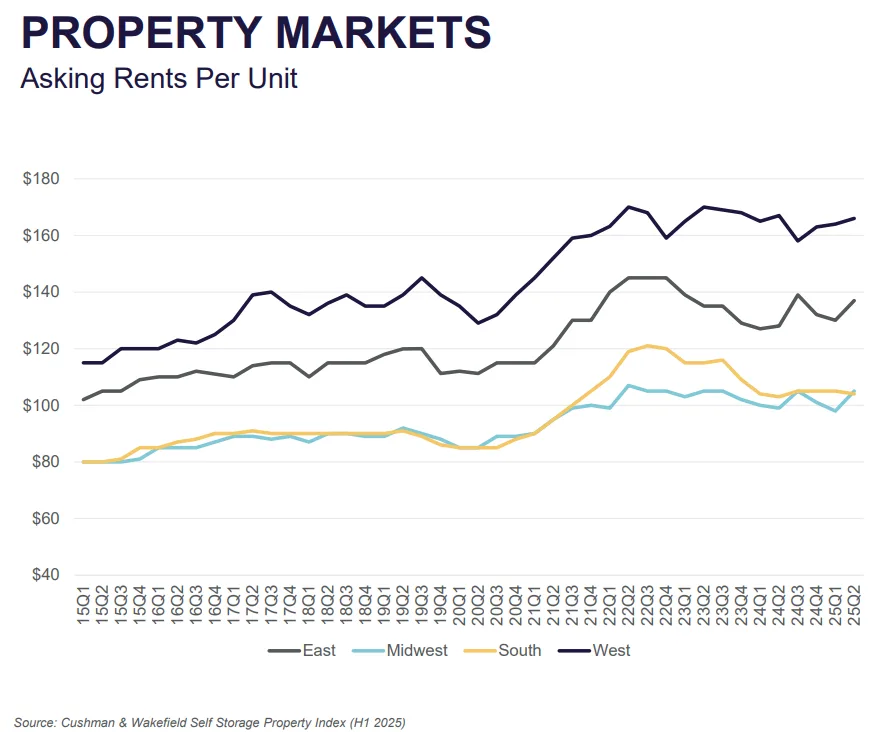

Rent Growth Slows

Average asking rents fell from the Q3 2022 high of $134/unit and now range from $124 to $132/unit, with a market average of $128. Despite softer net demand and financial pressures, tenant stay durations have remained steady. Some subregions, like the West, still command higher asking rents at $193/unit.

Construction Taps The Brakes

Rising costs and limited debt availability have slowed new development. According to Dodge Pipeline, Q2 2025 saw a notable rise in self storage projects being placed on hold. This trend is expected to continue as developers face tighter financing conditions.

Outlook: Holding Pattern

Investor interest remains strong, with 65% of survey respondents expecting to be net buyers in the coming year. However, valuation concerns are rising. The top concerns are the slowing housing market, cited by 39%, and interest rates, noted by 35%. Rent growth is expected to be modest, with 52% of investors forecasting 0–3% increases over the next 12 months.

Why It Matters

The US self storage market is showing signs of maturity and normalization. Though no longer booming, it remains a resilient sector with stable fundamentals. With most investors expecting flat cap rates and moderate rent growth, the sector appears poised for steady—not spectacular—performance in the near term.