- Self storage markets in the South and Mountain West dominate, with 49 of the top 50 performing metros located in these regions.rn

- Boise, Coeur d’Alene, and Fayetteville top national rankings, driven by high demand, operational efficiency, and population growth.

- Large metros like Houston, Jacksonville, and Sacramento lead in scale, combining high rental income potential with investor activity.

- The sector remains resilient amid economic shifts, with a $237B national market value and growing interest in tech-driven, unmanned operations.

Demand Surges In Texas And Florida

The Southern US continues to dominate the self storage sector, claiming 34 of the top 50 markets nationwide, reports StorageCafe. Texas and Florida stand out, with cities like Houston, Jacksonville, and Corpus Christi posting strong metrics. Houston leads large metros with $74M in monthly rental income potential and 77M square feet of inventory.

In Florida, Jacksonville registers nearly $16.5M in potential monthly income, while Cape Coral–Fort Myers leads the nation in online interest, with 152 searches per 10K residents—a sign of deep market engagement. Smaller metros like Fayetteville, AR, and Daphne, AL are also drawing investment, driven by affordability and in-migration.

Idaho And Nevada On The Rise

The Mountain West continues to outperform, claiming 15 of the top 50 markets. Boise, ID tops the list, offering a rare blend of scale, rent stability, and operational efficiency. It brings in $10.2M in estimated monthly rental income and boasts self storage values above $1B.

Coeur d’Alene, ID leads in SF per capita and sees healthy demand despite significant new supply. Meanwhile, Reno, NV commands the highest average sales price per square foot among top performers—$188—signaling investor confidence.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

CA And NY Still Matter

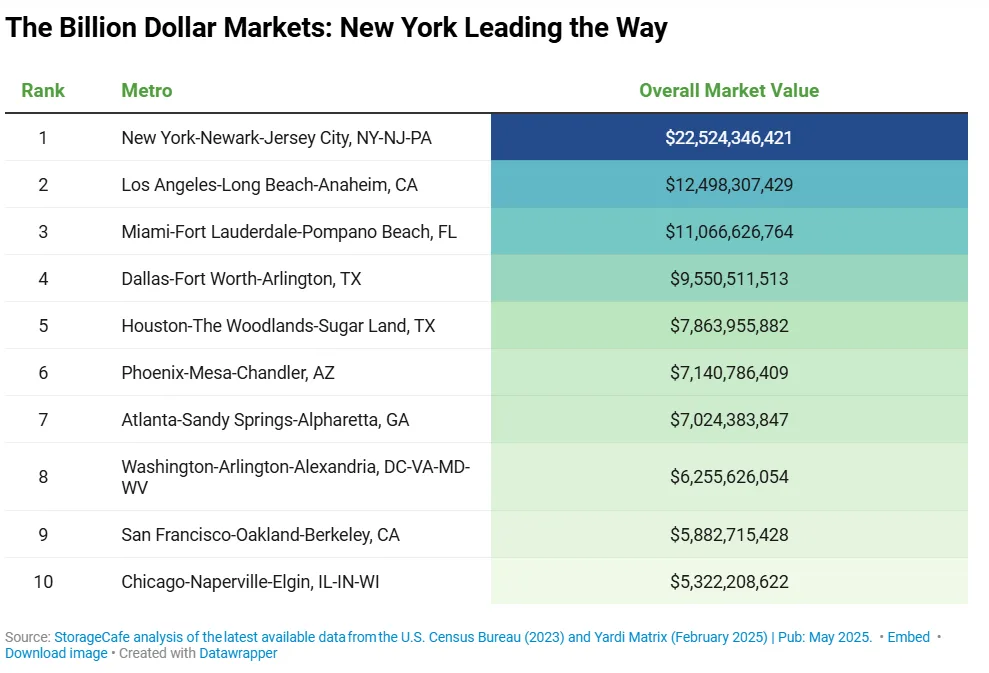

Despite fewer markets in the top 50, coastal metros remain high-value strongholds. New York City’s self storage market tops the nation in value at $22.5B, followed by Los Angeles ($12.5B) and Miami ($11B).

