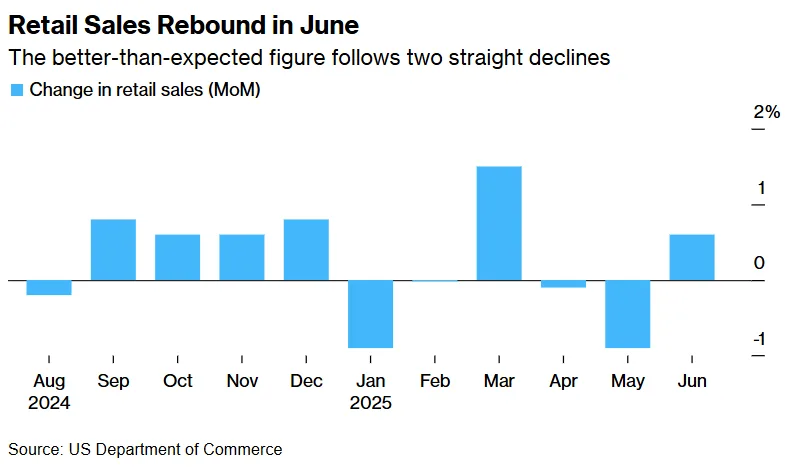

- Retail sales climbed 0.6% in June, beating nearly all forecasts and ending a two-month decline.

- Gains were broad-based, with 10 of 13 categories rising, including a surprising jump in auto sales.

- Control group sales, key for GDP, rose 0.5%, showing solid consumer spending momentum.

- Consumer sentiment remains resilient despite ongoing concerns over tariffs and inflation.

Retail Sales Outpace Expectations

US retail sales increased 0.6% in June, far outpacing the +0.1% estimate from their economist survey, reports Bloomberg. The gain marked a return to growth after two consecutive monthly declines. Excluding autos, sales rose 0.5%, while the “control group” — a narrower category used in GDP calculations — also advanced 0.5%.

The June rebound suggests consumers are still spending steadily despite elevated prices and mixed economic signals. Retail purchases, which reflect roughly one-third of overall consumer outlays, are reported in nominal terms and do not adjust for inflation.

Surprise Strength In Vehicle Sales

Notably, motor vehicle sales rose in June after consecutive drops, defying expectations. This came even as administrative data indicated a decline in car purchases and recent inflation readings showed falling new and used vehicle prices.

Alongside autos, sectors like restaurants and bars (+0.6%) also saw healthy gains, while just three out of 13 categories registered a monthly decline.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Resilience Amid Tariff Fears

Consumer sentiment has been under pressure in recent months, as tariffs threaten to raise costs on everyday goods. Yet spending appears to be holding firm. Heather Long, chief economist at Navy Federal Credit Union, said, “There’s still a lot of trepidation about tariffs and likely price hikes, but consumers are willing to buy if they feel they can get a good deal.”

President Trump’s shifting stance on tariffs — including renewed threats on key imports — is a looming risk for the second half of the year. Products like toys and appliances, which are exposed to those duties, saw noticeable price increases in the latest inflation data.

Implications For the Fed

The Federal Reserve is closely monitoring whether tariff-related price hikes will be temporary or more sustained. Policymakers are expected to hold rates steady at their next meeting, pending further inflation and consumer spending data.

Thursday’s release of jobless claims showed filings fell to the lowest level since April. The data further suggests labor market resilience, supporting continued consumer demand.

What’s Next

June’s inflation-adjusted spending figures and broader GDP data will offer a fuller picture of the economy’s trajectory later this month. For now, the strong showing in retail sales underscores the enduring role of the consumer in powering US growth.