- Retail valuations rose across the US, Canada, and Europe in Q1 2025, led by super-regional malls and retail warehouses.

- Investors continue to favor necessity-based retail for its stability amid economic and policy uncertainty.

- New US tariffs are creating caution in the market, impacting investor and tenant decision-making.

- While fundamentals remain strong, the global retail outlook is clouded by inflation and shifting consumer sentiment.

Retail Resilience Faces New Test

Retail real estate valuations across North America and Europe continued to recover in early 2025, building on momentum from late 2024, reports Altus Group. But optimism is starting to waver as newly introduced US tariffs inject fresh uncertainty into the global economic outlook.

Altus Group data indicates that retail, which had already endured disruptions from e-commerce, the pandemic, and interest rate volatility, is now entering a more hesitant phase. “The fundamentals are generally good, but the near-term uncertainty is creating a headwind that makes everyone pause,” said Robby Tandjung, EVP of Valuation Advisory at Altus Group.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

United States: Strength In Super-Regionals And Necessity Retail

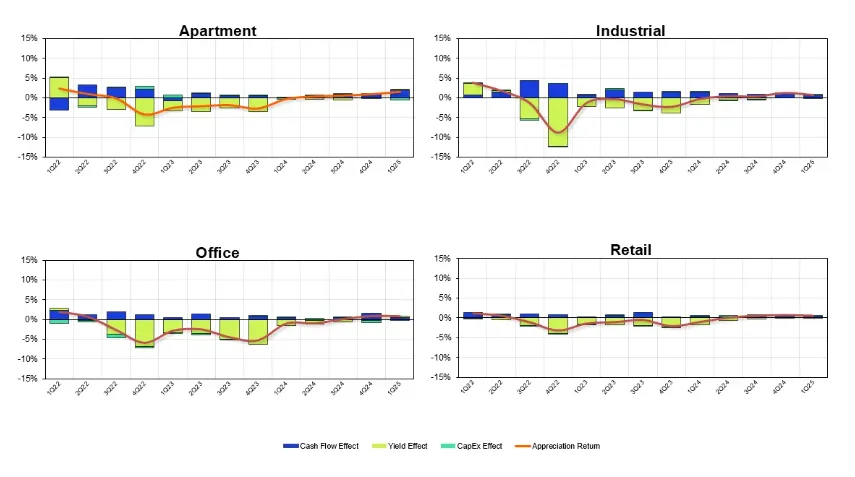

The US market led in valuation momentum this quarter. Super-regional malls posted a 5.5% YoY increase in value, powered by rebounding foot traffic, strong consumer spending, and higher lease renewal rates. Overall, US retail appreciation returns remained positive at 0.6% for Q1, continuing the upward trend from late 2024.

Grocery-anchored centers and power centers remained investor favorites, offering stability amid macro volatility. COVID-era leases expiring at below-market rates are also giving landlords an earnings bump as new leases are signed at higher rents.

Canada: Recovery Continues, But Challenges Remain

Canadian retail values rose 4.1% YoY in Q1 and 0.74% quarter-over-quarter. While still down 9.3% from pre-pandemic levels, retail is outperforming other asset classes. The exit of weaker tenants and roll-off of COVID-impacted leases is supporting rent growth and improving occupancy.

The high-profile liquidation of Hudson’s Bay added fresh volatility, with six store closures returning an estimated 2% of national retail space to the market. While some see redevelopment potential, others warn it may take significant investment to realize.

