- National advertised street rates dipped 0.5% year-over-year in May 2025, reflecting broader challenges stemming from weak housing activity and affordability concerns.

- Development remains active, with 55M SF under construction—2.8% of existing inventory—though forecasts show declining new supply through 2027.

- Chicago, Tampa, and Washington, DC were among the few major metros showing rate growth, while markets like Austin, Las Vegas, and San Diego saw the steepest declines.

National Outlook Slows Down

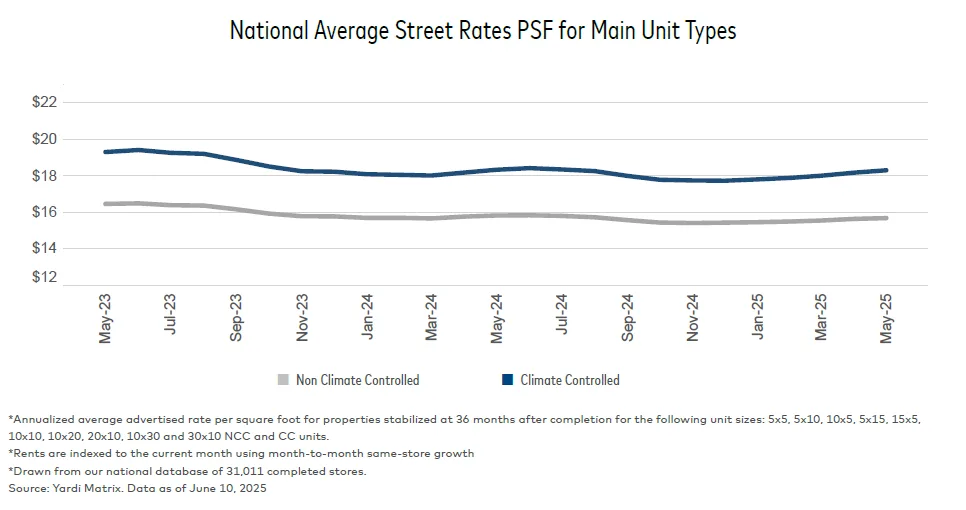

The self storage sector faced more headwinds in May, with the national average advertised rate PSF falling 0.5% year-over-year to $16.76, reports Yardi Matrix. Rates for non-climate-controlled (NCC) units dropped 0.8%, while climate-controlled (CC) units saw a milder 0.2% dip. The slowing US housing market continues to impact demand for storage space.

Supply Pressure Holds Steady

The development pipeline remains robust, with 3,058 facilities tracked in various stages. This includes 728 under construction—equal to 2.8% of existing inventory. Yardi forecasts a decline in new deliveries: down 19% in 2025, 18% in 2026, and 9% in 2027.

Winners And Losers

Chicago stood out with a 2.3% year-over-year rate increase, followed by Tampa and Washington, DC at 2.2%. These markets benefited from constrained supply and strong demand fundamentals. On the flip side, Las Vegas (-3.5%), Austin (-3.1%), and San Diego (-3.8%) recorded the largest declines due to overbuilding and softer demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Development Hotspots

Las Vegas leads the nation in supply under construction, totaling 7.2% of its existing inventory. Nashville posted the biggest month-over-month jump in construction, signaling continued interest from developers. However, elevated pipelines in markets like San Antonio and Charlotte are already weighing on rents.

Why It Matters

While demand has softened, self storage remains a defensive asset class with pockets of resilience. But with development still active in many metros, operators face pressure to manage lease-up risk and sustain occupancy amid declining street rates.

What’s Next

Operators will need to lean on technology, pricing strategies, and operational efficiency to navigate the current market cycle. Expect a cautious approach to new development as capital tightens and fundamentals moderate.