- Yardi Matrix raised its new supply forecast by 4.3% for 2025 and 4.6% for 2026 due to a larger-than-anticipated under-construction pipeline.

- Despite the short-term uplift, construction starts continue to decline from the 2023 peak, and the pipeline for future projects is contracting across planned and prospective phases.

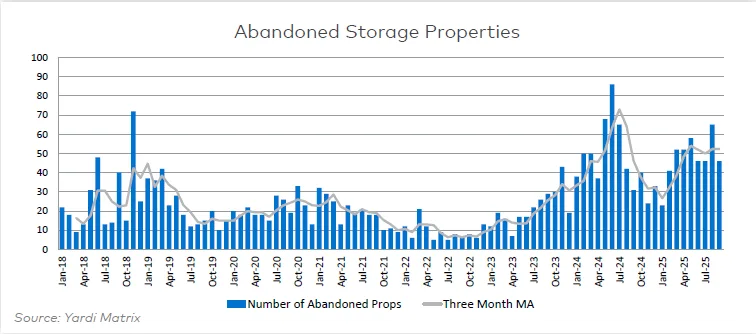

- A rise in abandoned and deferred projects suggests developers remain hesitant amid weak rental growth and NOI performance by self storage REITs.

Forecast Adjustments For 2025 And 2026

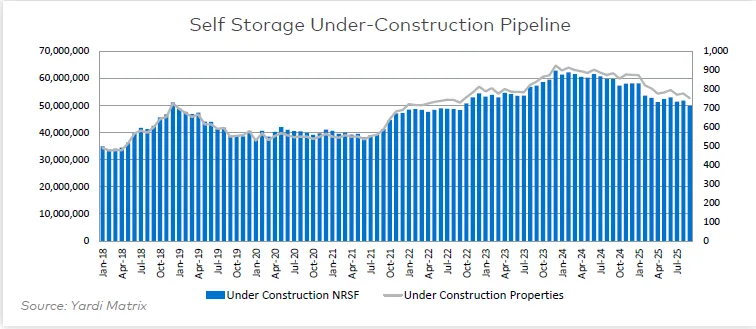

Yardi Matrix revised its self storage new supply forecast upward in Q4. The projection now stands at 59.4M NRSF for 2025 and 48.2M NRSF for 2026. These figures represent increases of 4.3% and 4.6%, respectively, compared to Q3 projections. This change stems from a larger-than-expected under-construction pipeline that should largely complete by the end of 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Construction Trends Signal Softening Momentum

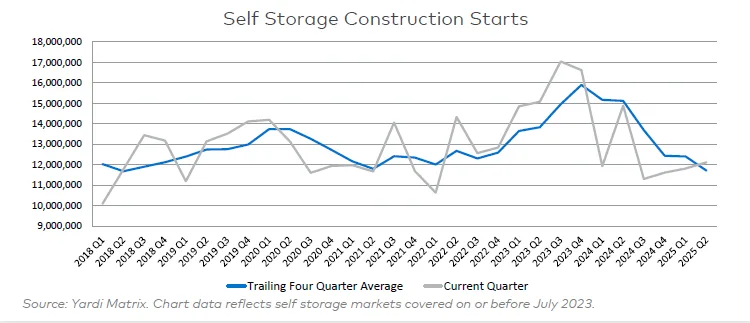

Although Q3 saw a modest 2.6% quarter-over-quarter increase in construction starts, the overall trend remains negative. Construction activity is down 21% from its peak. Additionally, 2025 year-to-date starts are lagging behind the pace set in 2024. Days in construction now average 410 days, up slightly from the previous quarter.

Weakening Future Pipeline

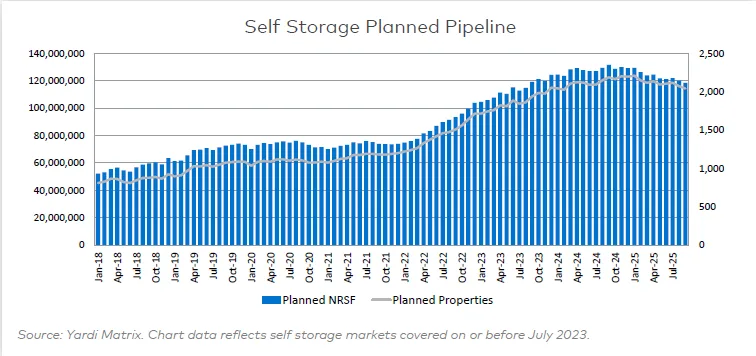

- Planned pipeline: Down 10.3% YoY to 118.4M NRSF, with a slower decline rate than under-construction inventory.

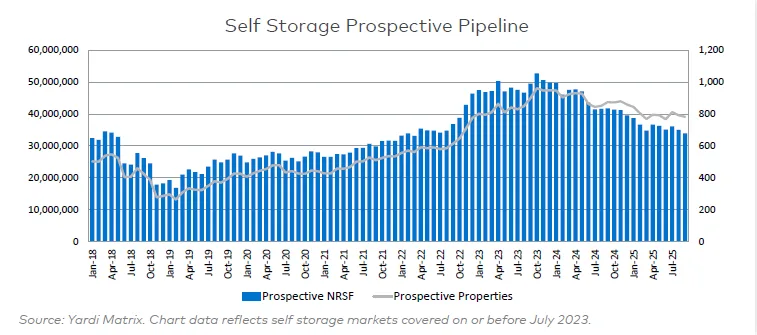

- Prospective pipeline: Down 18.8% YoY and 35.6% from its 2023 peak, indicating reduced appetite for longer-term development.

- Deferred projects: Up 33.3% YoY, suggesting more developers are putting projects on hold due to market uncertainty.

- Abandoned projects: Average of 52 per month, up sharply from just 7 per month in mid-2022.

What’s Driving The Caution?

Rental rate growth turned positive in September for the first time in three years. Still, overbuilding in 2023 and 2024 has kept pressure on occupancy and rates. Public self storage REITs have posted negative net operating income growth from late 2023 through mid-2025, dampening developer confidence.

What’s Next?

Yardi expects new supply to taper off to 1.5% of stock annually in the coming years unless rate growth accelerates and monetary policy loosens. If rental rates recover meaningfully, future forecasts could shift upward.

Bottom Line

While the near-term forecast has been revised higher, the self storage development cycle is shifting. It appears to be entering a more cautious, demand-driven phase. Developers are reacting to economic uncertainty, elevated supply, and soft operating fundamentals.