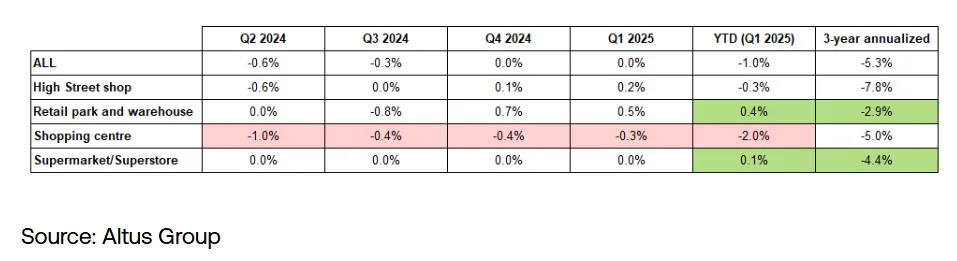

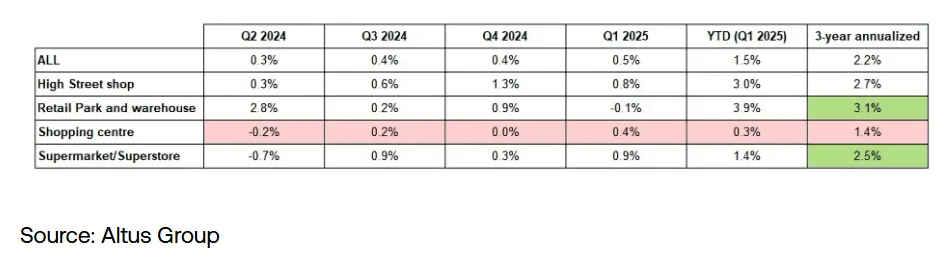

Europe: Retail Warehouses Lead, Shopping Centres Lag

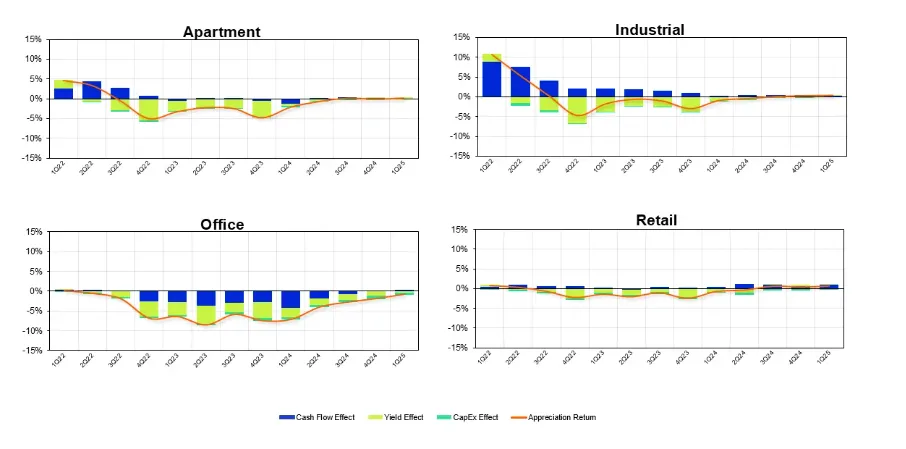

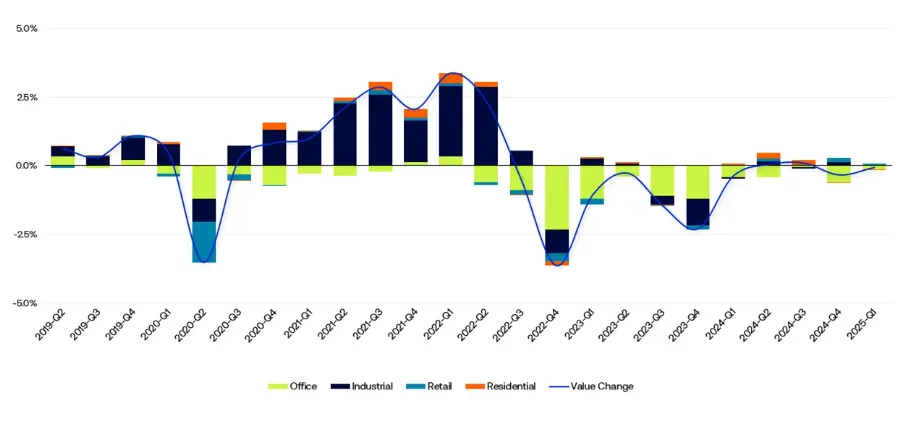

European retail valuations rose a modest 0.5% over Q4 2024. Retail warehouses led the charge, supported by a 4% increase in market rents. Supermarkets and high-street assets also posted modest gains, while shopping centers continued to struggle with rising yields and muted cash flows.

Europe yield impact by retail sub-sector

Europe cash flow impact by retail sub-sector

“Europe has the fundamentals in place but isn’t rebounding as fast as the US,” said Phil Tily, SVP of Performance Analytics at Altus. “Retail here didn’t correct as deeply but is also taking longer to regain full momentum.”

Defensive Plays Dominate Amid Uncertainty

Across all markets, necessity-based retail remains the top choice for investors. Food-anchored centers, pharmacies, and discount-oriented big-box stores have outperformed due to their reliable foot traffic and stable cash flow.

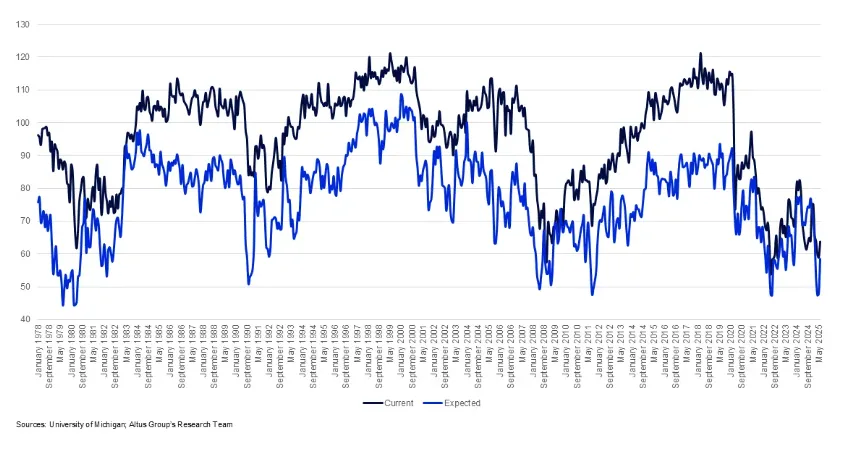

Yet, uncertainty stemming from new US tariffs is causing hesitation. While consumers have increased short-term spending in anticipation of price hikes, longer-term impacts on sentiment, inflation, and purchasing behavior remain unclear. US consumer sentiment saw its first uptick in six months in June but remains historically low.

What’s Next?

The trajectory for retail real estate remains broadly positive, but global investors are entering a more cautious phase. With tariffs in flux and consumer behavior at risk of cooling, many are in wait-and-see mode.

“The fundamentals are there, but when people don’t know what the rules are, it makes it difficult to plan,” Tandjung noted. “There’s more risk of executing today, and people are generally waiting for more clarity. There is no penalty for waiting.”

Bottom Line

Retail real estate is showing resilience and sector-wide stabilization, particularly in defensive formats. But growing trade policy risk has tempered optimism. As investors navigate tariff uncertainty, expect a continued focus on low-volatility assets and strategic repositioning in select markets.