- Self storage sales reached $855M in Q1 2025, up 37% year-over-year.

- Over 12M SF of space sold, with prices PSF rising 31%.

- Undersupplied markets like Davie, FL, and Seattle, WA, drove top transactions.

- West Coast cities led in pricing, with Costa Mesa hitting $387 PSF.

Strong Start To The Year

The self storage sector is off to a robust start in 2025, reports StorageCafe. Nationwide, Q1 transaction volume reached $855M, a 37% increase from the same period last year. Over 12.5M SF of storage space traded hands, as investors zeroed in on suburban and secondary markets where supply remains limited and demand steady.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Spotlight Cities

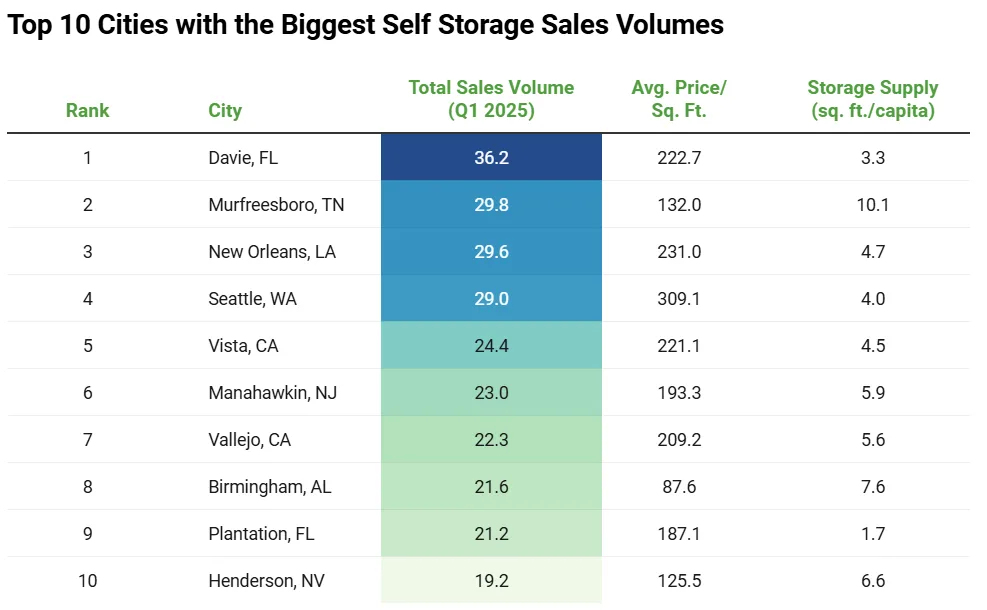

Investor appetite continues to favor fast-growing markets with limited existing self storage inventory. Davie, FL, topped the list with a $36M sale, followed closely by Murfreesboro, TN ($29.8M), New Orleans, LA ($29.6M), and Seattle, WA ($29M). In each of these metros, population growth and space constraints are driving demand — and prices.

- Plantation, FL, saw $21M in sales despite offering just 1.7 SF of storage per capita, underscoring its status as one of the nation’s most undersupplied markets.

- New Orleans and Seattle remain attractive infill targets, combining high population density with tight supply — under 5 SF per capita — to command premium prices and rents.

West Coast Dominates Price PSF

The West Coast posted the highest per-square-foot valuations, led by:

- Costa Mesa, CA – $387 PSF.

- Seattle, WA – $309 PSF.

- Vista, CA – $221 PSF.

- Vallejo, CA – $209 PSF.

These elevated prices reflect strong demand, limited developable land, and high construction costs, which continue to suppress new supply.

Strategic Shift Toward Undersupplied Markets

As developers face headwinds from rising rates and construction costs, investors are increasingly prioritizing acquisition of self storage over new builds. Markets with low per capita storage availability and growing populations — like Brookline, MA (0.1 SF), Byram, NJ (2.7 SF), and Liverpool, NY (4.6 SF) — offer attractive pricing power and long-term upside.

Storage Market Resilience Amid Selective Growth

While the rapid expansion of 2020–2021 has tapered, the current cycle favors measured growth and data-driven plays. Self storage remains a high-occupancy, income-producing asset class, supported by downsizing baby boomers, transient renters, and growing urban populations.

Expect more capital to chase limited inventory in high-barrier, high-demand submarkets. Investors are seeking recession-resistant returns amid an uncertain macroeconomic environment.