- Self storage demand remains strong nationwide, with household usage reaching 12.6%, helping sustain occupancy amid sluggish home sales and migration patterns.

- Rent growth, particularly for climate-controlled units and REIT-operated properties, is rebounding, with national advertised rates rising 0.3% YoY—the highest growth since 2022.

- Construction pipelines are easing across most metros, though some markets like Tampa and New York are seeing renewed developer activity due to strong rate performance.

The self storage industry is entering a phase of stabilization, reports Yardi Matrix. Signs of recovery are emerging after an overheated development cycle and capital market slowdown. The September 2025 report, released after the Self Storage Association’s 50th anniversary conference in Las Vegas, details how the sector is adapting to a shifting economic and demand environment.

Demand Normalizes, Occupancy Holds

According to the debut of the 2025 Self Storage Demand Study, household usage has risen to 12.6%. This growth is supported by long-term tenants. It’s also driven by consumers prioritizing space amid stagnant housing turnover. This stickiness is helping stabilize occupancy, even in the absence of pandemic-era migration trends.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Rent Growth Returns—Led By REITs

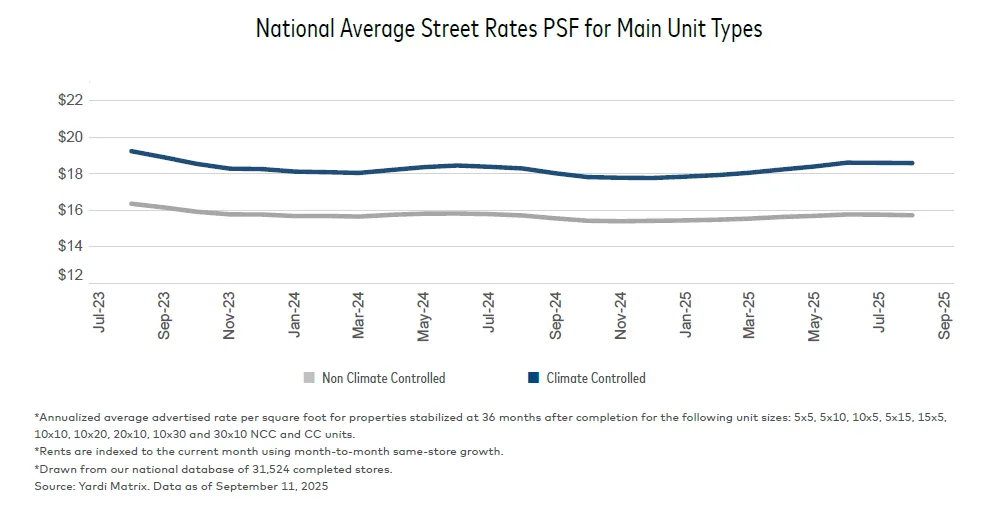

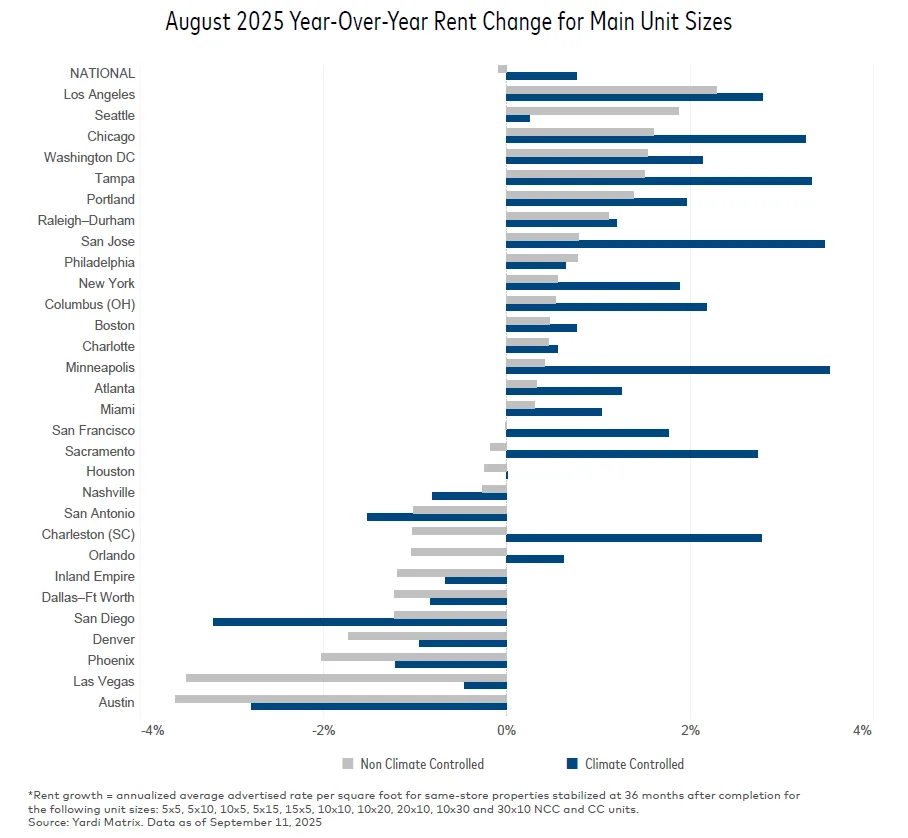

National advertised rates reached $16.91 PSF, a 0.3% year-over-year increase, improving from 0.1% in July. Climate-controlled (CC) units led the rebound with a 0.8% YoY gain, while non-climate-controlled (NCC) units saw a minor 0.1% YoY drop.

REITs outperformed the rest of the market: same-store rents at REIT-operated facilities were up 1.2% YoY, compared to a 0.2% decline at non-REIT counterparts. Markets like Los Angeles (+6.1%) exemplify this trend, where REITs are pushing rates aggressively.

Construction Slows, But Hot Markets Persist

The national construction pipeline contracted slightly, with 2.7% of inventory under construction—down from 3.4% a year ago. However, markets such as Tampa, New York, and Washington, DC saw increases in construction activity due to robust rent trends.

Still, some overbuilt markets are seeing rent compression. Austin, for example, posted a −3.3% YoY rent drop, the worst among top 30 metros, as demand softens and inventory grows.

Metro Highlights

- Tampa: Leading YoY rent growth at +2.5%, despite high new supply. Demand remains strong due to hurricane effects and active home sales.

- Chicago: Also saw +2.5% YoY growth, with broad gains across unit sizes.

- Los Angeles: Advertised rates grew 2.4%, driven by REITs; average rate now $30.13 PSF.

- New York: High-priced market with average rates at $35.59 PSF, modest 1.3% annual growth.

Meanwhile, Las Vegas (−2.2%), San Diego (−1.6%), and Phoenix (−1.7%) struggled due to oversupply and sluggish demand.

Why It Matters

With capital markets thawing and investor competition intensifying, the self storage industry appears positioned for a gradual but sustainable recovery. The combination of resilient demand and tempered new construction is shaping the market. REITs and climate-controlled units are also performing differently. Together, these factors are creating a more balanced environment than during the post-pandemic boom.

What’s Next

Markets will continue to diverge based on local demand and supply dynamics. Developers are becoming more selective, focusing on metros with strong fundamentals. With lease-up rates and absorption improving in key cities, the broader industry outlook is cautiously optimistic heading into 2026.