- Retail openings in the US are set to rise by 4.4% in 2026, led by value-focused chains.

- Projected store closures fall to about 7,900, the lowest level in three years.

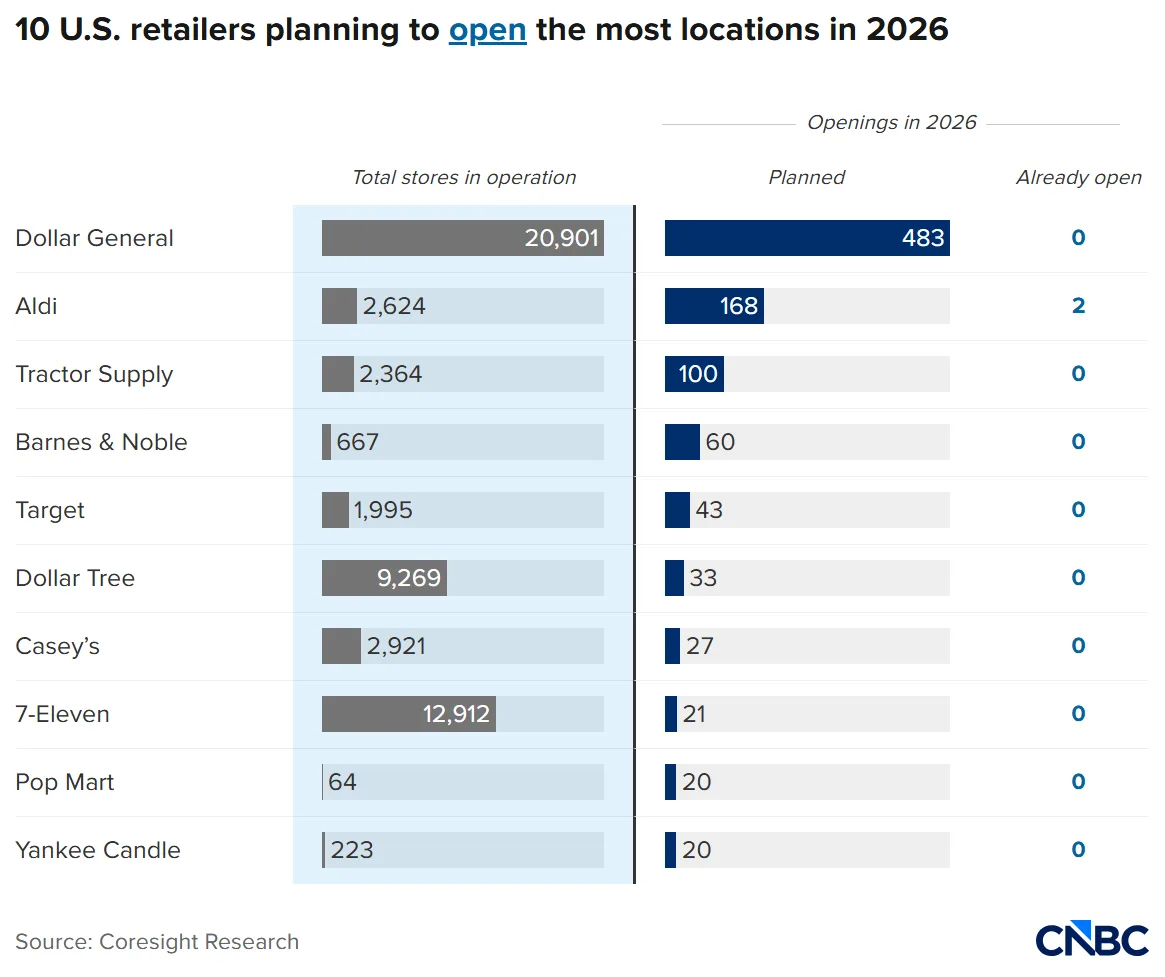

- Dollar General, Aldi, and Tractor Supply plan the most new store openings in 2026.

- Rising demand for retail space may drive new strip mall development as supply tightens.

Value Retailers Drive New Openings

CNBC reports that the US retail landscape is seeing a shift in 2026 as store openings outpace closures, according to Coresight Research. Value retailers like Dollar General, Aldi, and Tractor Supply are leading the surge in retail openings, catering to cost-conscious consumers and expanding their national footprint. Coresight estimates US retailers will open about 5,500 new locations, a 4.4% increase year over year.

