- The self-storage market began stabilizing in mid-2025 after demand cooled and investor sentiment softened in 2024.rn

- Slower supply growth and steady rents in core markets have helped restore confidence, with transaction volume and securitization activity rebounding.

- Cap rates have widened to 6.2%, and refinancing risks loom, particularly for lower-yield debt maturing in 2028–2029.rn

- Going forward, the sector’s performance will hinge on interest rate normalization and the ability of oversupplied markets to absorb new inventory.

From Boom To Balance

After years of pandemic-driven demand and rapid expansion, the self-storage sector faced a reset in early 2025, reports Trepp. Home sales—a key demand driver—fell more than 6% year-over-year through May. At the same time, a wave of new development expanded the national storage inventory by nearly 10% over the past three years. The FTSE NAREIT Equity Self Storage Index dropped 6.5% in 2024 as investor sentiment cooled.

Signs Of Stabilization

By mid-2025, market indicators showed a shift. New supply moderated to just 2.9% of existing inventory through May, and Public Storage lowered its annual supply growth forecast to 2.5%. Occupancy slipped slightly, but rents held steady. Infill markets in the Northeast and Mid-Atlantic performed better, with operators reporting stronger tenant retention and greater pricing power. In contrast, oversupplied Sunbelt metros faced mounting pressure on both rents and operating margins.

Capital Markets Reengage

With valuations stabilizing, transaction activity picked up. Newmark closed a $425M refinance for a 78-property portfolio owned by Centerbridge and Merit Hill Capital. The deal was supported by 18% NOI growth since 2023. The assets’ third-party management by Extra Space, CubeSmart, and Argus helped attract institutional lenders.

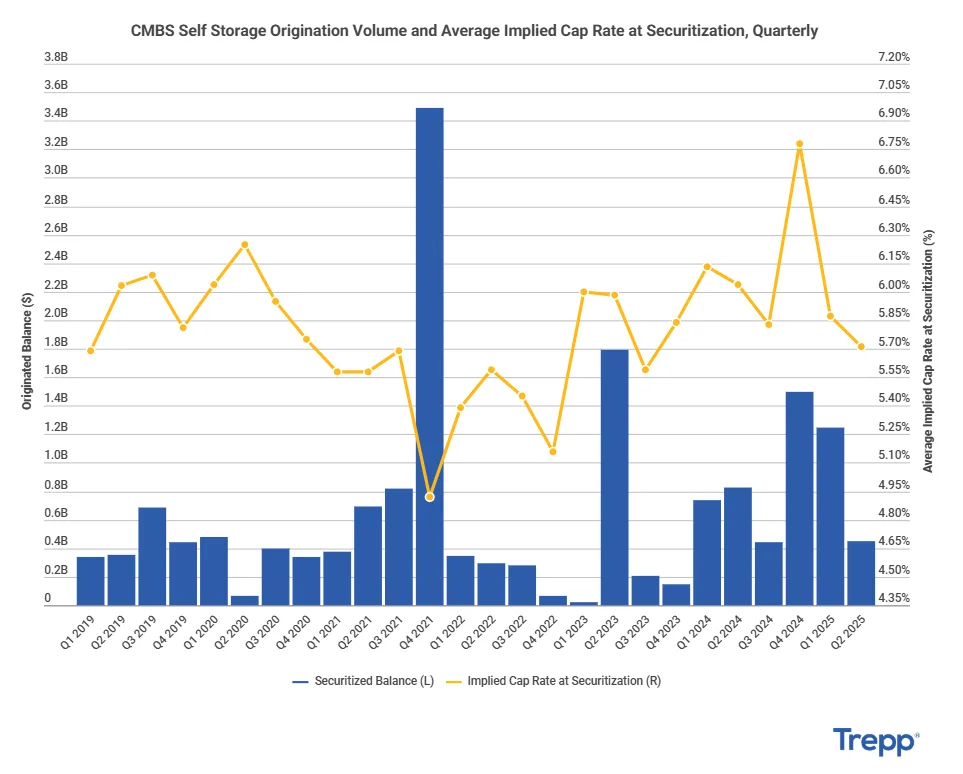

CMBS issuance also surged, with $2.7B in self-storage loans pricing in 2024—more than double the prior year. Cap rates widened to 6.2%, reflecting higher base rates and more conservative underwriting. Still, relatively tight spreads suggest investor confidence in self-storage’s income reliability.

