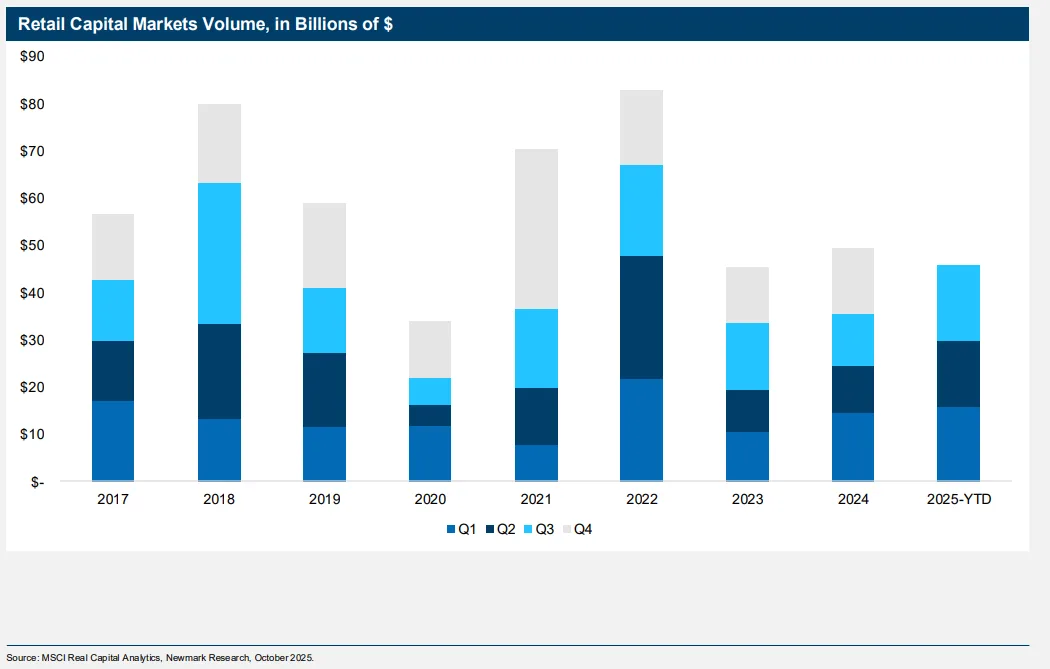

- Retail real estate sales hit $16.1B in Q3 2025, a 43% YoY increase—its best quarterly performance in three years.

