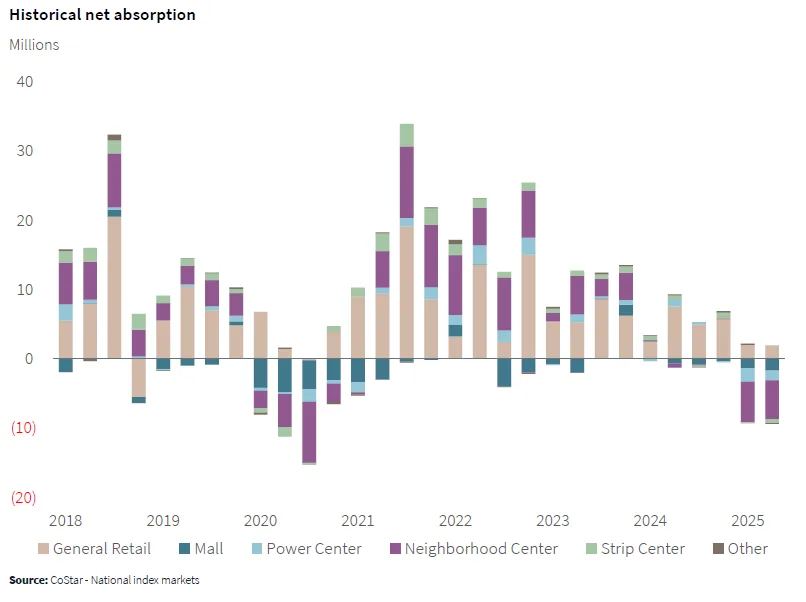

- Net absorption fell to -7.5M SF in Q2 2025, with bankruptcies and closures continuing to return large blocks of space to the market.

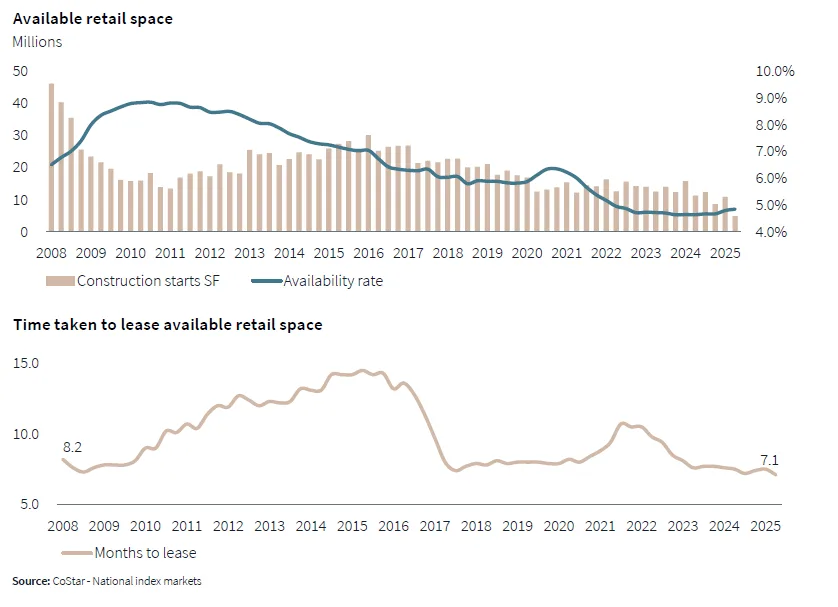

- Retail construction dropped sharply, with new starts down more than 50% quarter-over-quarter, as development economics remain unfavorable.