Credit Fundamentals Hold Steady

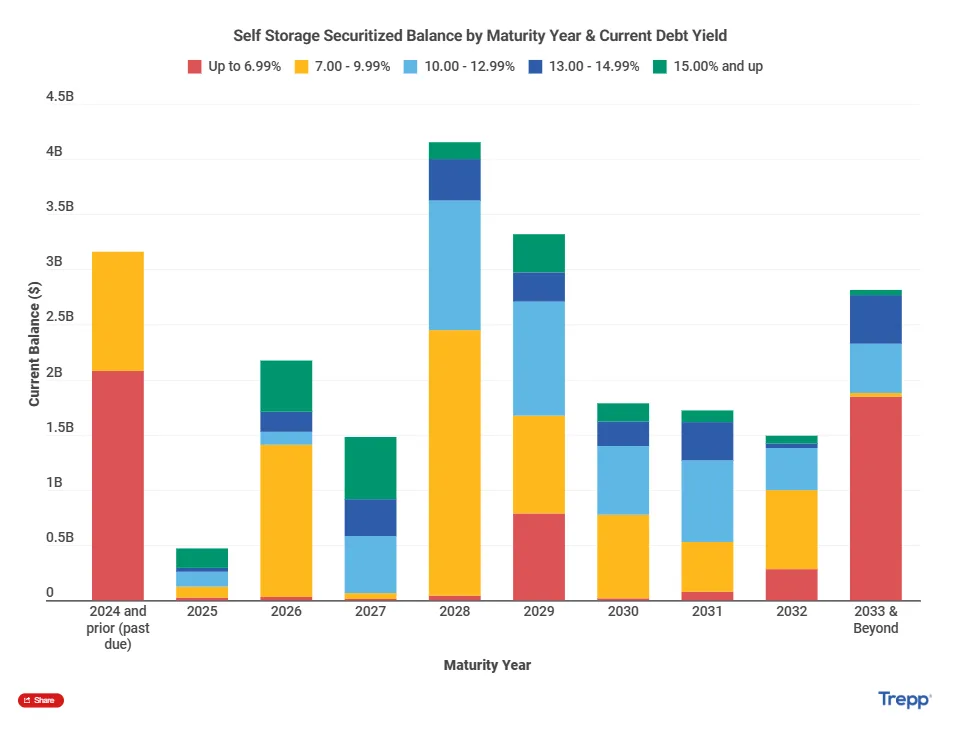

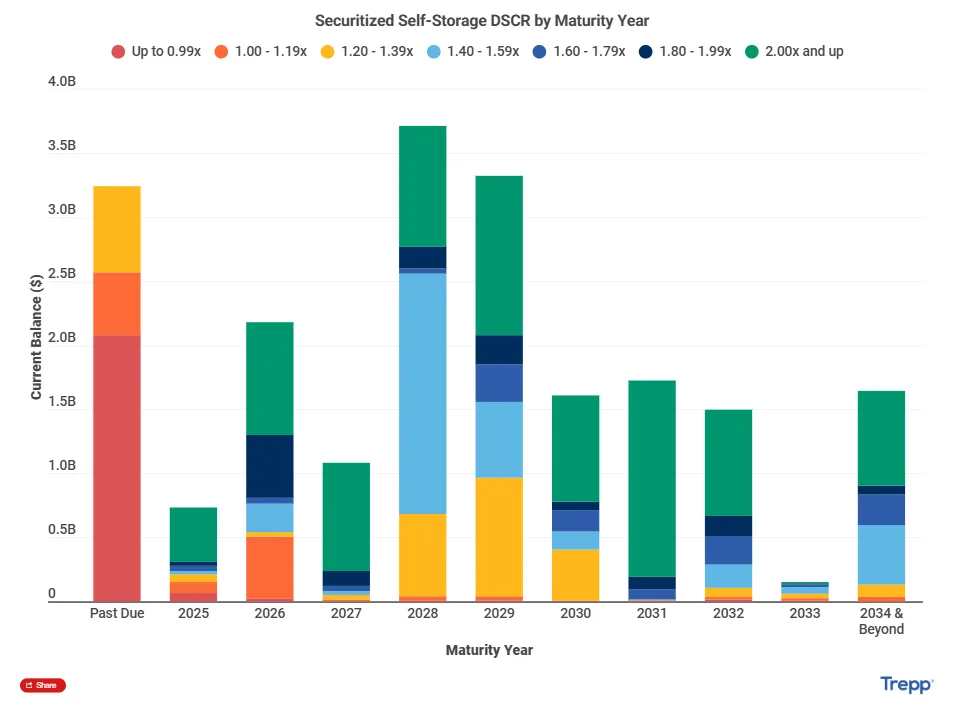

Credit performance remains strong. Delinquency in the $21.6B CMBS self-storage segment stands at just 0.28%, far below delinquency rates in multifamily or industrial. However, refinancing challenges loom. As NOI growth slows, underwriting standards tighten, and debt yields become a focal point.

Maturities in 2028—totaling $4.2B—are concentrated in the 7.00–9.99% debt yield range, where thinner equity buffers could face refinancing stress. Conversely, loans maturing in 2027 and those with yields above 10% appear better positioned to withstand rate pressure.

What To Watch

The sector’s near-term outlook hinges on two key factors: the pace of interest rate normalization and how efficiently new supply is absorbed. Stabilized assets in dense, high-barrier markets are best positioned to outperform. In contrast, newer deliveries in saturated regions may face valuation pressure.

Lenders and investors will need to assess risk across debt yields, maturity timelines, and geography. This will be essential not only for underwriting deals but also for timing capital allocation and managing liquidity in a shifting market.