Closures Drop Amid Improved Retail Health

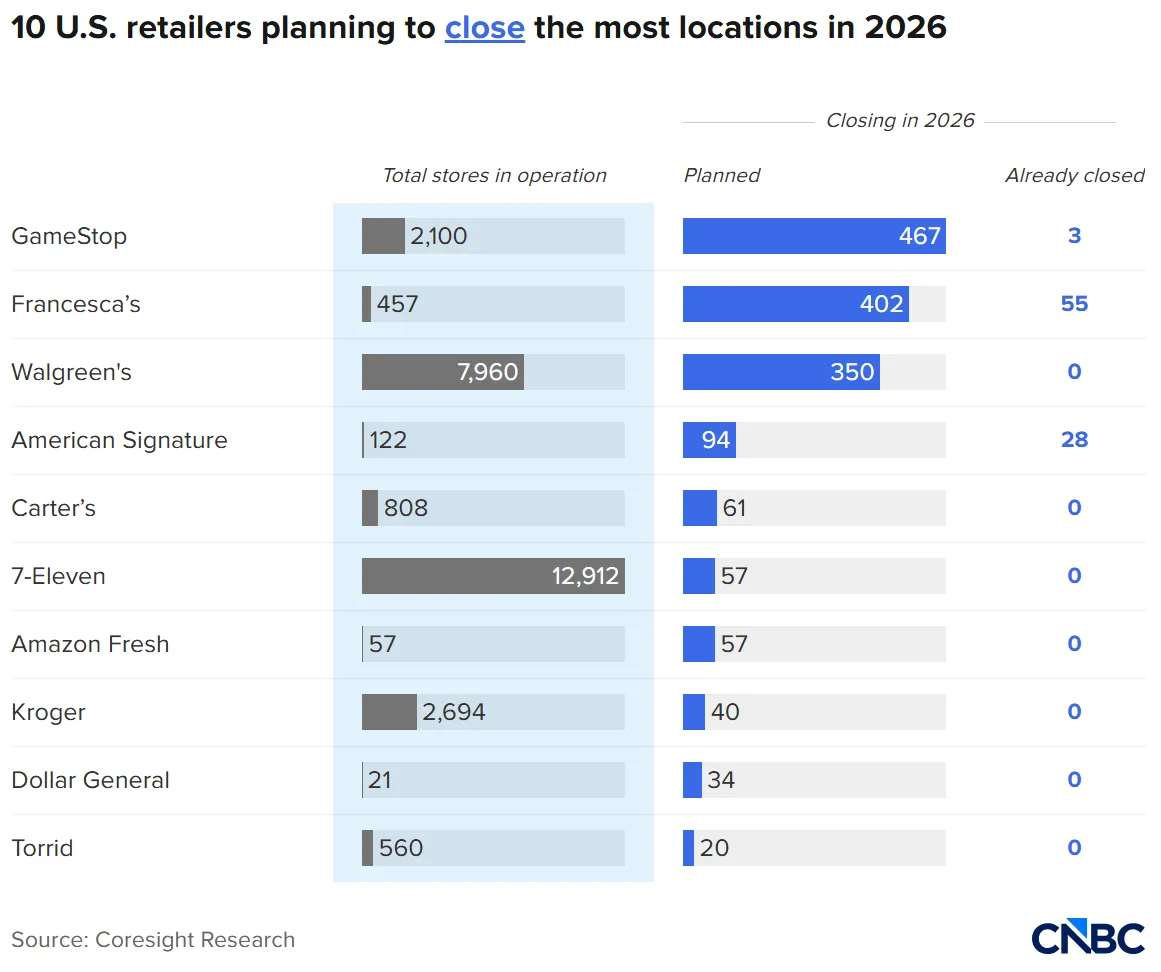

Store closures are expected to fall to about 7,900 in 2026, marking the lowest point in three years and a 4.5% drop from 2025. This decline follows several years of elevated bankruptcy activity, with the number of closures now returning to pre-pandemic levels. GameStop, Francesca’s, and Walgreens account for the most planned closures in 2026, while major bankruptcies are expected to slow.

Retail Space Becomes Scarcer

Retail demand is tightening as openings rise and closures fall. Value retailers quickly secured leases last year when bankruptcies freed up space. Chains like Bed Bath & Beyond and Joann left vacancies that others moved fast to fill. Aldi, one of the most aggressive expanders, has committed to opening 180 US stores in 2026, increasing pressure on available square footage. Now that supply is dwindling, developers and landlords see fresh chances to build or revamp strip malls. These projects could accelerate if construction and borrowing costs level out in the near future.

Experiential Trends and Competition for Space

Not only are value retailers seeking retail openings, but space is also in demand from fitness and food & beverage chains. The competition is pushing landlords to transform shopping centers, swapping out underperforming tenants for brands that drive more traffic. Meanwhile, retailers continue to explore ways physical stores can add value, such as offering convenience, immediate fulfillment, and experiential features that complement e-commerce platforms.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes