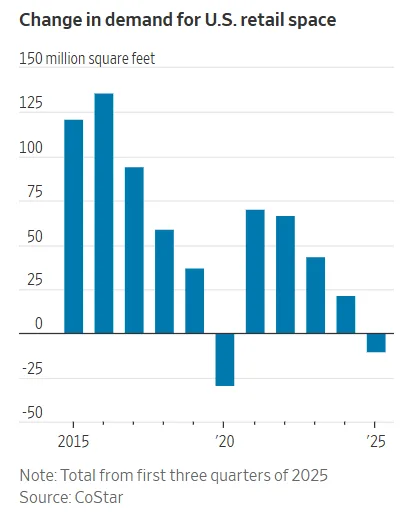

- Retailers occupied 5.5M SF feet than they vacated in Q3 2025, reversing the negative demand trend seen earlier in the year.

- Discount and value-focused retailers—such as Dollar Tree, Aldi, and Tractor Supply—are driving demand for space, especially in previously vacated locations.

- The national retail vacancy rate stands at 4.3%, with construction levels historically low and online sales accounting for 16% of total retail sales in 2024.

- Retail rent growth is slowing, but demand remains solid, especially from chains targeting middle- and lower-income shoppers.

Retailers Reoccupy Vacant Space

After a slow start to 2025 with bankruptcies and weak demand, retailers rebounded strongly in the third quarter, reports WSJ. According to CoStar, tenants absorbed 5.5M more SF than they vacated—a sharp contrast to earlier quarters when closures outpaced openings.

The retail vacancy rate remained tight at 4.3%, thanks in part to minimal new construction. With few new builds in the pipeline, expanding retailers are increasingly snapping up second-generation space left behind by struggling brands.

Discount Retailers Lead The Charge

Bankruptcies from major chains like Big Lots, Rite Aid, Joann, and Party City have left thousands of stores empty across the US. But discounters have moved in swiftly.

Tractor Supply, for instance, plans to open 90 stores in 2025 and ramp up to 100 annually by 2026, many in former Big Lots locations. Dollar Tree recently took over 15 former Joann stores. Aldi, Burlington, and 7-Eleven are also actively growing footprints.

These brands are capitalizing on demand from value-conscious shoppers and rural market growth, helping landlords fill vacancies quicker than expected.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Adapting To Tariffs And Headwinds

Chains like Tractor Supply are also adapting to new tariff environments—roughly 40% of its inventory is affected. Instead of slowing growth, the company is negotiating vendor pricing and passing some costs on to consumers.

Retail landlords are benefiting from this aggressive expansion. In Woodbridge, N.J., Urban Edge replaced two shuttered Bed Bath & Beyond stores with Trader Joe’s and Ross. Those new anchors are expected to increase foot traffic and attract more tenants.

Rent Growth Slows

Despite a relatively strong Q3, overall retail rent growth is decelerating. Online sales rose to 16% of total retail sales in 2024, and inflation-adjusted retail sales have remained flat for the past four years.

According to CoStar, rent levels are stable, but landlords have less justification to hike rates. Rising tariffs and persistent consumer pessimism could further soften retail fundamentals in 2026, particularly among mom-and-pop retailers.

Small spaces under 5K SF—often occupied by independent restaurants and service providers—are seeing an uptick in closures.

Cautious Optimism For 2026

While 2025 may close out with a net decline in occupied space, analysts expect this to be temporary. CoStar forecasts a return to net positive absorption in 2026, with retailers projected to occupy 4.7M more SF per quarter.

For now, continued consumer spending—especially among the employed and affluent—is buoying retail real estate. If that holds, the trend of discount-led expansion into vacated space may continue well into next year.