When it comes to value-add business plans, one key question often lingers in the minds of investors: Is there enough Return on Investment (ROI) in renovating a unit?

The ROI will allow you to determine if the renovation dollars make financial sense based on the rent premium you are expecting post renovation.

So if you could achieve a $500 rent premium on an apartment unit, but you had to spend $20,000 to get it, does this make financial sense? This blog will help you determine the answer.

What is ROI?

ROI stands for Return on Investment. Fancy phrase, simple idea: What do I get back for what I put in?

Commercial real estate investing is a business. Simply stated, if investors spend capital on their property, most investors will want to see additional yield as a result.

Most commercial real estate investors are striving to earn at least a 25% – 35% return on investment. Meaning if $10,000 was spent, the investor would like to earn an additional $3,000 back in income every year as a result.

If the property is not able to generate a sufficient ROI, based on the planned renovation cost, it may not make financial sense to spend that much capital on the project.

Description of the Calculator

So, what exactly does this ROI calculator do?

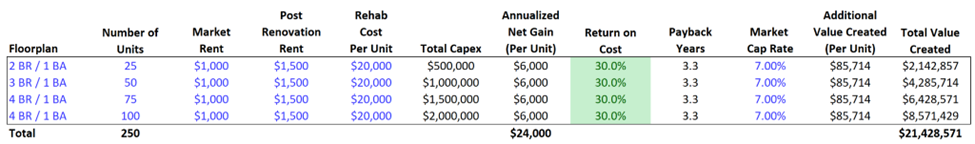

This ROI calculator will help you determine if there is sufficient value created, based on the amount of capex you plan to spend on unit renovations.

Here are some top reasons to use the CRE Daily ROI calculator:

- Evaluate Risk – The calculator’s projections show if returns could fall short, helping you avoid excess risk.

- Maximize Profits – Understanding the numbers helps target spending where it can drive the highest gains.

- Inform Strategy – Crunching different scenarios reveals the best options to optimize revenues.

Follow these steps to calculate the ROI on your next project:

- Enter the floorplan(s) of the project.

- Enter the number of units being renovated.

- Input the market rent and post renovation rent.

- Determine and enter the renovation cost per unit.

- Determine and input the market cap rate.

Breakdown of Key Terms

Market Rent

The “Market Rent” represents the current rental rate charged per unit, given the property’s existing condition and offerings.

It provides a critical baseline context, establishing what buyers in that area are willing to pay now for an apartment before renovations or upgrades. The market rent accounts for factors like location, size, layout, amenities provided, age, and general condition.

Understanding the as-is value is crucial. It offers perspective on whether planned upgrades could drive substantially higher rents – the fuel for your return on investment.

For example:

Current monthly rent per 1-bedroom unit: $1,000

This means tenants are presently paying $1,000 per month for units prior to remodeling. We’ll compare this benchmark to projected rents to estimate potential gains from cosmetic and structural improvements.

Post-Renovation Rent

The “Post-Renovation Rent” reflects the amount tenants would pay after renovations and upgrades are completed to the unit.

This projected figure is pivotal in the ROI equation – representing potential income generation. Compare it to current rents and rehab costs to analyze if returns warrant the investment spend.

For example:

Expected monthly rent post-renovations: $1,300

Here, the investor believes the upgraded 1-bedroom units can command $1,300 per month after completing kitchen, bath, and amenity upgrades. This $300 increment over the current $1,000 rent is the source of monetary returns on the $15,000 rehab spend.

Rehab Cost Per Unit

The “Rehab Cost Per Unit” captures the total expenses for remodeling an individual apartment. This includes cosmetic refreshes along with structural and operational upgrades.

Knowing per unit costs is instrumental in determining if returns warrant the spend.

You can establish renovation expense limits and targets to avoid overinvesting. Compare possible added rental income versus rehab costs to see if the juice is worth the squeeze.

For example:

Projected upgrade costs per 1-bedroom unit: $15,000

In this case, the investor anticipates spending $15,000 to renovate each 1-bedroom apartment. This includes new kitchen cabinets, subway tile backsplash, vinyl plank flooring, and bathroom upgrades.

Annualized Net Gain

The “Annualized Net Gain” represents the total boost in rental income per unit per year after covering renovation costs. This profit increment demonstrates the monetary payoff from upgrades.

For example:

Monthly rent increase per upgraded unit: $1,300 – $1,000 = $300

Annual rental income rise per unit: $300 * 12 = $3,600

Here, the $300 monthly rental lift per unit equals $3,600 additional income yearly. This net gain helps offset the $15,000 rehab cost through elevated rents. Evaluating over one year or multiple years shows profitability.

Return on Cost

The “Return on Cost” conveys the annual ROI percentage from a renovation, weighing gains against total spending. This measure of efficiency helps benchmark performance across opportunities.

The formula factors annual net income from upgraded rents and divides it by the per-unit renovation investment. The output percentage becomes an investor’s total yield (per year).

Strong returns signal a worthy rehab, while lower numbers may necessitate adjustments.

For example:

Annual rental income increase per unit: $3,600

Rehab cost per unit: $20,000

Annual ROI percentage: ($3,600 / $20,000) x 100 = 18%

Here, the $3,600 yearly net gain from higher rents represents an 18% 12-month ROI on the $20,000 renovation cost. An investor can evaluate if this efficiency fits their goals.

Payback Years

The “Payback Years” refers to the number of years required to recoup renovation costs through elevated rental income. It conveys the breakeven point for an investment to offset spend.

Faster payback periods signal lower risk and quicker profit generation.

The formula divides per unit rehab expense by the annual rental gains per unit. The output years become the recovery timeframe – when gains surpass costs.

For example:

Rehab cost per unit: $20,000

Annual rental income rise per unit: $3,600

Payback period per unit: $20,000 / $3,600 = 5.56 years

Here, it would take 5.56 years for the $3,600 yearly incremental rents to accumulate enough to offset the $20,000 renovation expense through higher incomes.

Market Cap Rate

The “Market Cap Rate” is used for valuation purposes.

Cap rates can be determined from appraisers, local brokers, and sale comps.

The annualized net gain is divided by the market cap rate to determine the dollar amount of additional value being created.

Value Created Per Unit

The “Value Created Per Unit” represents the additional yield created from each unit upgrade. This quantifies added value from the renovations completed.

For example:

- Cap Rate: 7.0%

- Annualized Net Gain: $6,000

Additional Value Created = Annualized Net Gain / Market Cap Rate

$6,000 / 7.0% = $85,714

The upgraded unit is able to generate an additional $6,000 in income per year. At a 7.0% cap rate, this equates to an additional $85,714 in property value.

Conclusion

At the end of the day, calculating ROI boils down to one key question – will this renovation pay off? Accurately answering requires number crunching.

The CRE Daily ROI calculator makes forecasting profits simple. Input your assumptions for rent and capex cost to calculate the return on investment. Now, determine if the risk-reward tradeoff works in your favor.

While using this ROI calculator, you can confidently pursue lucrative renovations and avoid potential money pits.

So, let’s start calculating! Crunch the numbers on your next multifamily renovation project.