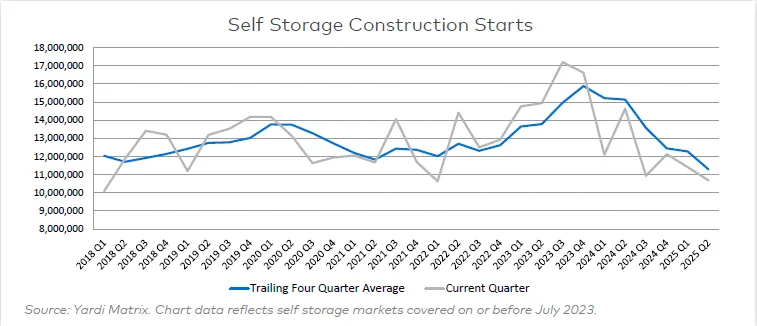

- Construction starts in 2025 are down 12.8% compared to mid-year 2024, continuing a downward trend in self storage development.

- Yardi forecasts new supply will decline to 46.1M SF in 2026 and further to 42M SF in 2027.

- The planned and prospective pipelines continue to shrink, while deferred and abandoned projects are rising, indicating long-term developer caution.

A Cooling Sector

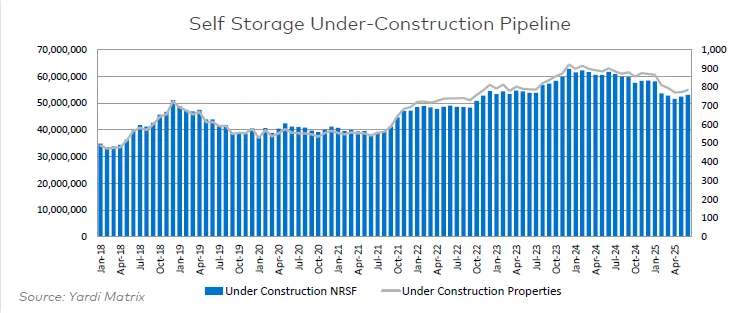

The self storage sector’s construction pipeline is cooling further in Q3 2025, reports Yardi Matrix. New development activity hit peak levels in late 2023 and early 2024. Since then, it has slowed notably due to a combination of high interest rates, weak demand, and sliding rental growth.

According to Yardi, the total new supply forecast for 2026 is 46.1M net rentable SF (NRSF), falling to 42M NRSF by 2027. That’s a significant drop from the 57M NRSF expected in 2025.

Construction Starts Fall Again

Construction starts identified through mid-2025 totaled 22.1M NRSF—down 12.8% from the same period in 2024. This follows a 22% year-over-year drop in full-year 2024 starts compared to 2023, reinforcing that the slowdown is systemic.

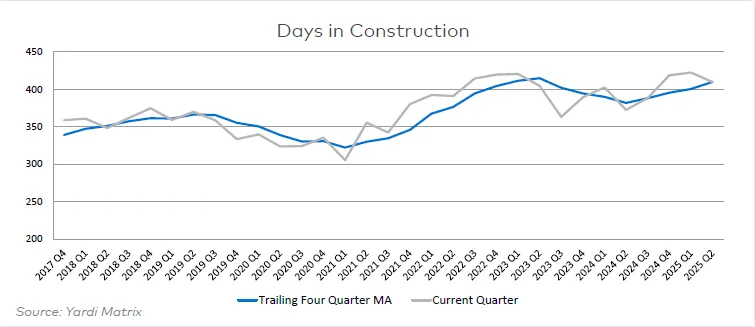

The average time to complete a project remains lengthy, with Q2 completions taking an average of 410 days—over 13 months—for the fourth straight quarter.

Pipeline Contractions Across The Board

- Planned pipeline: Fell to 123.4M NRSF at the end of Q2, down 4.6% YoY and 1.8% QoQ.

- Prospective pipeline: Declined 22% YoY to 34.3M NRSF.

- Deferred projects: Jumped nearly 30% QoQ to 6M NRSF.

- Abandoned projects: Although slightly down in June, the rate remains well above historical norms, with 46 projects categorized as abandoned that month.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Long-Term Outlook

The long-term supply outlook has also dimmed. With rental rates flat and REIT-reported net operating income growth negative or minimal, developer appetite has cooled. Yardi expects future annual supply additions to stabilize around 1.5% of existing stock, down from post-pandemic highs.

Why It Matters

The pullback reflects a more mature self storage sector facing macroeconomic pressures and limited demand growth. Developers are increasingly cautious, and the data suggests this trend is likely to persist into the next several years unless new demand drivers emerge.

What’s Next

Expect continued moderation in construction activity as developers assess economic risks and market saturation. Yardi’s outlook for 2026 and beyond suggests the days of rapid self storage expansion may be over—at least for now.