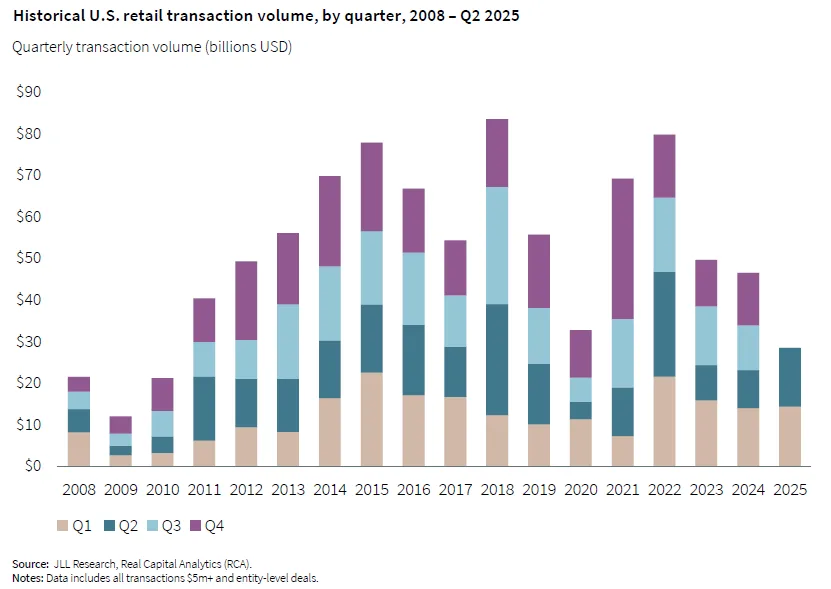

- Investment volume hit $28.5B in H1 2025, up 23% year-over-year, with strong capital flows into mixed-use assets and high-performing metros.

Closures Drag On Absorption

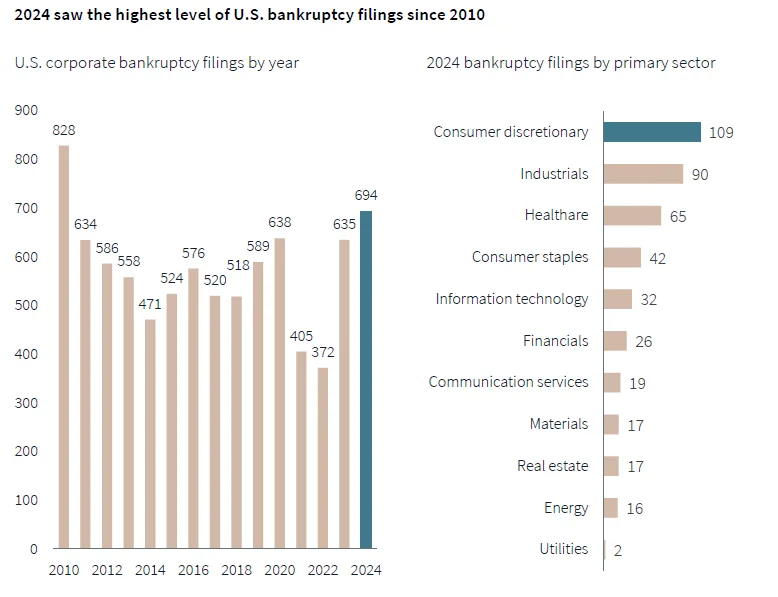

The US retail market logged its second consecutive quarter of negative net absorption, falling to -7.5M SF in Q2, reports JLL. That brings H1 2025’s total to -14.5M SF. The dip is largely due to thousands of store closures. These closures stem from a surge in bankruptcies that began in 2024. That year marked the highest level of US bankruptcy filings since 2010.

Big-box retailers and drugstore chains like Joann, Rite Aid, and Big Lots were among the major contributors to space returning to market.

Construction Slows To A Crawl

Retail construction activity remains muted. Projects underway dropped to 48.3M SF, and starts plunged by more than 50% to just 4.9M SF in Q2. Developers continue to face rising costs, weak rent growth, and growing opportunity costs tied to more lucrative multifamily or mixed-use projects.

As a result, retailers looking to expand are targeting existing space, with the average time to lease a vacated property at just 7.1 months.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Small Formats Win Out

Despite the closures, announced openings for 2025 (6,565) outpaced closures (5,633). But the footprint is shrinking: nearly 90% of new leases in Q2 were for spaces under 5K SF. Service-based tenants and quick-service restaurants are leading the charge, contrasting with closures of larger format retailers like Forever 21 and Walgreens.

Rents Stabilize; Growth Slows

Nationally, average asking rent rose 0.3% quarter-over-quarter and 2.0% year-over-year, showing signs of plateauing. Some markets—such as Los Angeles—saw declines, while Nashville (+4.9%), Tampa (+4.8%), and Dallas (+4.7%) led annual growth.

Investment Rebounds, With Mixed-Use In Focus

Retail transaction volume reached $28.5B in the first half of 2025, up 23% from a year ago. The West region experienced a dramatic 107% year-over-year increase in investment volume. This growth was driven by major deals, including FalconEye Ventures’ $645M acquisition of Scottsdale Quarter. The property is a retail-driven mixed-use development.

Liquidity remains strong for high-performing assets, especially those integrating retail with dining, office, or residential uses.

What’s Next

While net absorption is expected to turn positive later in 2025, growth will likely be modest. Rents are nearing their peak in many markets, and leasing dynamics continue to favor smaller-format, experience-driven retail. The permanent extension of the 2017 tax cuts via the recently passed “One Big Beautiful Bill” could further support retail spending and investment in the near term.