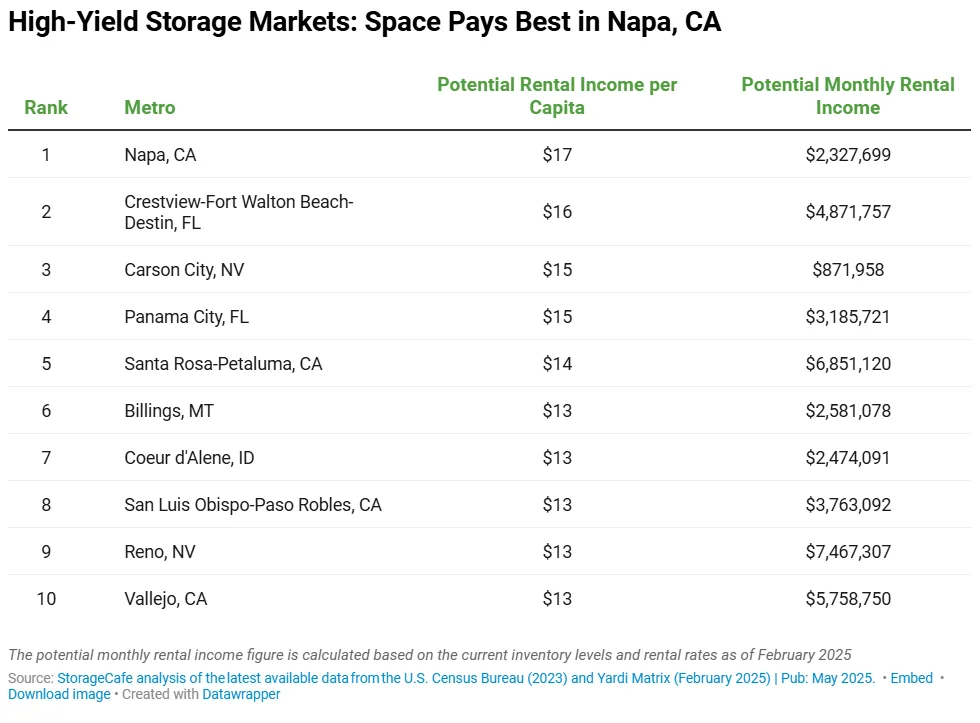

Napa, CA, although not a top-performing market overall, leads in rental income per capita at $17, driven by its affluent, space-constrained population. Sacramento, meanwhile, is an emerging Northern California hotspot, combining Bay Area outflow demand with relatively fewer regulatory hurdles.

Large Metros Still Lead In Scale And Liquidity

Among markets with populations over one million, Houston, Jacksonville, and Sacramento lead in performance. These metros pair size with strong economic fundamentals, capturing both institutional and retail investor interest.

Other top-10 large metros include:

- Virginia Beach, VA – consistent military-driven demand

- Dallas-Fort Worth, TX – high transaction volume and ongoing development

- Miami, FL – premium pricing and third-highest market value nationally

- Austin & San Antonio, TX – tech-driven demand and affordability

- Tampa, FL – lifestyle migration and strong income potential

- Atlanta, GA – $50M+ monthly rental income potential and high investor activity

The Sector’s Resilience And Evolution

Industry experts say the appeal of self storage lies in its recession-resistant cash flow and adaptability. Tom de Jong (Colliers) emphasizes the sector’s tech evolution—AI, automation, and pricing tools—as key to future competitiveness.

Eric Blum (BMSGRP) notes growing use of unmanned and digital-first facilities, while Doug Ressler (Yardi Matrix) sees continued growth in secondary and tertiary markets, particularly in the South and West, as urban decentralization takes hold.

Why It Matters

The US self storage sector is now valued at $237B and continues to evolve with demographic trends and investor expectations. As migration patterns shift and operating costs rise, markets with strong fundamentals and adaptive operators will continue to lead performance charts.

What’s Next

With construction moderating and technology adoption accelerating, expect the self storage sector to double down on performance optimization, particularly in high-growth secondary markets. The future will likely favor scalable, tech-enabled operations in regions attracting sustained in-migration and small business activity.