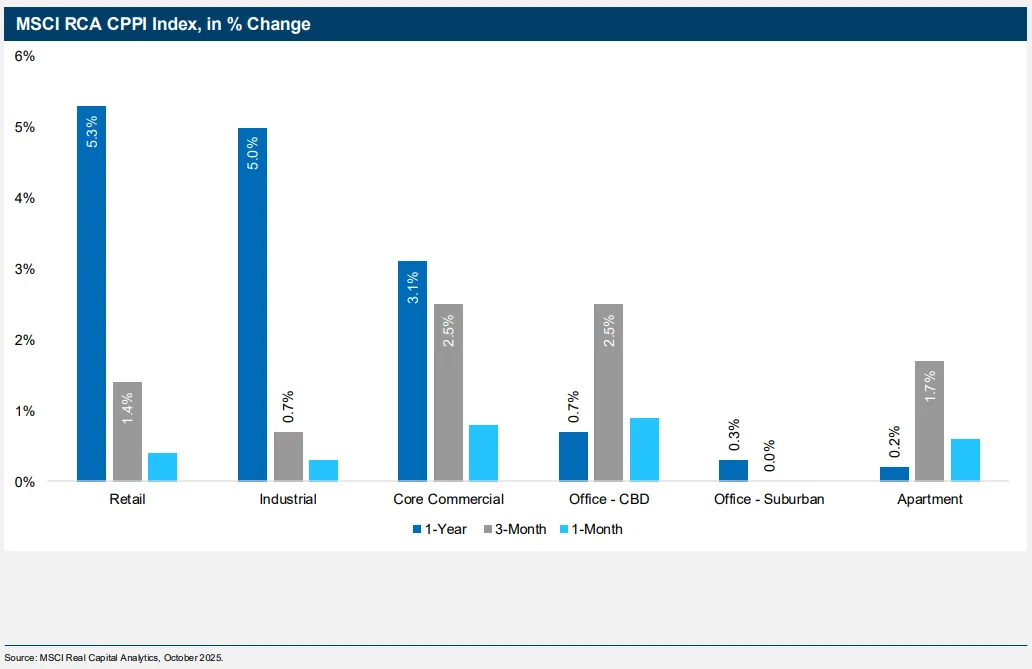

- Total capital markets activity reached $45.8B, up 29% YoY, with property values rising 3.5% annually—the strongest growth across asset classes.

- Sunbelt cities like Dallas, Houston, Phoenix, and Orlando led leasing demand, while retail availability remains tight despite high volumes of obsolete space.

Retail Regains Its Footing

Retail commercial real estate is enjoying a strong resurgence, reports GlobeSt. According to Newmark’s Q3 2025 report, retail sales volume soared to $16.1B—up 43% from the same time last year—marking the sector’s strongest quarter since 2022. Total capital markets activity for the year now sits at $45.8B, reflecting a 29% annual gain as investor optimism gains traction.

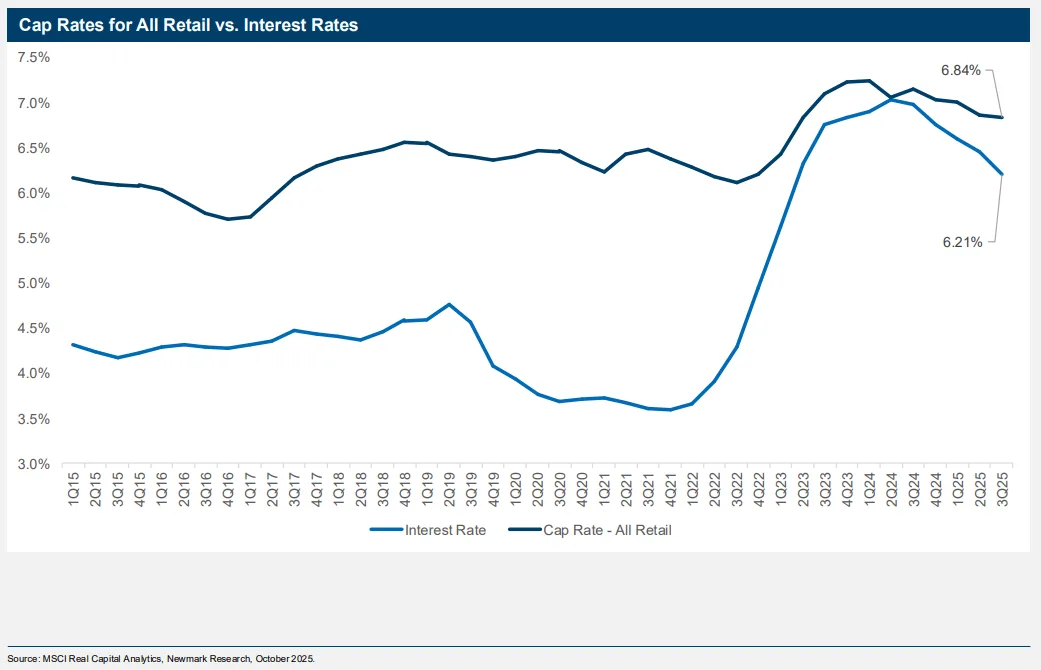

Pricing And Yields Strengthen

Retail property values posted a 3.5% year-over-year increase through September—outpacing all other major asset classes. Cap rates averaged 6.84% in Q3, down from 7.15% a year ago. With borrowing costs easing, the spread between lending and cap rates narrowed to 62 basis points, improving the investment case for many buyers.

Sunbelt And Select Markets Shine

Demand was strongest in the Sunbelt, with Dallas, Houston, Phoenix, Orlando, and San Antonio leading large-market absorption. Other strong performers included Austin, Raleigh, and El Paso. Northern New Jersey bucked regional trends to post gains in the Northeast, while West Coast markets like Seattle and Los Angeles showed weaker activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

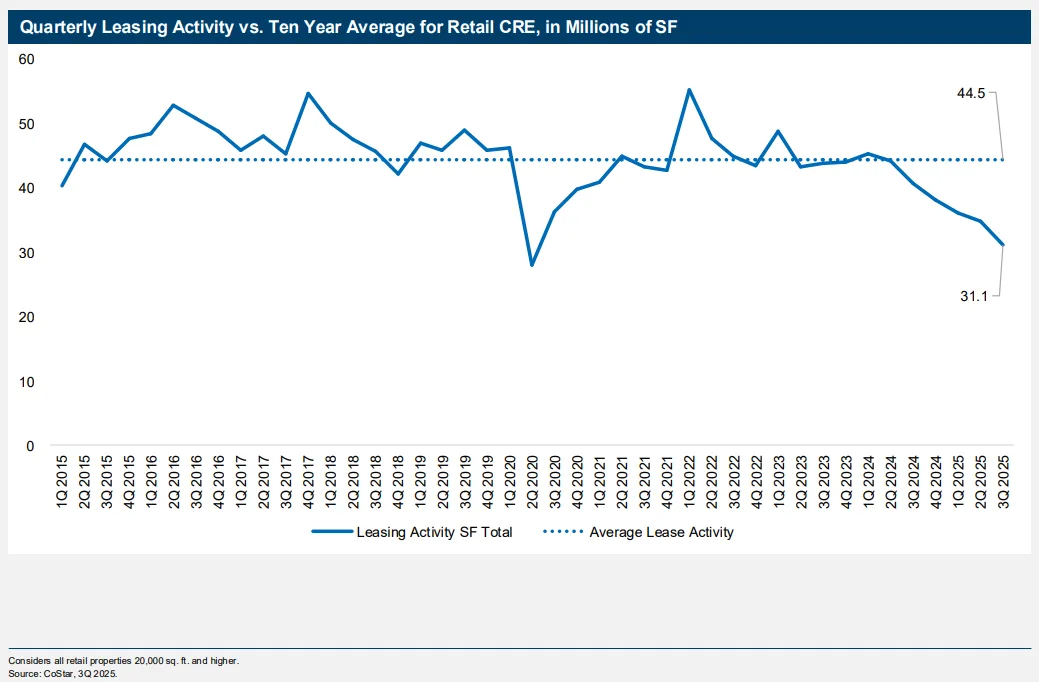

Leasing Activity Mixed But Improving

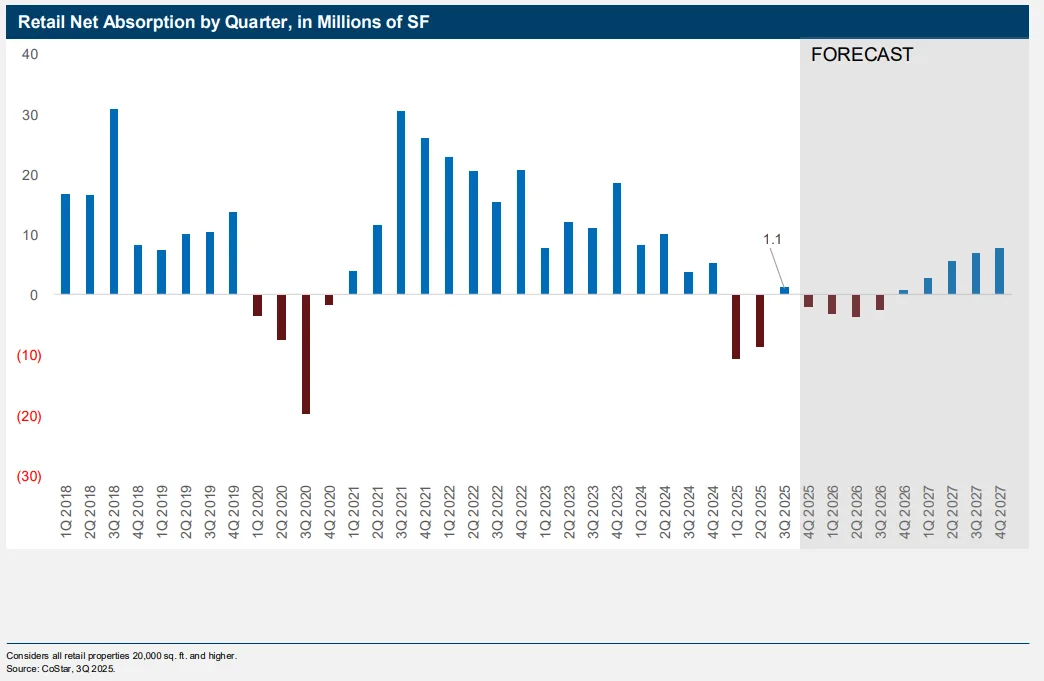

Retail posted 1.1M SF of positive net absorption in Q3 following two weak quarters, signaling a potential rebound in tenant confidence. While total leasing volume reached 31.1M SF—still 30% below the 10-year average—freestanding stores, power centers, and Class B malls led the way.

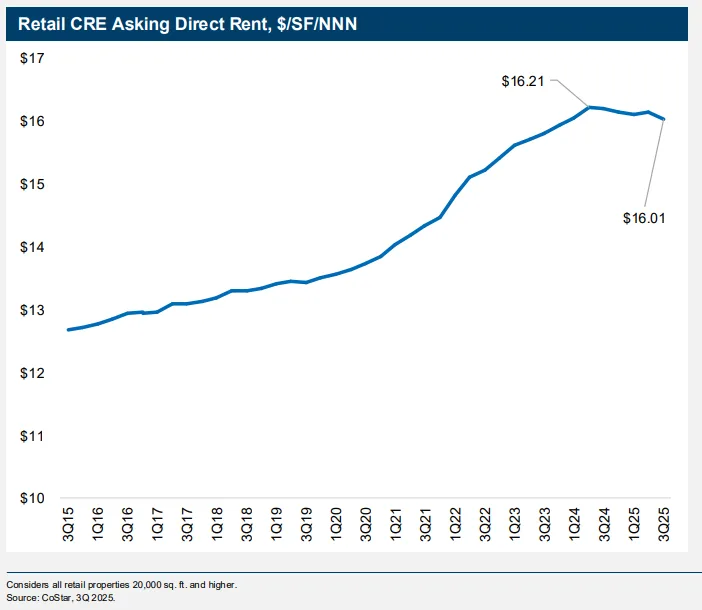

Availability ticked up to 5.3%, still well below the long-term average of 6.6%. However, asking rents declined both quarterly and annually for the first time in a decade, as outdated and underused space continued to weigh on averages.

Obsolescence Persists, But Investors Are Unfazed

Roughly 48% of available retail space—about 260M SF—has sat on the market for two years or longer, a record high. Still, healthy retention rates between 75% and 94% and continued store openings indicate strong tenant demand for quality space.

Consumer Demand Keeps Retail Resilient

Despite inflation and tariffs, consumer spending remains solid, especially in food services, health and beauty, and specialty retail. Non-store retail sales also climbed 2% month-over-month in August, bolstered by back-to-school shopping.

Outlook

Retail real estate’s fundamentals remain solid heading into 2026. As borrowing costs stabilize and consumer activity holds steady, investors are doubling down—both increasing their exposure and drawing new capital to the sector. Availability and rent pressures remain challenges, but Newmark says the sector is far healthier than during past downturns.

“Retail CRE has navigated every obstacle,” the report states. “Strong fundamentals have encouraged current investors to add to their portfolios, attracting new capital and amplifying market momentum.”